Auction update: Comtes Lafon

This Côte de Beaune producer is an integral part of the winemaking history of the region. As one of the best estates for white wines on the planet, what makes it tick?

Jules Lafon founded Comtes Lafon at the start of the 20th century after marrying into the Boch winemaking family. A lawyer by trade, he caught the winemaking bug and took over the family’s vines at Clos de la Barre, Meursault, as well as buying several well placed vineyards in Meursault, Volnay (for red wine) and Montrachet.

Following his death, the vines were leased to tenant wine growers until Jules’ son René took over, but the estate really started to shine under Dominique Lafon, René’s son, who succeeded him in the 1980s. It’s under his leadership that the property converted first to organic agriculture in 1993, and then to biodynamic in 1998. Nowadays,

Dominique Lafon is slowly transferring responsibility for the estate to his daughter, Anne, and his nephew, Pierre. Comtes Lafon owns vines in six of the best Meursault crus, and a plot in the star Montrachet grand cru, so it’s unsurprising that its bottles are considered some of the best white wines in the world. But what does the estate do to merit this title?

Well, yields are controlled, averaging 35 hectolitres per hectare in recent years, meaning that acidity can be retained in grapes that are harvested by hand as late as possible, so they are at full ripeness. The berries are vinified following traditional Burgundian methods and aged for between 18 and 20 months before bottling. This leads to wines that are fresh, elegant and mineral, which reflect the terroir they come from.

So how do these bottles perform at auction? iDealwine, France’s leading wine auction house, can shed some light on this. Routinely in the company’s list of the top 20 best-selling Burgundian producers, Comtes Lafon finished 16th at the end of 2023, with 694 bottles sold at auction throughout the year for a total of €184,381. The estate’s highest-priced wine that year was a 2002 Montrachet Grand Cru, which sold for €3,005.

Reviewing auction results from this year reveals that a bottle of 2014 Meursault Premier Cru Perrières sold at auction for €826. Given that this bottle is now entering its uncorking window, it’s no surprise that this perfectly balanced wine with notes of honey, acacia and hazelnuts sold for what it did.

And, when iDealwine looks at auction results for what could arguably be called Comtes Lafon’s crown jewel, its Montrachet Grand Cru, five bottles passed through its doors in the first six months of 2024, with the wines coming from a number of vintages. The prices range from €1,815 for a 1999 to €2,880 for a 2009. This wine is known for its notes of dried quince, lemon and almond, as well as the impeccable minerality which perfectly balances it.

