Why Rioja is considering removing vineyards

Even a wine region as successful as Rioja is considering removing vineyards in a bid to bring down the future supply of grapes. We consider why this might be desirable.

In a world where red wine consumption has been suffering a decline since it peaked in 2004 – taking reds share of global output from 48% to 43% – Rioja has proved a beacon of resilience.

While the proportion of white wine overtook that of red in 2013, and sparkling and rosé has been on the rise, Rioja, despite being almost entirely a red wine producing region (vinos tintos represent 84% of sales), has managed to hold onto its market share – and even enjoyed a 0.6% growth in volume sales last year.

Nevertheless, when db visited the DO last month, there was talk of removing vineyards to bring down future wine supply, as producers fear that the famous Spanish region may tip into a situation of excess.

In fact, recent history has already seen Rioja suffer from excess production, as db was told by José Luis Lapuente, who is general manager of the Consejo Regulador de la DOCa Rioja.

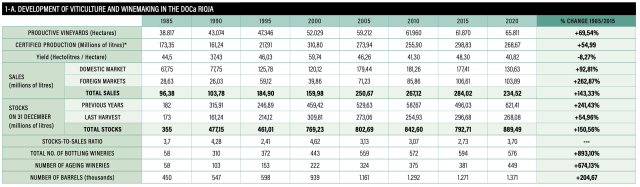

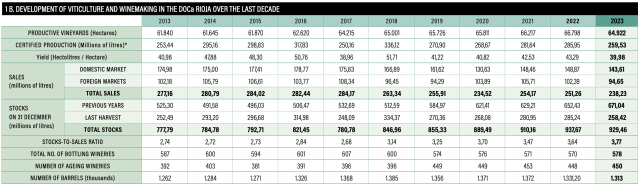

Speaking with db last month, Lapuente explained that the consejo has an ideal level of stock in its plans, which the region had surpassed in 2022 and ’23 (as you can see in the table, bottom), before bringing it down to a desired ratio by the end of last year.

“We compare the inventory in the wineries with the annual sales, and we want to find a ratio between 3.08 and 3.4,” he said, referring to the number of years’ worth of stock.

However, he continued, “In 2023, we closed the year over this range, it was 3.77, so we have made efforts to recover the balance, which is down to 3.38 [by the end of last year].”

In terms of the amount of wine, this has seen Rioja’s stock levels drop during the course of 2024 by as much as 90 million litres, which has partly been achieved due to the smaller than average harvest of last year.

Indeed, last year’s vintage produced 189m litres of wine, down from 259m litres in 2023, which itself was smaller than 2022, which yielded 286m litres (although the region’s peak this century was 336m litres in 2018).

But that isn’t the only reason why levels are down: Lapuente said that “various actions” have also caused inventories to fall, ranging from distilling 30m litres of wine last year, as well as practising a “green harvest” in vineyards – which see growers remove a proportion of the grapes on the vine before the harvest, reducing yields and raising the concentration of liquid in the remaining bunches.

He said, “We are on the right path, but it is not enough.”

Which presumably explains why some are calling for Rioja to also start removing vineyards – a measure that has most famously been occuring in Bordeaux, and been proposed for across the rest of France, with plans submitted to the European Commission for €120 million in subsidies to pull up 30,000 hectares of the nation’s vineyards.

And like France, Rioja’s vineyard owners want money from the European Union to remove vines, with db told that sums of around €6,000 per hectare have been requested for stopping production.

As for how much vineyard area could be removed, the range is between 7-9,000 hectares, which would represent 11-14% of the near 66,000ha of productive vines in Rioja.

Partner Content

Should that amount of productive vineyard be taken out, it would only reduce Rioja to a size similar to earlier this century, when the region was 59,000ha (2005), up from 52,000ha in 2000 – although the region has a whole has grown by almost 70% since 1985, when it covered 39,000ha.

There’s a feeling that Rioja has grown too quickly, particularly in areas such as Rioja Oriental, previously called Rioja Baja, where a lot of new plantings have taken place.

In terms of stocks held across Rioja, Lapuente told db that the decline was from almost 930m litres in 2023 to nearly 841m litres by the end of last year, noting that news of a need to distil wine has alarmed the trade, even though the amount is relatively minor: “We are talking about 30m litres out of 900m litres [worth of stock] – there is a perception that this is a disaster, but it is small,” he said.

The reason for keeping a tight control on production in region, despite the fact that stocks have been brought down to an acceptable level of around three years – which is the required ageing time for Reserva Rioja – concerns the projected demand for the DO’s wines.

Noting that sales in 2024 totalled 240m litres, Lapuente said that “we should assume that the market will be tough in the future… we don’t think the market will grow for Rioja, and we don’t think it will grow for anyone.”

Indeed, he said that in 2021, the consejo employed KPMG consultants to draw up forecasts for Rioja sales in the future, and the prediction was for the region to sell 313m litres of wine this year – significantly greater than the region’s peak performance, which was in 2017, when it sold almost 284.2m litres

With the market for Rioja essentially stagnant at 240m litres in 2024, it is highly unlikely it will grow by more than 70m litres by the end of this year to reach KPMG’s prediction, which was made when the market was enjoying a post-pandemic bounce-back.

The market for Rioja may even reduce, said Lapuente, noting that not only are prices of Rioja rising due to the increasing cost of raw materials and labour, but also the impact of Trump’s 25% tariffs, which will affect sales of the Spanish wine in the US.

Meanwhile, Rioja’s largest market, its domestic one – which accounts for almost 60% of sales – is in decline: demand was down almost 2% in volume in 2024, due to people in Spain drinking more white wine, as well as other drinks, from beer to cocktails, as well as reducing their consumption of alcohol more generally.

As a result, Lapuente said of the future market size for Rioja.“We need to be realistic and conservative.”

Read more

The red wine region that’s defying market trends

French government asks EU for more cash to pull up vines

Related news

A journey through Rioja Alavesa with Bodegas Ysios