This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

The economy for Champagne in Australia

Champagne sales may have declined in the once-booming Australian market, but there’s an opportunity for raising turnover as demand diversifies into higher-value and drier styles. Sara Underdown reports from the nation.

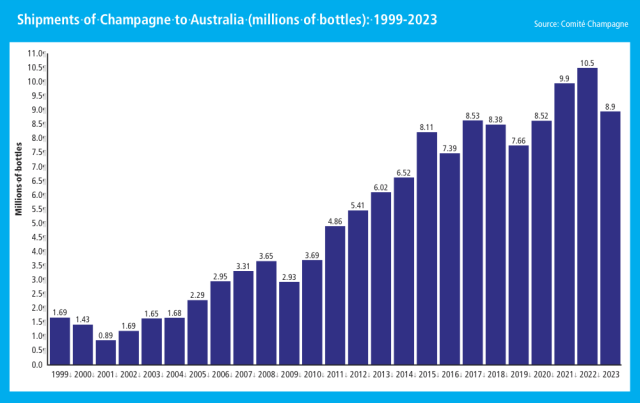

“So, what are other Champagne Houses doing with their pricing in Australia?” asked a leading cellar master from one of Champagne’s biggest maisons when I sat down to lunch with him in Reims. It was a tell-tale sign of the industry’s desperation to reclaim ground in a market that has been spiralling down for the past 18 months, after spiralling up for so long (see chart of shipment trends, bottom). Even more compelling, was that the question came from a winemaker, not an export director or marketing representative.

In places like Sydney and Melbourne, the on-premise scene has become a bloody battle ground for many brands – and not just the top four (G.H. Mumm; Moët et Chandon; Veuve Clicquot; and Piper-Heidsieck). Some leading hotels and venues have reported to me huge price discounts for pouring, by the glass, lesser-known and even grower Champagnes. I was surprised to hear that, Henri Giraud – a small producer – had pipped Bollinger at a leading hotel in Melbourne for the prized position of house pour.

The competition is also reverberated at a retail level.

“We have extremely aggressive competitors putting their prices down and recruiting consumers in our price position,” says Laurent Valy, brand development manager for Champagne Lanson, which retails a bottle of their non-vintage Black Creation for AUD$60-$80.

Australia has experienced escalating interest rates and general cost of living pressures over the past two and a half years, resulting in the worst economic growth in decades outside of the pandemic – just 1.1% growth for the financial year. It has many consumers juggling rising household expenses with non-essentials, like Champagne. But this is being felt mostly at the lower end – the non-vintage category – that Australia is overwhelmingly dependent on to the tune of 88% of total Champagne imports.

Millennials take the lion’s share of Champagne spend year on year, says Leigh Firkin, head of commercial wine from Dan Murphys, Australia’s largest wine retailer. However, as quoted in The Guardian in June this year, Stephen Halmarick, chief economist from the Commonwealth Bank, points out that it’s an age bracket that has recorded the weakest spending during the economic downturn.

Though consumption may be disappointing for producers and vendors alike, it’s not at all surprising given Australia’s reliance on more affordable Champagne by younger customers. Dig a little deeper, and it’s also a sign that the market is normalising, following the frenzied rate at which Aussies consumed Champagne during the pandemic. This is more telling of the economy for Champagne going forward, than the current economic downturn.

In 2020, while global Champagne exports suffered an almighty blow, recording an 18% drop, Australia was the exception. Imports grew by 11.2% and our appetites, even more, for Champagne’s very best. The likes of Krug, Cristal and Dom Pérignon became our go-to in lieu of cancelled travel plans, as Aussies embraced their relative freedom to wine and dine, took time to restock dwindling cellars, and indulged in the shift to online retailing. A massive spike in sales followed with some brands reporting up to 400% growth.

By 2022, Australia’s imports ballooned to an all-time high of 10.5 million bottles, representing a 12-fold growth in volume, and even greater growth in value, since a low of 890,000 bottles in 2001.

Then in 2023, global shipments fell by 27 million bottles (from 326 million to 299 million), representing a total decline of 8.2% between 2022 and 2023 and a return to pre-Covid levels. In Australia’s case, imports were around 8.9 million bottles.

Notwithstanding this weakening, Australia’s unwavering reliance on the non-vintage category solidified its place in the top-10 bracket for Champagne markets for more than a decade, and is currently positioned in sixth place of export destinations.

Leading Champagne commentator, Tyson Stelzer, says that Australia has followed a pattern of oscillation in Champagne imports over the past decade, as currency fluctuations and pipe-filling activities have created an alternating cycle of growth and decline in imports from one year to the next.

“Going forward, once the current economic downturn is behind us, I anticipate that Australia’s Champagne imports will ultimately plateau in the vicinity of 10-11 million bottles annually and that value will rise slowly and steadily at 3-7% per annum,” he says, which comes in response to both the rising cost in production of Champagne and a gradually increasing interest in cuvées of higher value (rosé, blanc de blancs, vintage, prestige, growers, etc.).

