Supernova Style – the Liv-ex Power 100

Which fine wine brands are enjoying otherworldly success? And which have come crashing back down to Earth? Find out in this detailed report compiled by Liv-ex.

In a brutal year for the fine wine market, it is tempting to consider the notion of a Power 100 — a ranking of fine wine brands that reflects trade on the global marketplace over 12 months, which takes into account a range of criteria, such as price performance, average price and value and volume traded on Liv-ex — as an attempt to hide a pack of wolves in sheep’s clothing. This would be a mistake. Yes, the might of many estates has been eroded since the downturn began two years ago, but as a list of the most reliable, consistent brands during a down market, an entry on the Power 100 is arguably more valuable than ever.

Before diving into the list, the facts. All major Liv-ex indices are down at least 9% year-on-year. The industry standard Liv-ex 100 is down 9.2%, the Liv-ex 1000 (the broadest measure of the market) is down 9.6%, and the Liv-ex Fine Wine 50, which tracks the performance of the 10 most recent physical vintages of the Left Bank first growths (ie the historical powerhouses) is down 12.5%. Of the Liv-ex 1000 sub-indices, the Italy 100 has weathered the storm better than the rest (down 4.1%).

In short, the market correction has continued, pretty much unabated. The two questions on everyone’s lips have been: “Are we seeing signs of reaching the bottom?” and: “How much further can the market fall?” The answers, broadly speaking, have been: “No” and: “Until prices reach a point to clear out an excess of stock.” September saw the downturn accelerate. Perhaps enough stockholders were beginning to feel enough pressure to drop their prices in meaningful ways, rather than the steady death by 1,000 meaningless cuts that had characterised the preceding months.

In short, the market correction has continued, pretty much unabated. The two questions on everyone’s lips have been: “Are we seeing signs of reaching the bottom?” and: “How much further can the market fall?” The answers, broadly speaking, have been: “No” and: “Until prices reach a point to clear out an excess of stock.” September saw the downturn accelerate. Perhaps enough stockholders were beginning to feel enough pressure to drop their prices in meaningful ways, rather than the steady death by 1,000 meaningless cuts that had characterised the preceding months.

Beyond price pressure, the 2024 fine wine market has been characterised by two trends. First, activity has remained high – the number of wines traded has stayed consistent. We see this in the Power 100 – the count of trades for the 2024 list is 7.9% higher than for the 2023 list

‘Positive price performance – or generally an ability to limit one’s losses – has been hard to come by’

‘Positive price performance – or generally an ability to limit one’s losses – has been hard to come by’

Secondly, volumes traded are down 6.5% and the total value of trade is down 19%. In that context, positive price performance – or generally an ability to limit one’s losses – has been hard to come by. In 2022, no more than 30 brands that qualified for the Power 100 registered a negative price performance. This rose in the 2023 list to 216. This year, 343 (83.7%) of the brands that qualified fell in value. Of this year ’s final Power 100, only 11 brands recorded a rise in their Market Price over the past 12 months.

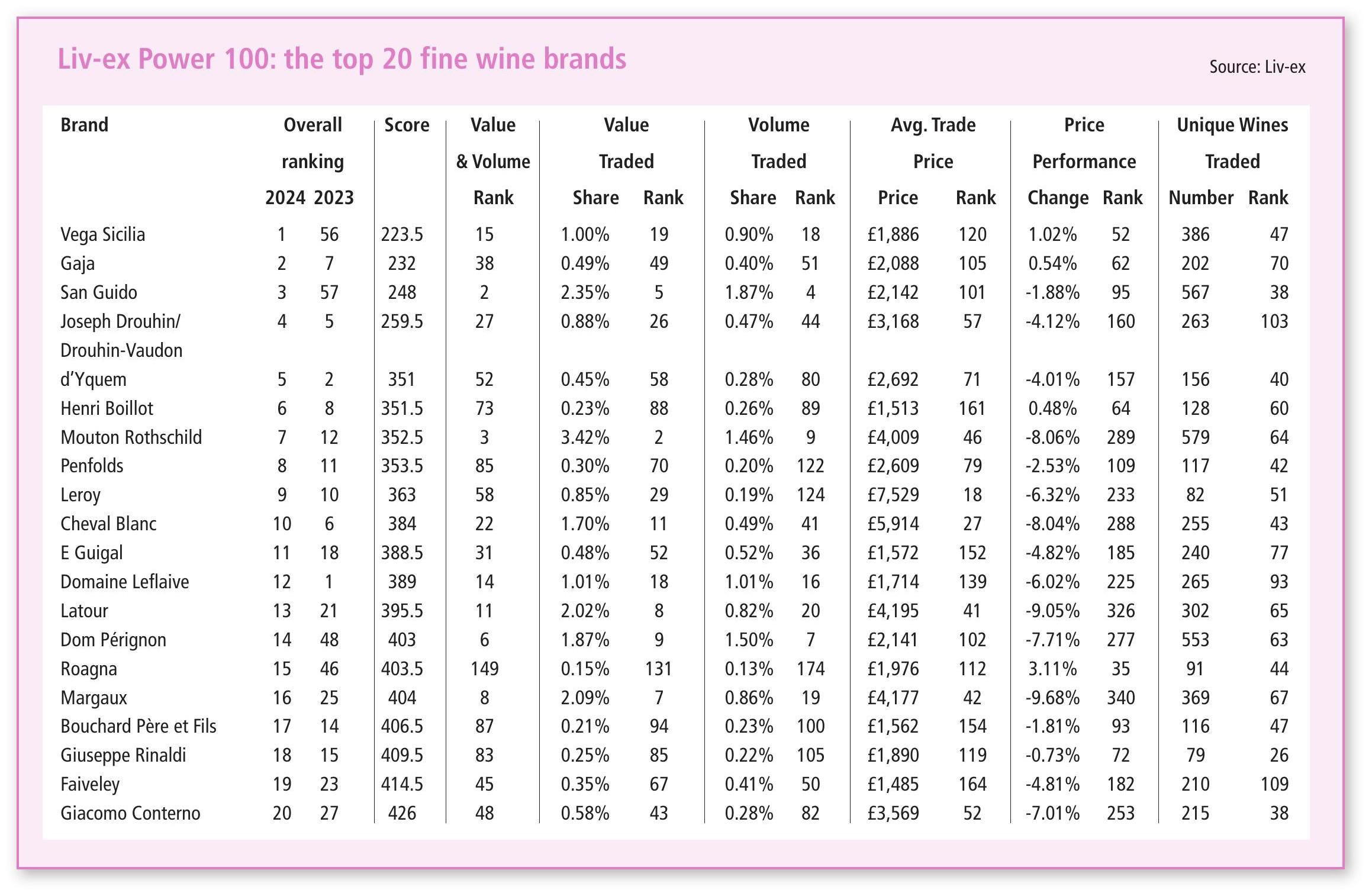

In some ways, what we tend to see at the very top of the list is an exaggerated view of last year, it being heavily skewed towards brands with high liquidity and generally a wide range of labels.

