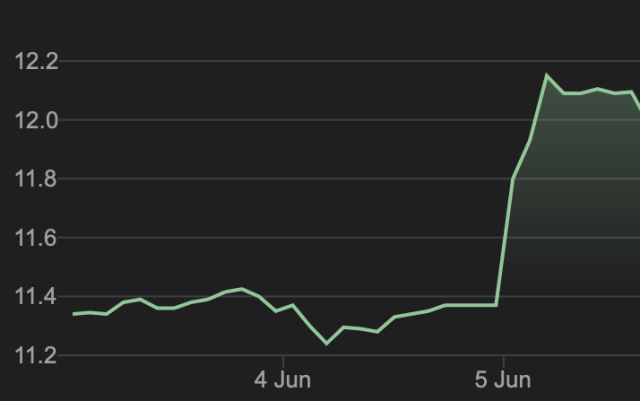

Treasury Wine Estates shares surge

While investors are awaiting news of Australian Vintage’s attempts to raise new funding and the outcome of talks between Pernod Ricard and Accolade, shares in the country’s biggest group, Treasury Wine Estates, have been surging.

They have risen by 10% in the past month to more than $AU12. They hit almost AU$20 at their peak in 2019.

The company has reshaped its business plan since being devastated by China’s tariff regime and has shed its commodity lines in the US as well as developing markets in South East Asia.

But the spurt has been underlined by a bullish presentation to investors in the US.

Not only did Treasury confirm that it was online to meet its profit predicts for the year, but it also presented a positive picture about its US activities, which were boosted by last autumn’s purchase of Daou Vineyards in California.

Partner Content

That, it believes, has given a significant long term growth opportunity to Treasury Americas.

It says that it has created the leading luxury wine business in the US and filled a big gap in the portfolio at the US$20 to US$40 per bottle range. It has also complemented its luxury portfolio where bottles are priced above US$40.

At the presentation it claimed that there are significant value creation opportunity leveraging Treasury Americas and Daou’s strengths.

Commentators believe the new scale of the US operation will allow Treasury to consider the creation of a standalone Treasury Americas Luxury division to operate alongside Penfolds.

Overall, Treasury reaffirmed that it expects mid to high single digit growth in the current financial year, excluding US$24 million from Daou in the second half.

It predicts Treasury America’s earnings will be between $223 million and $228 million, based on luxury portfolio growth, supported by increased availability, with revenue from the premium portfolio broadly in line with the same period last year.

Related news

'Rare buying opportunities' as fine wine prices hit a five-year floor