This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How has Latour fared since leaving en primeur?

A decade after the French estate quit the en primeur system, Liv-ex examines its performances on the secondary market.

In 2012, Latour announced that its 2011 wine would be the last vintage offered via the en primeur system. Since then, the château has been drip-feeding the market with releases from its cellar.

The estate offered its first back-vintage release – Latour 1995 – to the international trade in 2013. The wine was priced at a premium above cases already in the market and was met with a lukewarm response.

Although buyers have historically been willing to pay a premium for provenance, 20% seemed like too much of a stretch.

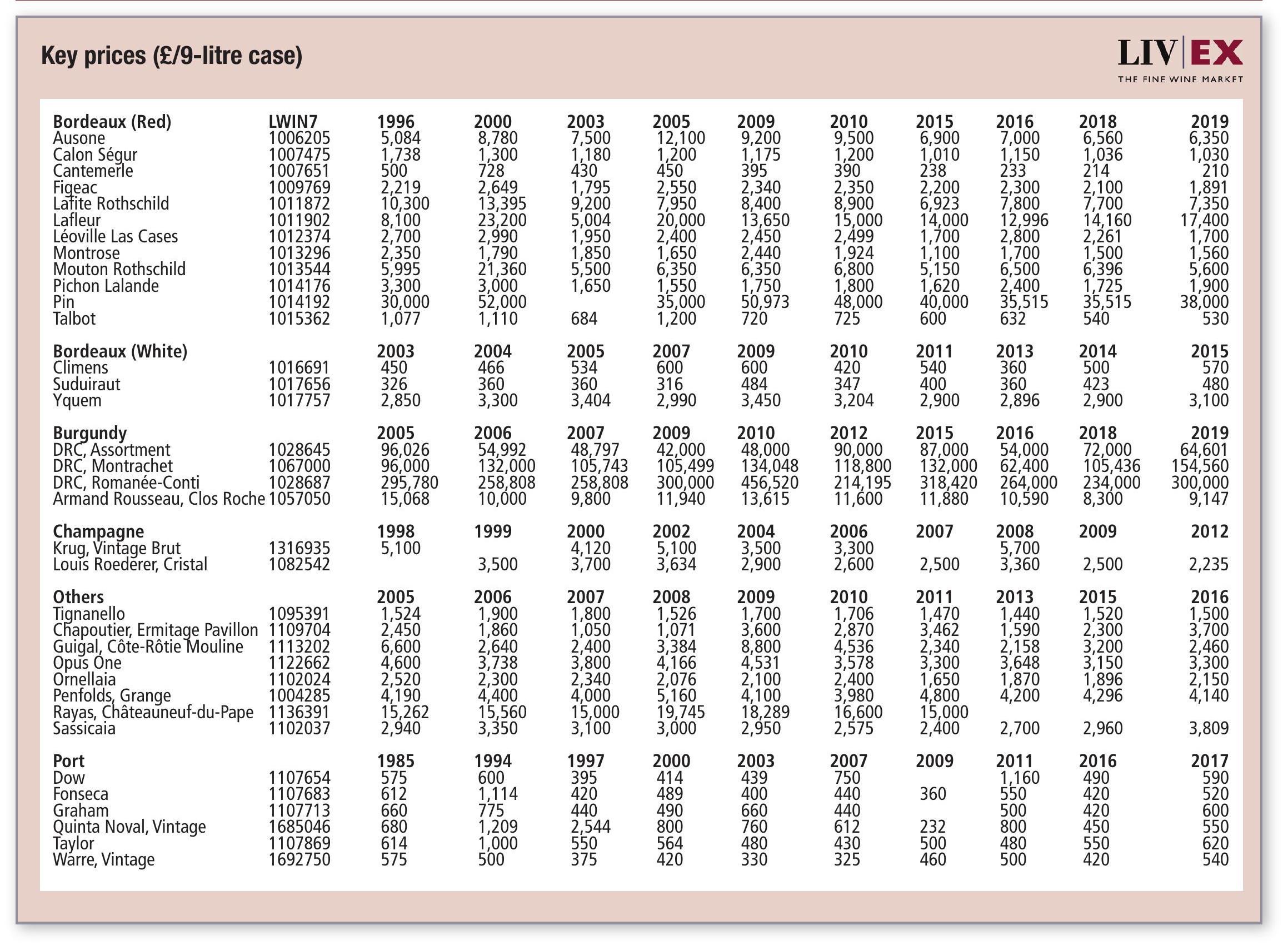

Following the release of the Latour 2015 and Forts Latour 2017 on the UK in mid-March (at £6,300 and £1,980 respectively, per 12x75cl) we take a look at Latour’s secondarymarket performance in recent years, and question whether the estate’s decision is finally starting to pay off.

