Tuscany trumps Bordeaux

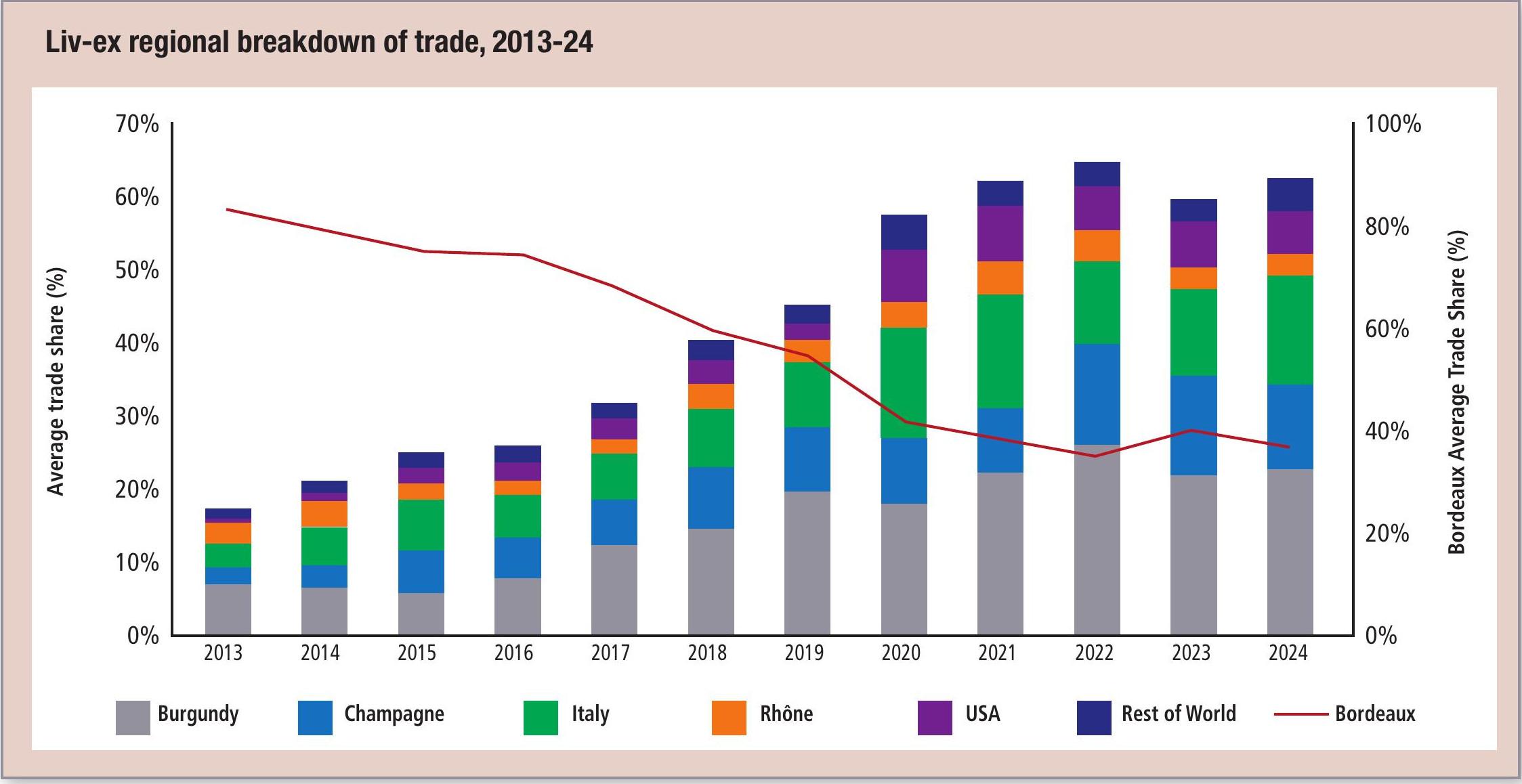

As Bordeaux reverts to the long-term trend of seeing its share of regional trade decline, a resilient Italy is picking up the pieces – with Tuscany to the fore.

Bordeaux’s share of regional trade declined during 2024. This is a reversal of what we saw last year, and a return to the longer-term trend which has seen the market diversify away from Bordeaux’s historic dominance. In a down market, this is notable.

Last year, Liv-ex suggested that, in a risk-averse market, buyers gravitate towards the safest bets. Given its volumes, well-understood mechanics and number of well-established brands, it appeared that Bordeaux represented that safe bet. However, with its share of trade down, that appears to no longer be the case.

Along with a subdued Chinese market, the reason why this is the case is most likely ineffective release prices, and the knock-on effect they have on the demand-supply balance.

The bid:offer ratio (total value of firm bids against firm offers) of the Bordeaux 500 has hovered around historic lows throughout the year. Sheds are full of stock, at no little expense.

As the market searches for a clearance price, the number of Bordeaux wines trading beneath ex-château release prices is the highest it’s been since 2015. In short, at each step of the supply chain after the wine leaves the château, participants are more likely to be making a loss than before.

However, this is primarily an issue with vintages post 2015. Pre-2009 Bordeaux, hailing from a different era of release pricing and benefitting from consumption-based scarcity, has been more resilient.

