This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

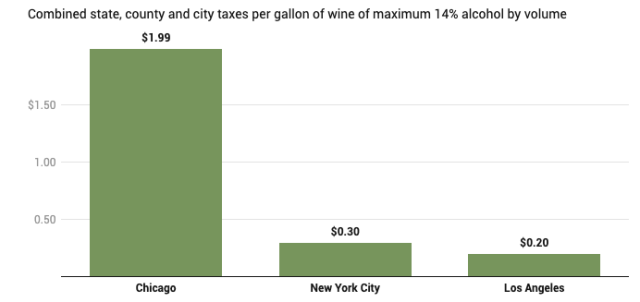

Illinois wine tax four times higher than in New York and LA

Excise taxes on wine are significantly higher in the state of Illinois than in other major US regions, meaning Chicago consumers are among the hardest hit in the United States.

Alcohol tax rates vary significantly from state to state, with the taxes often used to fund public services. Taxes are applied based on the type of alcoholic beverage. For example, wine is taxed at a higher rate than beer, and spirits at a higher rate than wine.

According to a recent report by Illinois Policy, Chicago residents are being hit hardest in the pocket compared with other major metropolitan cities such as New York and Los Angeles.

The state of Illinois currently taxes wine at US$1.39 per gallon, before a further US$0.24 per gallon is added by local Cook County on wines up to 14% alcohol by volume. If you are buying wine in Chicago (the largest city in Illinois), an additional US$0.36 is slapped on, bringing the total combined state, county and city taxes per gallon of wine to US$1.99.

For comparison, the total taxes applied to wine sold in New York is just US$0.30. And it’s even less in Los Angeles, where consumers will cough up a mere US$0.20 tax on their wine.

In fact, California is level with Texas for having the lowest per-gallon wine tax rate in the United States.

However, as per information on Wise Voter, Illinois is nowhere near the top of the list when it comes to the highest overall alcohol tax rates applied in the US.

Washington comes off worst of all, with the highest alcohol tax rate in the United States during 2023, at US$33.22 per unit.

Oregon (at US$21.95) and Virginia (at US$19.89) occupy second and third places in terms of highest alcohol tax.

Illinois is in 11th place, with a tax rate of US$10.91 per unit, and the state uses the revenue it gains from alcohol tax to fund public health initiatives, addiction treatment programmes, and responsible drinking campaigns.

By ‘alcohol tax rate’, db assumes this to be an average of combined liquor, wine and beer taxes, all of which are taxed at different amounts.

In 2022, revenue from alcohol tax in the United States amounted to US$10.2 billion. Statista forecasts that this sum will grow to US$10.54 billion by 2028.

Related news

Eminent Greek winery founder dies aged 82

Sherry Week celebrates gastronomic potential of historic wines

Spain 'needs to learn how to market our fine wines', producer claims