This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

The dangers of expansion: will La Place de Bordeaux become too crowded?

Fine wine marketplace La Place de Bordeaux is evolving and expanding in tune with the increasing diversity of the secondary market – but it offers newcomers no guarantee of instant success, cautions a new report from Liv-ex.

The report – La Place de Bordeaux and the Expanding Fine Wine Market – warns that the continued enlargement of an increasingly crowded La Place might make it more difficult for new arrivals to find an audience in the future, despite the system’s undoubted benefits.

For centuries, the three-tier system of La Place has been the preferred sales platform for Bordeaux châteaux, and the first non-Bordeaux participants – including Chile’s Almaviva in 1998, and Napa’s Opus One in 2004 – had obvious links with the region through the Rothschild family.

Over the past decade or so, however, that has changed. Super Tuscan Masseto joined in 2009 with its 2006 vintage, and the trickle of newcomers has since become a flood: 75 wines from eight countries in last autumn’s tranche of new releases, according to db’s Bordeaux correspondent Colin Hay – expanding to more than 100 from 11 countries this year, by the reckoning of Liv-ex.

The most obvious benefits of La Place identified in the report are its scale and reach, with producers trading through brokers or courtiers to a network of more than 300 négociants, who in turn sell to merchants in more than 170 countries. With years of experience in trading limited quantities of sought-after wines in sometimes complex export destinations, négociants offer a route to market that is relatively smooth and hassle-free.

But that’s not all. “Part of the allure is the prestige of the system,” says the Liv-ex report. “Producers join to build or strengthen a globally recognised fine wine brand and, by doing so, hope to raise prices. Strategic brand development and gradual price increases over the long term are key to their success, which becomes evident when the wines enter the secondary market.”

There are pluses for the négociants too, at a time when many Bordeaux châteaux are releasing smaller quantities of their wines at higher prices; as merchants and their customers increasingly look beyond Bordeaux, it makes sense for La Place to evolve in order to satisfy that demand.

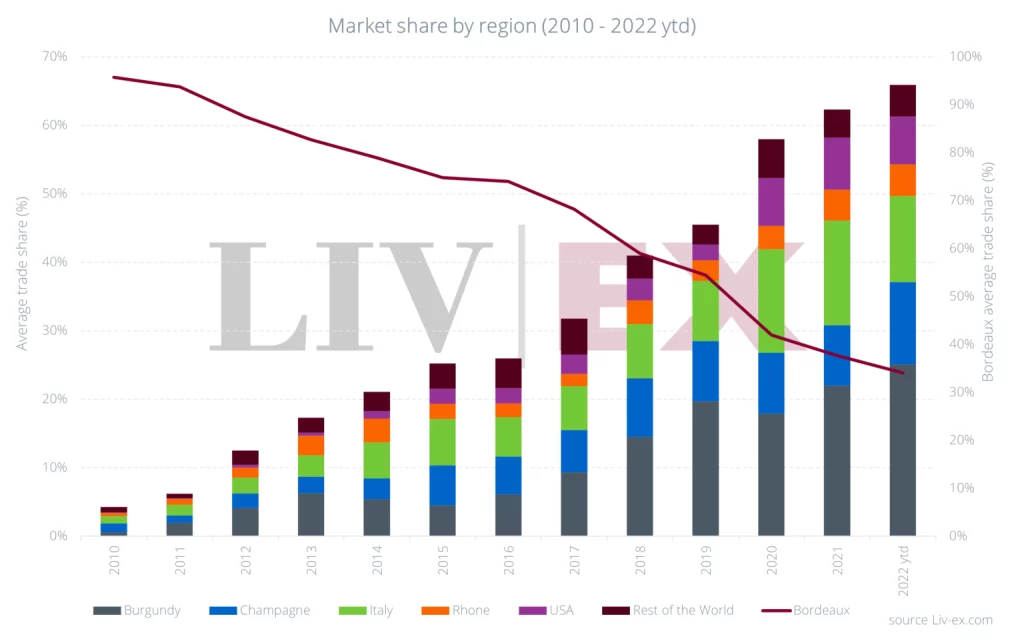

As such, the changes reflect the broader shifts in fine wine’s secondary market, the report notes. In 2010, Bordeaux accounted for 95.7% of Liv-ex trade by value; in 2022 to date, that share has fallen to a new low of 34.1% – and, in key regions such as Asia, Bordeaux has been supplanted by Burgundy as the most traded fine wine region.