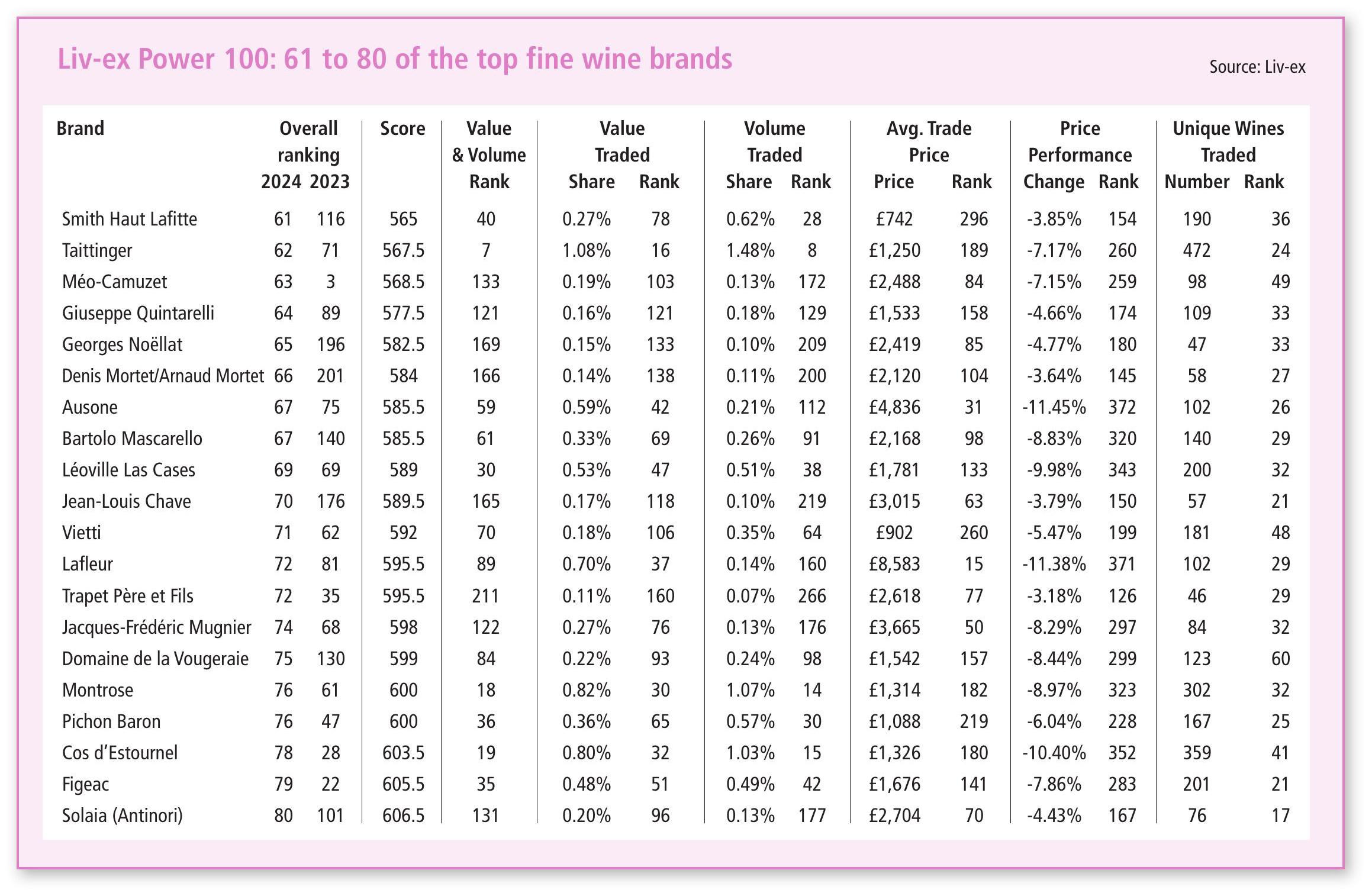

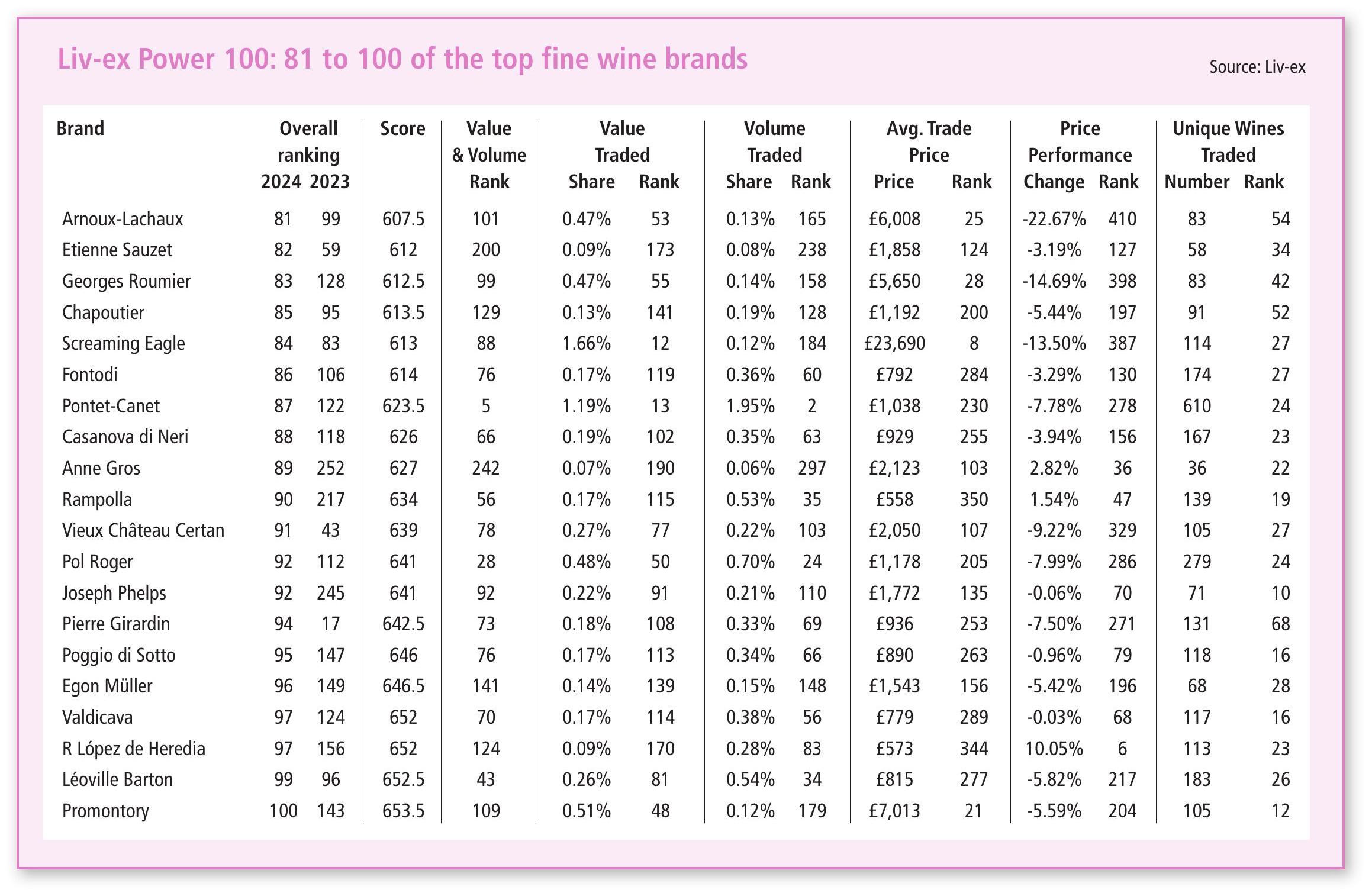

The dataset considered covers the year from 1 October 2023 to 30 September 2024. The rankings are then calculated based on several weighted criteria including price performance, the number of a brand’s wines traded, and the cumulative value and volume of that trade over the selected period. You can read the full methodology at the end of the report.

