Rock star energy: Australian fine wine takes centre stage

By Sarah NeishAustralia’s premium wine is on the ascent against a backdrop of consolidation in the lower end of the country’s wine market, reports Sarah Neish.

If Charles Dickens were alive and wielding a BIC ballpoint today, he might have found himself inspired to pen a sequel to his famous literary work A Tale of Two Cities, only this time set in the thick of Australia’s wine trade. A pair of subplots is currently unravelling in the nation’s wine narrative – the unification of the entry-level of the market at one end, and the beatification of Australia’s carefully handcrafted old vine expressions on the other.

The catalyst for the former was the signing of an agreement by Pernod Ricard on 17 July, 2024 to sell its wine business in Australia to Australian Wine Holdco Limited (owner of Accolade Wines). The deal brings the Jacob’s Creek, Orlando Wines and St Hugo brands from Pernod’s side of the fence together with Accolade’s comprehensive Australian portfolio, which includes such household names as Hardys, Jam Shed, Banrock Station and Grant Burge, labels which Accolade itself calls its “global growth engines”.

It’s little wonder then that talk has skewed heavily of late towards the commercial or volume end of the Australian wine market, particularly what this latest merger might mean for quality moving forwards.

However, there is another equally compelling story playing out; that of Australia’s incomparable fine wines. These are capturing the attention of a new generation of collectors who are searching for a sense of connection with the heritage of great winemaking regions, whether those be Bordeaux or the Barossa Valley.

Producers who communicate their custodianship of ancient terroir are finding their cachet is creeping up, and Australia is no exception.

According to Matthew O’Connell, head of investment and CEO of trading platform LiveTrade, two of the most resilient Australian vintages to look out for on the secondary market are 2008 and 2010, with prices for the former declining “by just 5% and the latter by 12%”.

Over at online auctioneer iDealwine, sales of Australian wine totalled €14,659 in the first six months of 2024 and Alix Rodarie, head of international development, expects total 2024 auction sales for Aussie wines to “easily eclipse those of 2023.”

Excited bidders

As word gets out about the exceptional quality of premium Australian wines, prices too are climbing.

The most expensive bottle of Aussie wine sold via iDealwine auction last year was a 1982 bottle of Penfolds Grange, which went under the hammer for €751.

However, “bidders got most excited about The Schubert Theorem 2019 from The Standish Wine Company in Barossa”, adds Rodarie. Following a flurry of bids, the latter, heralded for its “haunting beauty”, went under the hammer for €175, more than twice its estimate. A great example of the kind of wine helping to carve out a glowing reputation for Australia, The Schubert Theorem has received widespread acclaim. Stuart McCloskey, founder of specialist Australian wine retailer The Vinorium, based in the UK, went so far as to say that “with 20-30 years of cellaring the 2019 vintage will be otherworldly.”

Not to be outdone, on 18 August Coonawarra’s Redman Family auctioned one of the most complete Australian Cabernet verticals to ever come to market.

Spanning 50 consecutive vintages from 1971 to 2021, the sale was “an exciting chance to own a piece of Australian wine history”, said winemaker Dan Redman, as well as a “rare opportunity to see how the wines have evolved” across different winemaking styles and a changing climate. The aim of the sale was to show “how beautifully Coonawarra Cabernet Sauvignon can age”, and it did just that, with the sale bringing in a total AU$4,651 (£2,381), averaging out at around AU$93 (£47.60) per bottle.

Silver lining

In many ways, the recent deal struck between Pernod Ricard and Accolade has helped to further differentiate Australia’s fine winemakers, giving them the opportunity to emphasise why their expressions are cut from a different cloth.

“These kind of situations highlight the need to balance the industry with family-owned wineries that focus on longevity,” Michelle Geber, managing director of Château Tanunda in the Barossa Valley, tells db. “As our winery is more than 130 years old, we understand the pivotal role we play, and are constantly striving to upkeep it for generations to come. Authenticity of place is where our focus lies in order to keep operating for the long-term.”

For others such as Burch Family Wines in Margaret River, which is responsible for roughly a quarter of Western Australia’s premium wine through brands such as Howard Park, the Accolade acquisition leaves a slightly more sour taste.

“I’m sure these mergers create efficiencies for production and supply chains, and follow a growing trend of larger companies restructuring their portfolios to focus on premiumisation,” says sales and marketing director Rich Burch.

“However, I’m not sure it’s necessarily good for the future of Australian wine, as it reduces competition and provides less variety for customers. Efficiency is important, but unfortunately you can’t ‘save’ your way to success.”

What you can do is invest in the scrupulous investigation of your vineyard, drill down on what each individual block and row brings to the table and work with the best technical teams in the country to craft a wine that whispers to consumers from that very corner of the world. You can also borrow from ancestral wisdom.

Generational knowledge

According to James Lindner, co-owner of Barossa’s Langmeil Winery, home to Australia’s oldest Shiraz vineyard, premium Australian wine should “accurately represent accumulated generational knowledge” of the region and its soils.