All is not what it seems

Australia’s gluttonous obsession with non-vintage Champagne is a phenomenon that is out of step with the rest of the world, and that the industry doesn’t have an answer for. With almost 90% of imports coming from this category, it represents 82% of total import value. By comparison, in the US, non-vintages make up just 58% of total import value and just 43% in Japan. It’s considered to be a problem because the terms of trade are massively based on volume over value which ultimately fuels a ‘race to the bottom’ in price wars, especially during more challenging times.

Last year, Australia recorded the lowest average ex-cellar value of the top ten markets, which Stelzer believes indicates the capacity for the market to mature and fully embrace the diversity of Champagne beyond entry-level non-vintages.

John Noble, director of Australia’s Champagne Bureau, says there are indicators of this already, pointing to some clear trends emerging in Australia as Champagne lovers seek out more diverse styles.

“There has been a significant increase in the number of producers investing in the Australian market,” he says comparing figures from 2019 and 2023, where there were 233 producers exporting to Australia in the former and 340 in the latter.

Concurrently, there was a rise in rosé, prestige and low dosage Champagnes.

Prestige cuvées remain a strong sector of the market representing almost 2% of the volume, yet 6% of the value whereas the vintage category remains somewhat static, having seen little change since 2016.

The interest in low dosage (being extra brut or brut nature styles) Champagnes has been a global phenomenon and could be especially transformative for the Australian market. Since 2019, global exports of this style have risen by 107%. In 2023, 300,000 bottles arrived into Australia, representing 4% of volume and 4.3% of value, up from 142,000 bottles in 2021. Noble believes that the lower dosage is particularly suitable to Australia’s preference for lighter and seafood-led cuisine.

Rosé Champagnes are also a point of fascination in Australia, representing 4% in volume and 4.3% in value. “Whilst it may appear as a small segment of the market, rosé Champagne is a diverse category that restaurants like because of its potential with food,” says Noble who references leading restaurants Quay, Shell House and Aria in Sydney as well as Supernormal and Society in Melbourne.

A two speed economy

“There is a two-speed market where we have consumption of entry level Champagnes, which are cheaper, but also purchases of rarities and prestige cuvées at the top end of the market,” says Kyla Kirkpatrick, owner of online Champagne retailer, Emperor, based in Melbourne.

Non-vintage Champagnes are the driving force for Kirkpatrick’s business but the ‘basket size’ of customer purchases is down at least 10% from last year. “What’s interesting is that consumers are happy to take a lesser-known Champagne brand over a bigger house…if it’s more price competitive.”

Kirkpatrick’s conversion strategies, particularly at the top end, are also a sign of the times. She is now hand-selling to individual customers and offering Champagne concierge services.

Annette Lacey MW, beverage director for the prestigious Solotel Group, echoes these comments. She says they have been able to sharpen their pricing due to “every brand becoming more competitive, because the market has shrunk.”

However, price competitiveness has been impacted by concurrent price rises with almost every shipment arrival. Domestic pressures in France associated with increased costs in production, but also shipping fees, point to an anecdotal impact on Champagne sales at restaurants and bars.

“Price rises make it increasingly hard to pour by the glass,” says Lacey. To this end, she says that non-vintages perform best at a pub level, but there is less impact at the fine dining level with prestige cuvées and vintage Champagnes on offer. “At the high-end, people are drinking less quantities now but drinking better. Those that are unaffected by the cost of living are still spending on luxury.”

At a time when entry-level Champagnes are on the decline, and higher-end Champagne availability remains limited with pricing at a record high, it’s never been a better moment for Champagne to trade-up its offer to aspirational consumers.

Off the back of the hugely successful Sotheby’s rare Champagne auction, held in Paris in June, Langtons (Australia’s premier destination for fine wine auctions), announced their intention to excite affluent collectors and drive awareness of the depth of the ultra-luxe category of prestige Champagnes.

Tyson Stelzer was revealed as the auctioneer’s partner to drum-up business for a summer auction, which he says is expected to generate more than AUD$1million in sales.

Baby boomers prop-up this pointy end, according to Langtons, though not exclusively. This was backed-up, again by the Commonwealth Bank’s, Stephen Halmarick, who was quoted in The Guardian as saying that those 60 and above are relatively insulated by the current economic turmoil and have the cash to splash, spending more than the rate of inflation.

Champagne remains bubbly down under

While various economic reports suggest that the Australian economy may remain ‘flat’ and households will continue to struggle, at least for the short term, other reports indicate that the market for luxury goods remains strong.

Though the recent downturn for Champagne is disappointing, its return to pre-pandemic levels, albeit with a decline in non-vintages but a boost in diversity of producers and categories, suggests this is encouraging for the outlook.

“It is important to remember that Champagne is a luxury product, and as such, maintains a strong emotional connection to many consumers,” emphasises John Noble. “Champagne lovers have continued to explore their preferences and a new definition of a ‘Champagne moment’ is emerging.”

While Champagne is often regarded as the ‘wine of celebration’ Noble believes that the concept in Australia is evolving and the question now is, what does ‘celebration’ look like?

“Australians generally take a casual approach to entertaining and our relaxed social culture means that a gathering of a few close friends may constitute a ‘celebration’ and serving Champagne can elevate these occasions as no other wine can.”

Champagne has a superpower, its ability to adapt. If nothing else, it always brings Australians a reason to dress up and step out.

Related news

Playing the long game: fine wine’s global trajectory