ITALY MAKES A SPLASH

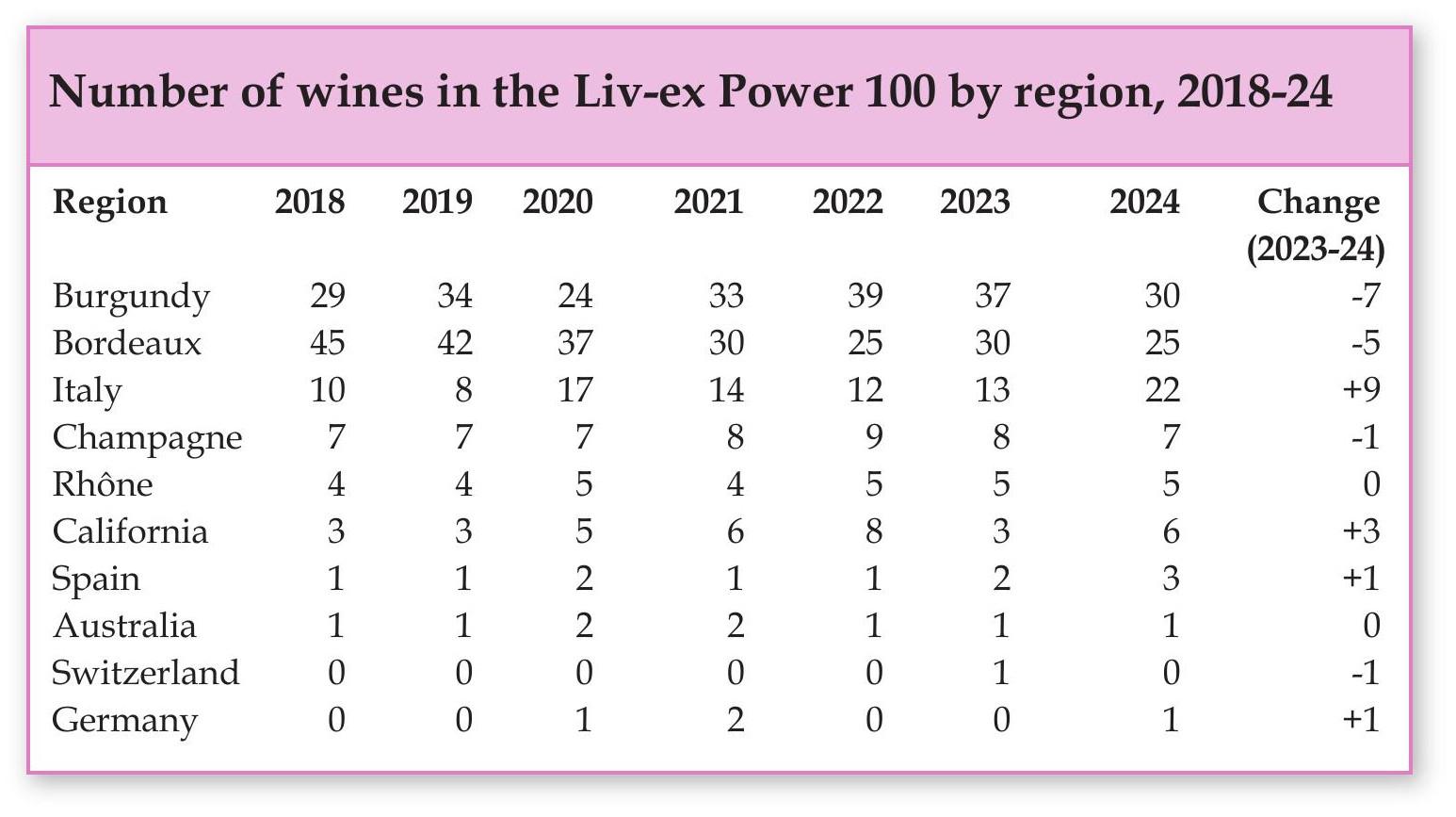

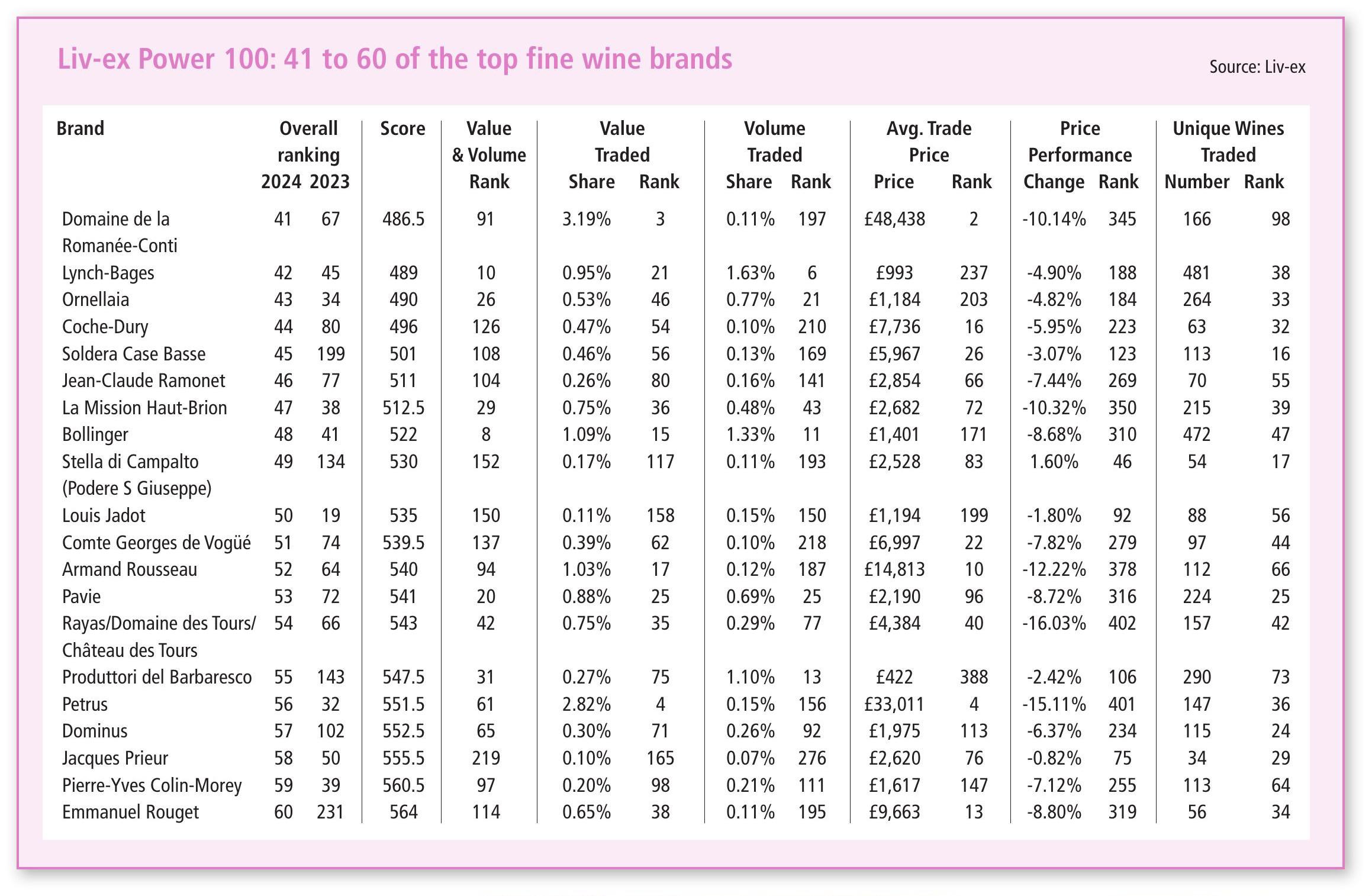

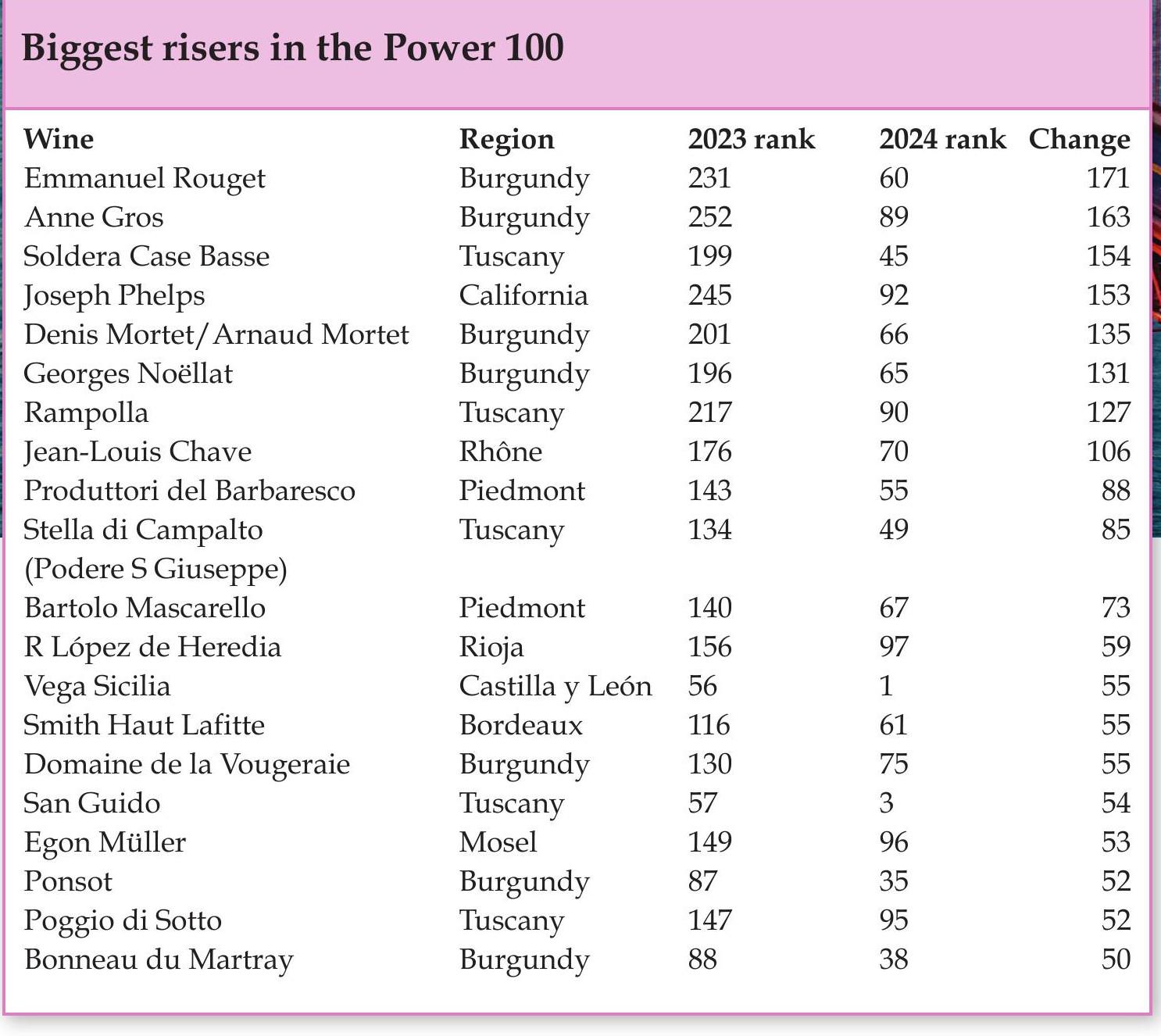

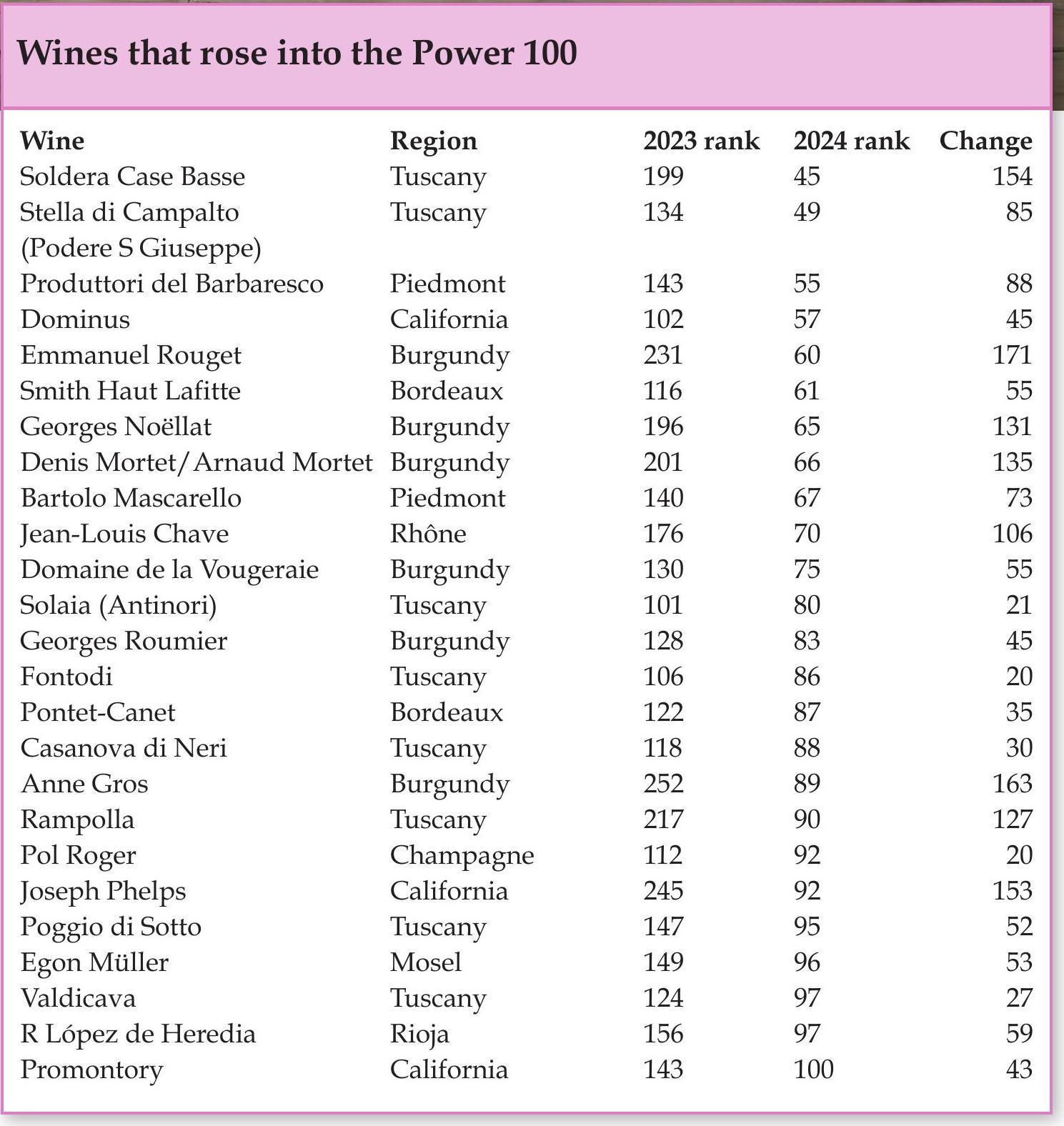

Italy stands tall as the clear winner in the 2024 Power 100, filling 22 spots, nine more than last year, and snapping at the heels of Burgundy and Bordeaux. While Tuscany, and in particular Brunello (and declassified Brunello in the case of Soldera Case Basse), has made the greatest gains, a deeper look reveals a far from homogenous type of producer.

