This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

2021 a record year for Champagne exports

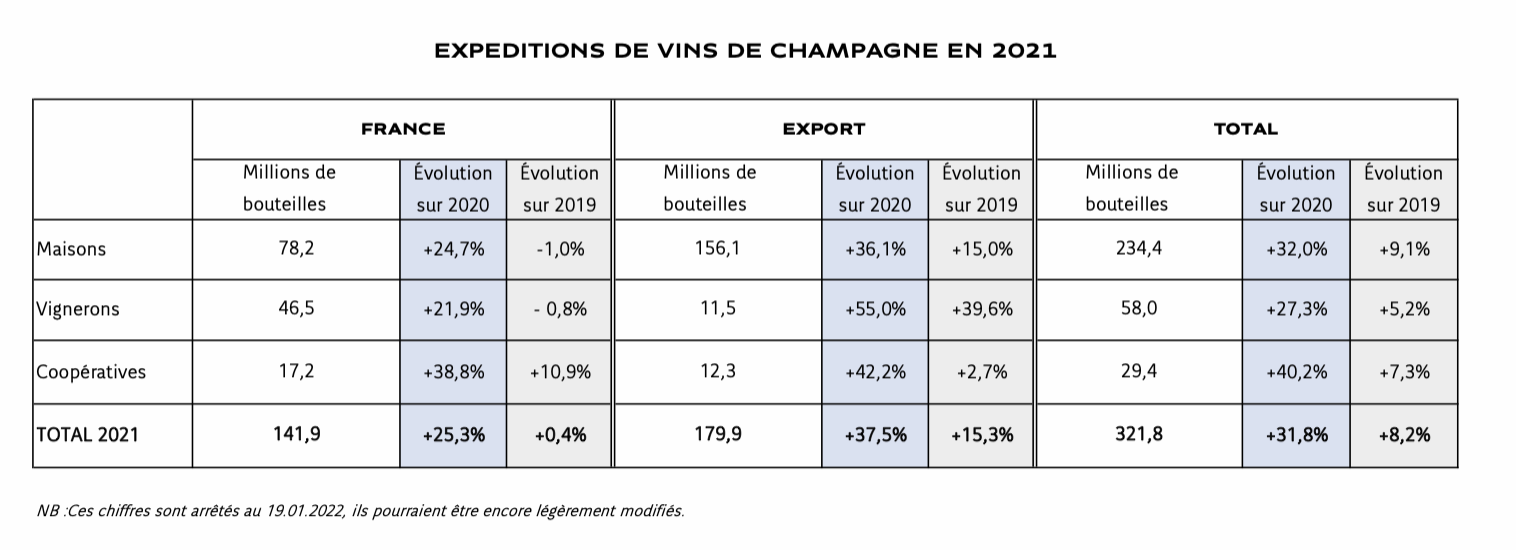

Champagne shipments in 2021 have been confirmed at 321.8m bottles, with exports reaching a new record of almost 180m bottles.

Overall shipments of Champagne, which include the domestic market, rose by 31.8% compared with the 245m bottle total for 2020, the first year where sales were hit by the pandemic, but they were also 8.2% up on the 297.5m bottles shipped in 2019 and only fractionally behind the second-best previous year of 2011 when 322.9m bottles were sold.

Overall shipments of Champagne, which include the domestic market, rose by 31.8% compared with the 245m bottle total for 2020, the first year where sales were hit by the pandemic, but they were also 8.2% up on the 297.5m bottles shipped in 2019 and only fractionally behind the second-best previous year of 2011 when 322.9m bottles were sold.

While the detailed country by country split for shipments is not yet available, overall exports were ahead 37.5% to 179.9m bottles and 15.3% up, the equivalent of an extra 24m bottles, on the 2019 level of 155.96m bottles, which was a record year for exports of Champagne.

The French domestic market recovered by 25.3% versus 2020 levels to 141.9m bottles, very close to the level in 2019 (just 0.4% ahead), but the overall trend of the French market remains downward, dropping every single year (bar 2021) since the recent high of 185.1m bottles shipped in 2010.

The négociants, the houses that dominate sales, particularly on the export market saw their shipments rise 24.7% in France to 78.2m bottles, while exports rose 36.1% to 156.1m bottles (which on its own is higher than the previous level for all exports) with overall shipments rising by 32% to 234.4m bottles.

The houses’ export shipments were up 15% on 2019 levels, but domestic shipments were down 1% on 2019, adding fuel to the idea that had they made more wine available in 2021 they would have sold more.

Any slack in the French market was taken up by the co-operatives which saw their shipments go up by 10.9% compared to 2019 and 38.8% compared to 2020, rising to 17.2m bottles.

The growers, much harder hit by the lower yields the négoce forced on them in 2020, were not in such a good position to take advantage of the recovering demand in France and while their domestic shipments were up 21.9% on 2020 levels to 46.5m bottles they were slightly down, by 0.8% on 2019 levels.

Growers’ exports recovered significantly, rising by 55% compared to 2020 to 11.5m bottles and by a still impressive level of 39.6% on 2019.

It seems that those growers geared up for exports sensibly concentrated on these more lucrative markets, where prices they achieve can be significantly higher than at home. And it will be interesting to see the figures for shipments to individual countries like the US, where growers’ wines have been doing so well in recent years, when they become available next month.

The co-ops also saw export growth of 42.2% to 12.3m bottles in 2020, but that level was only 2.7% higher than in 2019.

As we know that the market recovery is considerably stronger in countries where off trade sales are more developed, with on-trade outlets still closed or operating very restricted hours in many countries during 2021, there will no doubt be some significant growth showing in markets like the US, the UK and Australia.

Announcing the figures, Maxime Toubart, président of the Syndicate Général des Vignerons, and co-president of the Champagne Comité, said “This rebound is a good surprise for the people of Champagne after a year 2020 very impacted by the closure of the main places of consumption and the absence of events around the world.”

His Champagne Comité co-chairman Jean-Marie Barillère, also president of the l’Union des Maisons de Champagne, sounded a note of caution, however. Stressing that while thanks to exports and the appetite of consumers, Champagne will achieve a record turnover of more than €5.5 billion, average Champagne shipments over two years (2020 and 2021) at 280m bottles and turnover of €4.9 billion were below pre-pandemic levels.

Read more

Champagne shipments could total 320 million bottles for 2021

Related news

Grammy-winning Ariana Grande bewitched by Barolo