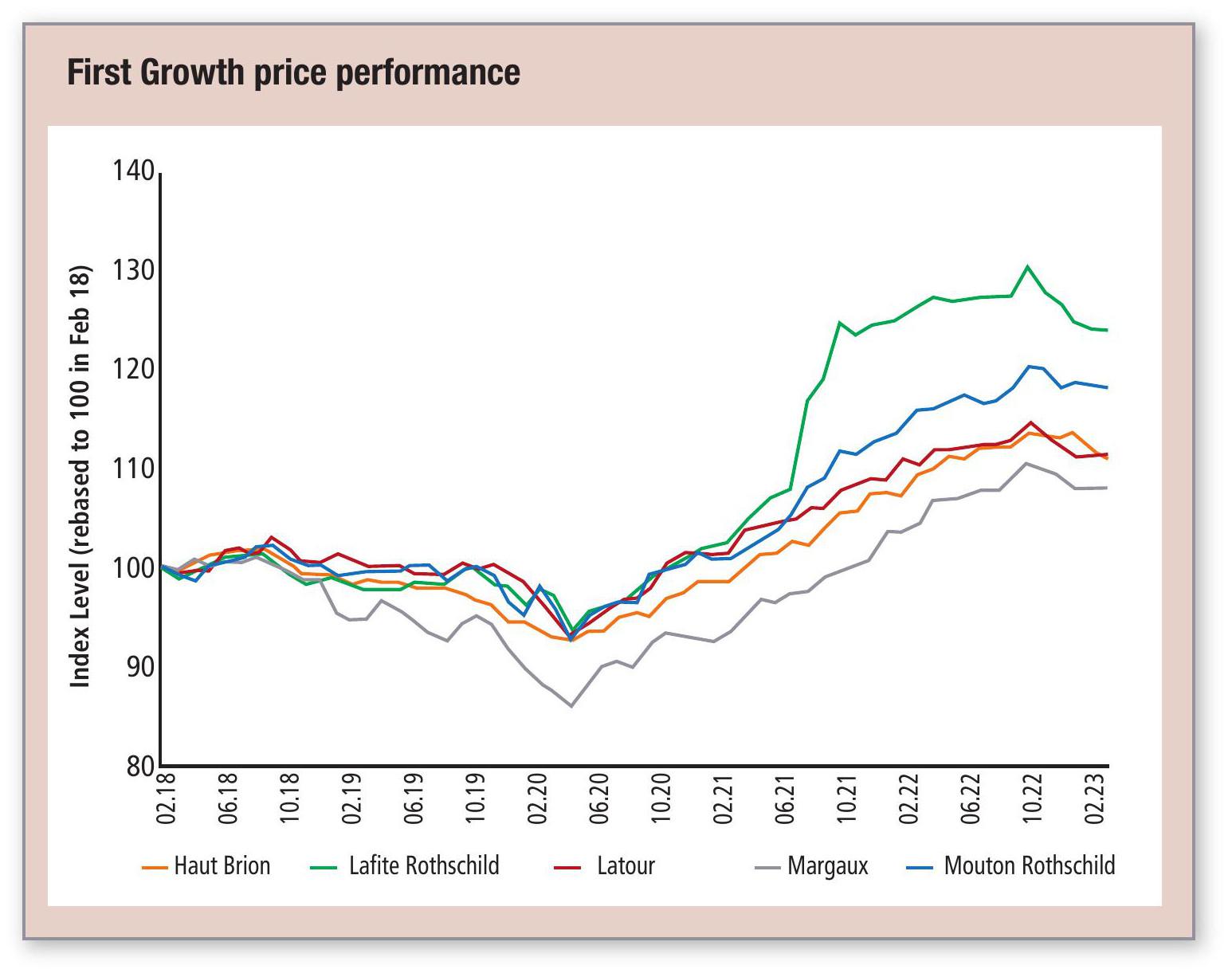

PRICE PERFORMANCE V FIRST GROWTHS

Historically, Latour has lagged behind the other First Growths on the secondary market. In 2021, it was the least-traded First Growth. Its 2021 Power 100 ranking was also weighed down by poor price performance.

However, the First Growth has started to outperform some of its peers. On average, Latour prices are up by 11.5% over the past five years, compared with 11.2% for Haut-Brion, and 7.9% for Margaux.

In the 2022 Power 100, Latour ranked 24th – above Margaux and Haut Brion, which placed 33rd and 34th respectively. Part of the reason for its success in the ranking was due to its average market price changes. At the time of the Power 100 report, Latour prices were up by 9.5%, and Lafite Rothschild was the only other first growth to see higher returns (of 14.5%).

Latour is also beginning to see increased trade on the secondary market. In 2022, it accounted for 15.4% of first growth trade by volume, up from 7.8% in 2021. (Although this is still below the levels achieved in 2012). However, despite recent price increases, not all Latour purchases have seen positive returns.

Buyers who bought the 2007 and 2008 vintages during en primeur have seen positive nominal returns, of 100.4% and 214.5% respectively.

Even those who bought the 2007 vintage when it was rereleased in 2016 have seen a 22% price increase since.

However, buyers who bought 2008 ex-château in 2019 have seen a 2% drop.

For further information, see Liv-ex’s recently published pricing analysis on the 2015 release.

fine wine monitor – in association with

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Liv-ex offers the wine trade smarter ways to do business. It offers access to £81m worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Glenfiddich becomes official partner of Aston Martin F1 team

Spain 'needs to learn how to market our fine wines', producer claims

Bourgogne wine see global growth despite difficult market conditions