On the one hand, there are high-value, relatively illiquid brands with the likes of Soldera Case Basse, which has risen 154 spots on last year. On the other hand, there is Produttori del Barbaresco, which is the 13th top-traded brand by volume in this year ’s list, but 388th most expensive. The top two Italian brands, Gaja and San Guido, exemplify this variety. San Guido has climbed 54 spots to reach third in this year ’s rankings. Produced in decent volumes, with relatively consistent release prices and, in the scheme of things, affordable trade prices, it represents a safe bet in a down market. It is a wine that can be bought and, crucially, drunk in high volumes without too much concern as to whether one should wait for tomorrow. Sassicaia 2020 was the eighth most traded wine during the time period considered for the Power 100, with a Market Price of £2,000 per case and a 97-point rating from Antonio Galloni (Vinous).

While the wider market has fallen over the past two years, Gaja has rebounded: 38th in the 2022 list, seventh in 2023 and now second. The Gaja brand, carefully and consistently built up over decades, is well-known, trusted and mighty. And it shows in the breadth of Gaja wines that trade. Seventy different vintages of 13 different brands have changed hands over the past 12 months. As an added bonus, it is one of the 11 producers in the Power 100 whose average price has not fallen over the past year.

SPAIN: UNDER THE RADAR NO MORE?

Vega Sicilia tops the Power 100 list. This is the first time a Spanish wine has done so. While there are other wines in the stable, this is overwhelmingly a story about Unico (and to some degree Unico Especial). Spearheaded by US demand, Unico has been one of 2024’s few success stories. The facts speak for themselves. Compared to 2023, Vega Sicilia Unico’s trade count is up 193%, its trade volumes are up 324%, and its trade value is up 310%. With considerable heritage – it was first produced in 1915 – and still representing good value, it is unlikely that this is a flash in the pan.

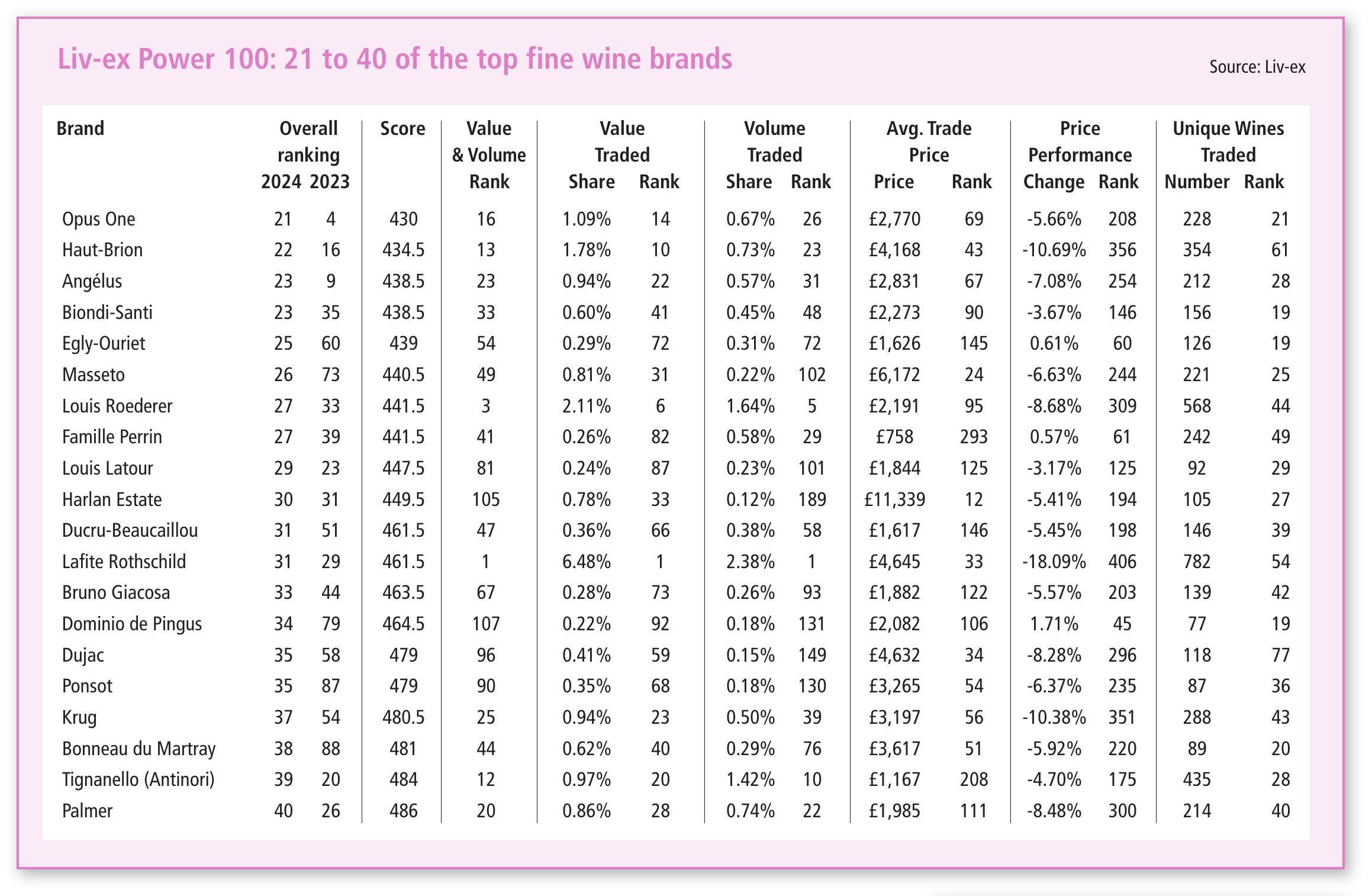

The question does remain, however, whether more Spanish brands are poised to join Vega Sicilia. There are only two other Spanish entrants in this year ’s list – fellow Ribera del Duero (by way of Denmark) label Dominio de Pingus and Rioja’s R López de Heredia. The latter is a new entrant.