Partner Content

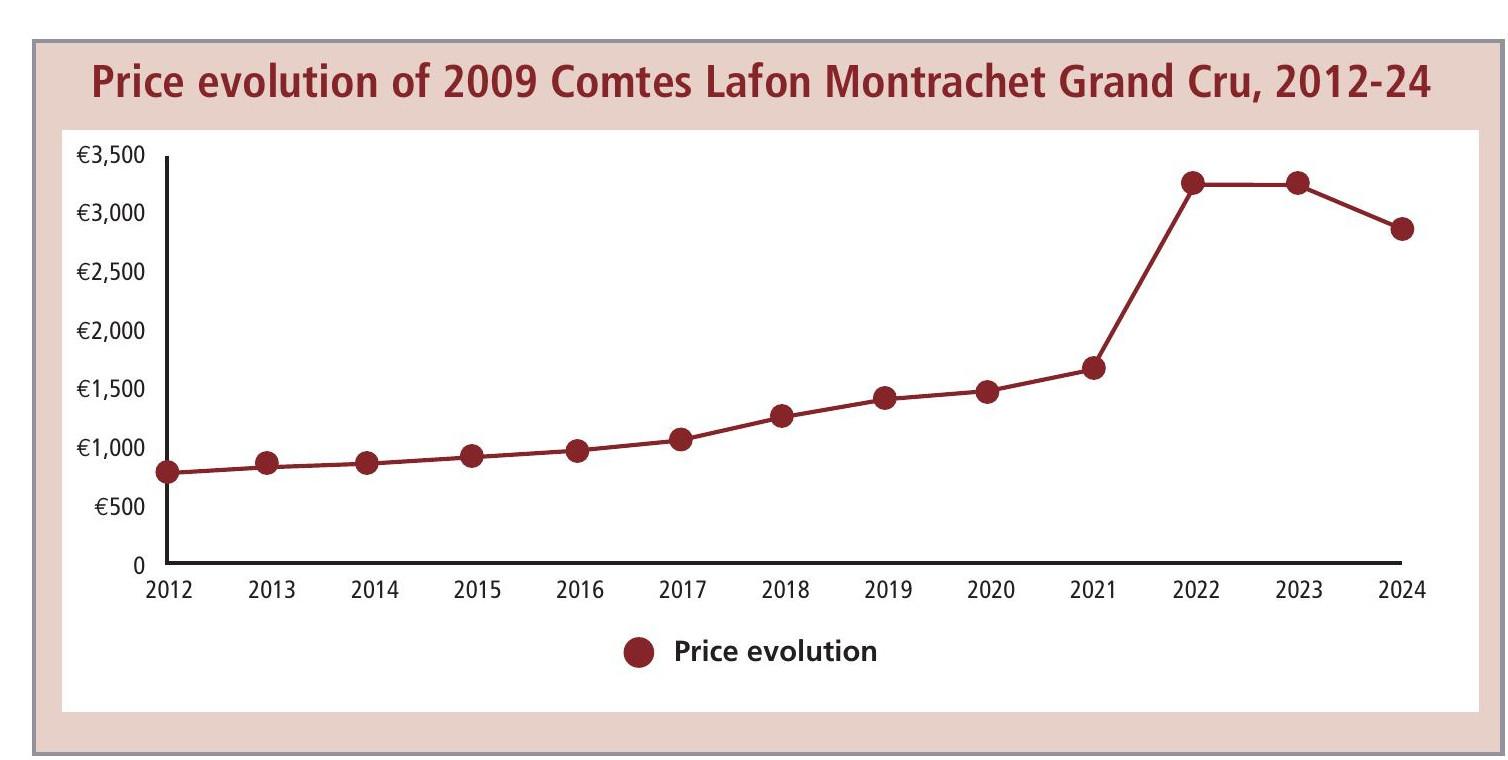

Taking a closer look at the price evolution of the 2009 vintage – a wine that is about ready to be opened and that has been on the market for more than 10 years, giving plenty of data to analyse – the 2022 boom in Burgundy prices and the subsequent calming is clearly visible. The price estimate raises steadily after the wine is released onto the market, with an uptick in 2021 as the market awakened. For reference, the highest auction price it saw in 2021 was €2,229 in November of that year. And then 2022 happened and the prices soared. The 2009 vintage appeared at auction three times in 2022, obtaining hammer prices between €2,985 and €3,478. Following the boom in 2022, the market corrected itself throughout 2023.

A moment to breathe

According to iDealwine figures, the price estimate for Montrachet Grand Cru 2009 has fallen 11.5% in one year but, as you can see from the prices quoted in this article, this wine is still selling far above its 2021 price. At the moment, the market is taking a moment to breathe while it feels the effects of the current macroeconomic situation.

The last time the market reacted in such a way was after the 2008 financial crisis. iDealwine’s analysis of wine prices from 2008 onwards shows prices rising before the crash and then dipping in the aftermath, but this was quickly offset by an enormous rise in global demand for very rare wines.

The current geopolitical and economic situation remains unfavourable, making it difficult to predict what the market will do next. On the other hand, demand for fine white wines continues to grow, boosted by their scarcity, which is augmented by the weather patterns seen during the growing season in recent years, which have been affecting yields. This demand is evidenced by the results of the recent Hospices de Beaune auction. Despite a 5.37% decrease in the average hammer price for red wines, the white wines auctioned saw their average price rise by 8.02%.

About iDealwine.com

• Founded in 2000, iDealwine is France’s top wine auctioneer and leading online wine auction house worldwide.

• Founded in 2000, iDealwine is France’s top wine auctioneer and leading online wine auction house worldwide.

• Fine Spirits Auction (FSA) is iDealwine’s dedicated spirits platform, launched in partnership with La Maison du Whisky, a French specialist in high-end spirits since 1956. Seven auctions of the finest whisky, rum, Cognac and more take place annually.

• Based in Paris, and with offices in Bordeaux and Hong Kong, iDealwine sources rare bottles from European cellars, private collections and direct from producers before meticulously authenticating and shipping to enthusiasts, collectors and trade customers worldwide.

• If you are keen to sell your wines or spirits, check out idealwine.com.

About the Barometer

In 180 pages, iDealwine’s annual auction Barometer analyses the fine wine auction market and delves into the latest trends in fine wine. With an in-depth look at 15 French wine regions, fine wines of the world and a list of rising-star producers in each one, the Barometer is an invaluable resource for serious wine enthusiasts. The Barometer is available for purchase on iDealwine.com, with a complimentary copy provided for clients.

Related news

iDealwine partners with Burgundy producer Méo-Camuzet

iDealwine: Burgundy 'most attractive' region for wine investment