Australian wine exports climb 34% thanks to China

By Eloise FeildenExports of Australian wine reached AU$2.39 billion in the 12 months to September 2024 as gains made by the re-entry into Mainland China offset declines in the US market.

Australian wine exports increased by 34% in value to AU$2.39bn in the 12 months ended September 2024.

Volume exports were also up, though at a significantly lower rate, climbing 7% to 643 million litres, according to Wine Australia’s Export Report released today.

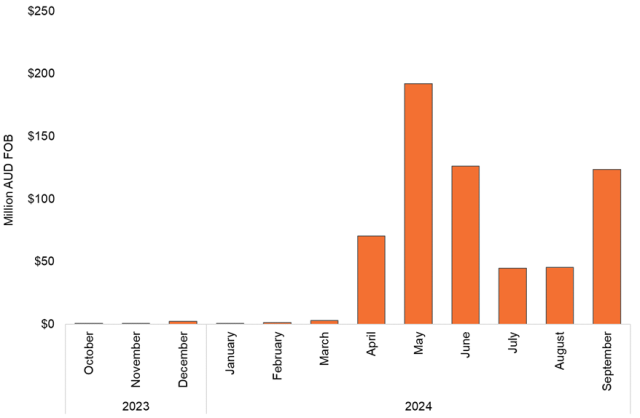

These are the highest levels of shipments by both volume and value since the 12 months ended August 2021, and the growth was driven by the re-entry of Australian wine exports to Mainland China following the removal of import duties on Australian bottled wine in late March 2024.

Premium wines making their way back into Mainland China are responsible for a significant part of the value increase. Peter Bailey, Wine Australia manager for market insights, explained: “While the export figures to mainland China are very positive, the impact on total export value is much larger than volume due to the premium price point of most wine entering the market.”

The value of Australian wine shipments to China rose by AU$604m to AU$612m over the 12-month period. Volume shipments increased by 58 million litres to 59 million litres.

A total of 927 businesses exported Australian wine to Mainland China during the same 12 months. The top 10 exporters by value were responsible for the vast majority of shipments, contributing 68% of the total valie and 38% of total volume.

Bailey warned that while the figures in China are positive, they do not equate to sales, nor indicate consumer sentiment. He said: “It’s important to note that shipments in these first six months are likely to be characteristic of re-stocking Australian wine after a long absence. Export levels are not equivalent to retail figures, and it will take time before it is evident how Chinese consumers are reacting to having Australian wine back in market.”

Partner Content

Despite the growth in China, Bailey warned against returning to an over-reliance on the market. “It is increasingly important to pursue market diversification and defend our share in other wine markets,” he said.

Exports to all other destinations were stable in value at AU$1.78bn and declined in volume by 3% to 585 million litres.

Shipments to the US fell in both volume and value terms. Volume losses (down 21 million litres to 113 million litres) were caused by reduced shipments of unpackaged wine, according to Bailey, following a surge in unpackaged wine to the market throughout 2022 and the start of 2023.

“Exports to Canada stabilised in value as the decline in unpackaged wine eased and exports with an average value of $7.50 and above increased by 28 per cent in value,” Bailey said.

Other than a sharp uptick in China, and declines in the US, the rest of Australia’s major export markets for wine showed a mixed picture. In Europe, growth in exports to the UK and Belgium more than offset declines to Germany, Denmark, and Spain, resulting in a small increase overall for the region.

According to Trade Data Monitor, total wine exports of the world’s top 10 wine exporting countries dropped by 3 per cent in volume in the year ended June 2024, with Italy, Spain, France, South Africa, Germany, and New Zealand each reporting declines in wine exports.

Bailey said that factors including the moderation trend, cost-of-living pressures and shipping delays and costs due to regional conflicts are also leading to challenges for exporters trying to get their wines to market.

Related news

What brought Bijou to the south of France?

CIVB: breaking the feeling of 'exclusion' to make Bordeaux accessible