Partner Content

Italy: holding firmer than most

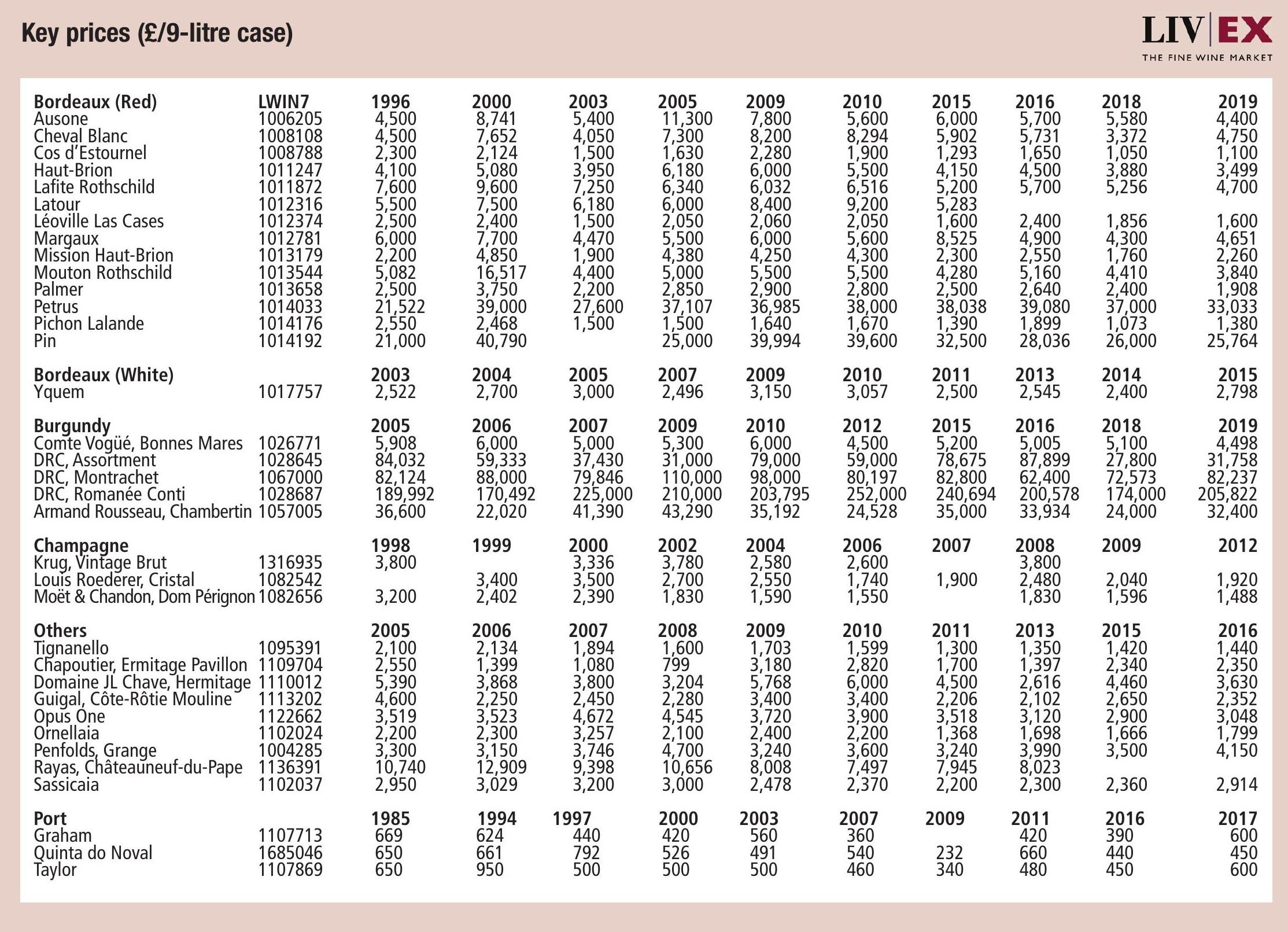

While still down 6% year-to-date, the Italy 100 has weathered the storm better than any other sub-index of the Liv-ex 1000. At the same time, the trade count of Italian wine is up 17.6%, trade volume is up 17.3%, and trade value is up 9.8%. Interestingly, the count of unique Italian brands traded is up 1.8% on 2023, while the count of unique wines (brand plus vintage) is up 11.3%. Buyers are purchasing a wider range of Italian vintages. Specifically, this has been driven by the US, where the total value of Italian wine bought is up 69.3% on last year. While in 2023 it was Piedmont that represented the Italian face of resistance, 2024 was overwhelmingly a story about Tuscany. Trade value for Tuscan wine has risen 16.1% compared to 2023. This compares to a 5.2% fall in trade value for Piedmont.

Digging deeper into Tuscan performance, it’s clear that it isn’t just Super Tuscans that have performed well, with leading Brunello (and declassified Brunello Soldera Case Basse) also trading more than last year. Masseto and Soldera – different grapes, different types of brand, but both produced in low volumes – benefit from scarcity and have traded in significantly higher value than last year. They are also two of the most expensive Tuscan wines.

Sassicaia represents the other side of the coin. Produced in higher volumes and trading at moderate prices, it has performed relatively well in 2024. The 2021 and 2020 vintages are the two top-traded Italian wines by value year-to-date. As a sign that the market deemed the 2021’s international release price of £2,500 per 12×75 acceptable, trade has been very consistent at that level.

fine wine monitor – in association with

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Castel Group leadership coup escalates

For the twelfth day of Christmas...

Zuccardi Valle de Uco: textured, unique and revolutionary wines