An increasingly cosmopolitan La Place now trades wines from Argentina and Australia, from Chile and China – and from previously absent French regions such as Champagne and the Rhône Valley. This year, the first New Zealand winery – Craggy Range, with Le Sol Syrah and Aroha Pinot Noir – is joining the fray.

The most successful of the debutant nations on La Place, however, has been Italy. The country accounts for more than one-third of the autumn releases and, since Masseto’s arrival in 2009, the likes of Solaia, Ornellaia, Testamatta and Colore, among many others, have followed suit.

Some of these wines have reaped clear rewards from participation in La Place. Liv-ex analysis of price performance between July 2019 and July 2022 shows Masseto rising by 40.5%, Ornellaia by 38.2% and Solaia by 37.2% – well ahead of the increases recorded by Château d’Yquem (+15.9%), Opus One (+12.6%) and Beaucastel Hommage à Jacques Perrin (+11.3%).

Perhaps more telling is the individual performance of Masseto, which has been Liv-ex’s second-most traded Italian wine (after Sassicaia) over the past three years. During the 2005-7 period, prior to joining La Place, it was only the ninth-most traded Italian label in a much smaller pool of wines.

“Masseto built and enhanced its brand image over time, while prices gradually appreciated based on scores, age and vintage quality,” the report says. “New releases such as last year’s 2018 offering tend to offer relative value compared to older vintages from the same producer. The brand has also outperformed the broader Italy 100 index over the last three years.”

Not every La Place wannabe, however, can do a Masseto. Liv-ex analysis of 12 newcomers from autumn 2021 shows as many failures as successes: four wines have risen in value, four are flat, and four have declined – the latter including vintages of Vivaltus (Ribera del Duero), Beaux Frères Vineyard Pinot Noir (Oregon), Giodo La Quinta (Tuscany) and Peter Michael Les Pavots (Knights Valley).

Of the four success stories, two are provided by Champagne Philipponnat Clos des Goisses, with the launch of its 2012 vintage (price up 42.9% since last September), and the re-release of the 1996 (+50%) – as Liv-ex points out, an established name on the fine wine scene that is also part of a currently buoyant Champagne category.

One year is a relatively brief timescale from which to draw firm conclusions about the longer-term price evolution of the underperforming wines, but for Liv-ex it helps to illustrate the point that La Place offers no guarantees of an overnight return. “A successful release can see a wine selling out in a matter of hours,” says Robbie Stevens, Liv-ex’s Americas territory manager, “[but] the wrong price can leave stock languishing in négociant and merchant cellars for years. Whether the wine is from Bordeaux or elsewhere, it needs to be priced correctly relative to the ever-broadening market.”

In turn, this raises the question of the future of La Place, and of the wines that choose to participate in it. The benefits today in terms of prestige and route to market are clear, but the potential downsides of expansion may only now be emerging into plain view.

“It remains to be seen to what extent La Place, and indeed the fine wine market, will continue to expand,” the report says. “The more crowded it becomes, the more new arrivals might struggle to find an audience. There might yet be a saturation point where the benefits of being released through La Place are lost in an enormous jumble of releases.”

It is clear that ambitious producers will continue to join La Place in the hope of broadening their consumer base, elevating prices and raising their profile; but it is equally clear that many may have to be patient before seeing a quantifiable return on their involvement – and, for some, that return may not come at all.

Related news

A 'challenging yet surprising' vintage for Centre-Loire in 2024