The question does remain, however, whether more Spanish brands are poised to join Vega Sicilia. There are only two other Spanish entrants in this year ’s list – fellow Ribera del Duero (by way of Denmark) label Dominio de Pingus and Rioja’s R López de Heredia. The latter is a new entrant.

BORDEAUX: SURVIVAL OF THE FITTEST

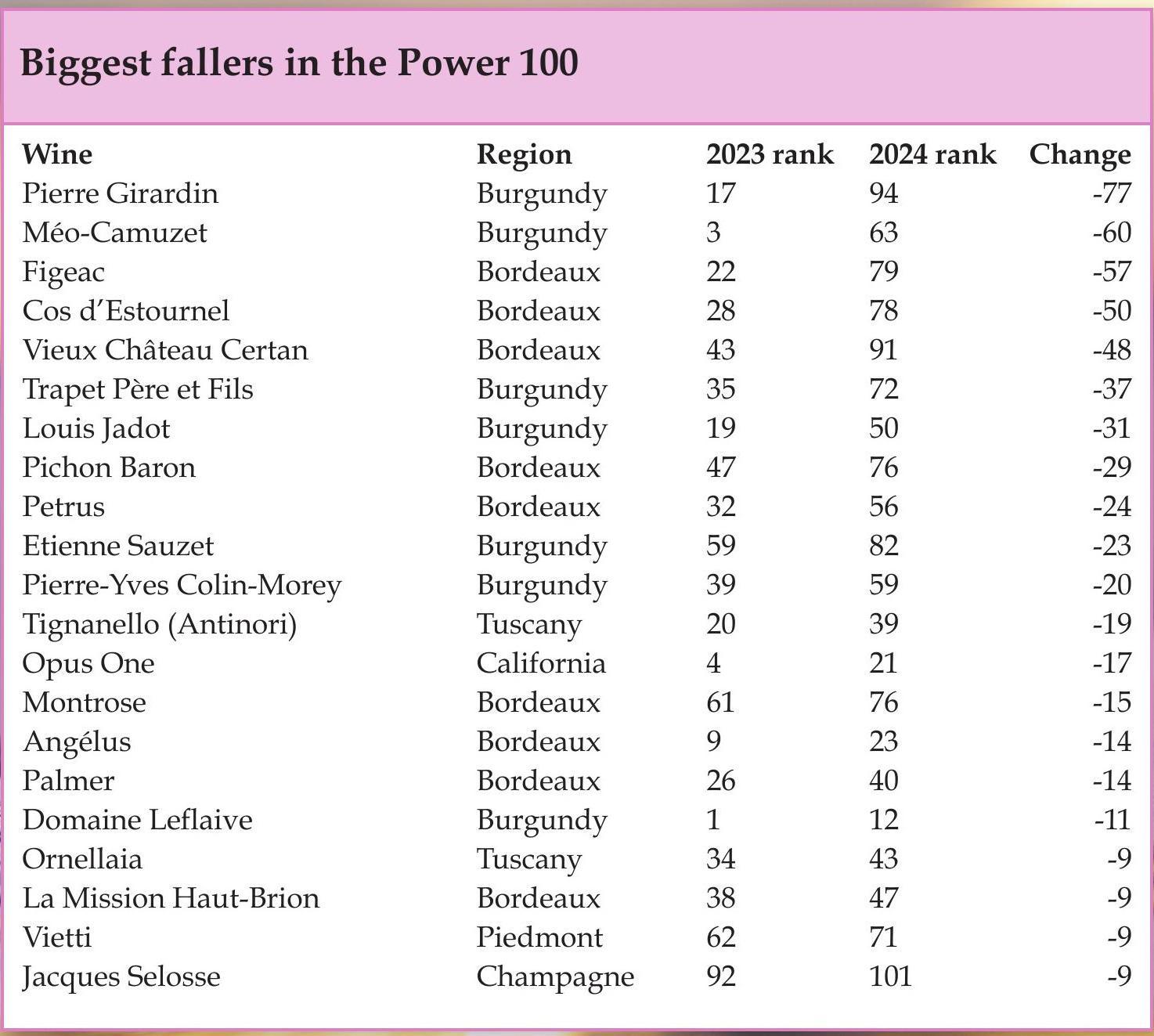

In last year ’s Power 100, Bordeaux emerged as the beneficiary of Burgundy’s travails since the turn of the market in late 2022. As we wrote at the time: “[Bordeaux is] the least risky market, the best understood; collectors know what to expect from these wines, which is quality at a certain price, and relative liquidity.” Twelve months later, not all the same can be said. It certainly remains the best, and most widely, understood – the mechanics are unchanged and liquidity is still its strength. However, in the current market, it is not necessarily the safest bet, in particular for recent vintages, which have crashed through release prices pretty much across the board. Lafite is the prime example of Bordeaux’s dilemma. The number one brand in terms of traded value and volumes, its prices have, on average, fallen 18.1%.

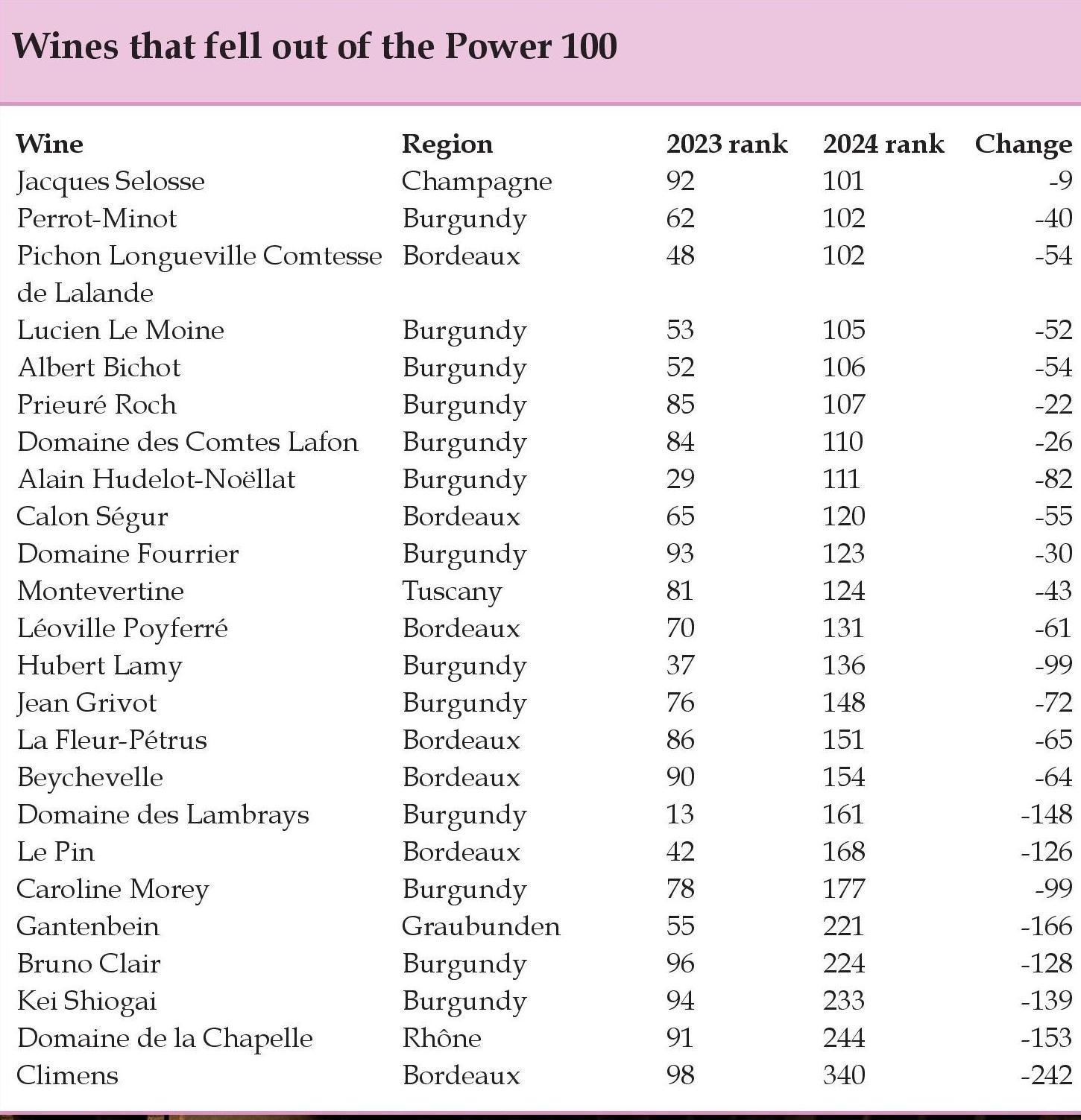

There are five fewer Bordeaux brands in the Power 100 compared to last year, with the likes of Le Pin, Pichon Longueville Comtesse de Lalande and Léoville Poyferré dropping out. Nevertheless, Burgundy continues to be the best-represented region in the Power 100.

BURGUNDY: A VICTIM OF ITS OWN SUCCESS?

Given that high volumes and reasonable prices have been the calling cards of this year ’s biggest risers, it’s not surprising that Burgundy has fared worst this year. This is reflected in the Burgundy 150 having fallen 14.7% over the past year, and 27.8% since its peak in October 2022. We also see the impact in this year ’s Power 100, with seven fewer Burgundy brands on the list than last year.

California has held steady, maintaining a 6% regional trade share since 2023Perhaps Burgundy’s one saving grace is its sheer diversity. Burgundy brands take the top five spots in the rankings in terms of number of unique wines traded. The Power 100’s methodology means that domaine, maison and négociant labels are all grouped together. This, of course, increases the pool of wines and levels the playing field in favour of the larger brands. It is therefore no surprise that Drouhin, Bouchard Père et Fils and Louis Latour sit alongside blue-chip producers such as Leroy near the top of the table.

CHAMPAGNE

The Champagne 50 has fallen 10.6% over the past year. Its share of trade is also down, from 14.4% last year to 11.4% this year. Jacques Selosse has also dropped out of the Power 100, Egly-Ouriet remaining the only grower Champagne in the list. This is not surprising. The grandes marques represent volumes, consistency (in both taste and trade) and accessible prices. Crucially, the grandes marques are regularly opened and drunk. They are, in short, reliable and liquid.

WORST PERFORMERS

Given the characteristics of this year ’s top performers, it is no surprise that Burgundy accounts for the greatest number of fallers this year. Moreover, we note that many of the Burgundian brands that rose the fastest have now crashed the hardest. The likes of Kei Shiogai and Domaine des Comtes Lafon have dropped out of the Power 100 altogether.

The travails of many of Bordeaux’s household names are also notable. Figeac, Cos d’Estournel, Vieux Château Certan, Palmer… the list goes on. What is undeniable is that Bordeaux has all the fundamentals to be struggling less. It has the volumes, it has an enviable number of established brands, it has the distribution, and it should have moderate prices to sustain it. That Sassicaia – Tuscany’s mirror image of the Bordeaux model – is thriving should be a sign that something is wrong. That something is undeniably release pricing. This year ’s en primeur campaign was, to put it mildly, hard going. With cellars full of back-vintage Bordeaux and a flailing Chinese market, there is a significant stock overhang. It is hard to see a solution – other than a price-slashing-inspired stock clear-out.

Power 100 methodology

To calculate the rankings, we took a list of all wines that traded on Liv-ex in the last year (from 1 October 2023 to 30 September 2024) and grouped these by brand. As is now standard, Burgundy labels with both maisons and domaines were combined as one. We then identified brands that had traded at least three wines or vintages, and that had a total trade value of at least £10,000.

Brands were ranked using four criteria: year-on-year price performance (based on the price for a case of wine on 1 October 2023 versus its market price on 30 September 2024); trading performance on Liv-ex (by value and volume); number of wines and vintages traded; and average price of the wines for a brand. The individual rankings were combined with a weighting of 1.0 for each criterion, except trading performance, which had a weighting of 1.5 (because it combined two criteria).

About Liv-ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business, with access to £100m-worth of wine and the ability to trade with more than 620 other wine businesses worldwide. It also organises payment and delivery, through to storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at www.liv-ex.com.

Related news

'Rare buying opportunities' as fine wine prices hit a five-year floor