In other words, age matters: the age of the wine estate and the epoch of expertise it has amassed, the age of the vine itself and the age of the wine (time spent in barrel). Top-end Australian wine must, Burch stresses, hone in on its “strong sense of place, pedigree, and heritage”.

Individualised care

For Geber at Château Tanunda, it’s not enough “to simply say you’re a premium wine producer. You have to show it, too.”

She insists that the best wines are made with individualised care of the fruit from vineyard to bottle: “For all our wines, whether single site or blends, a handcrafted approach at every stage of the process ensures a wine that has nuance and depth of character.”

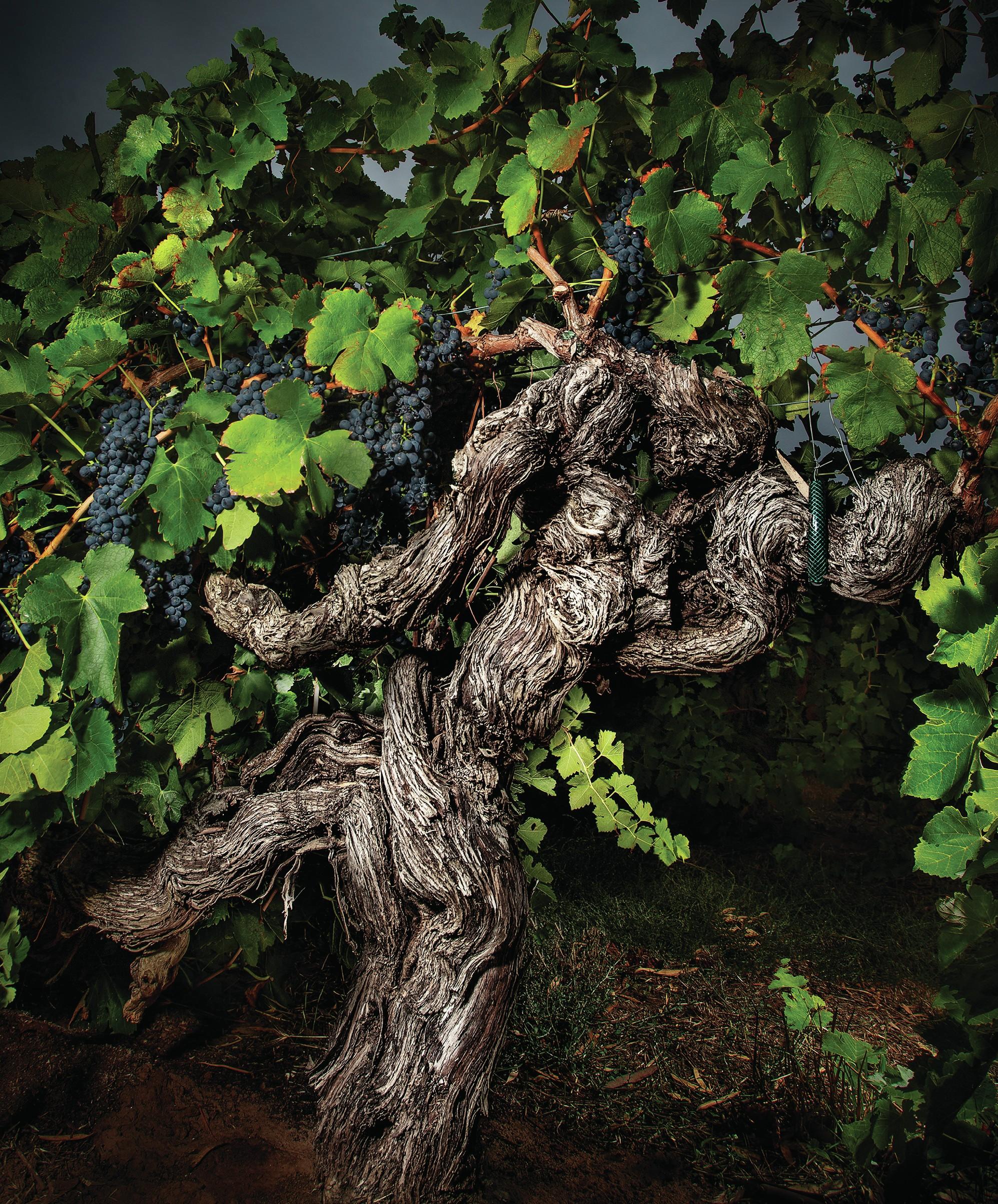

Another golden thread that runs through many of Australia’s fine wines is the country’s gnarled and twisted old vines.

“Our unique access to old vines on original European rootstock in the Barossa surpasses any other region in the world,” says Geber. “We have vines that are aged 50, 100, and 150 years old in varieties including Shiraz, Cabernet, Semillon, and Grenache.

“It’s a strong USP for Château Tanunda and for Australian wine more widely that we should lean on to develop an international taste for top-end Australian wines.”

Some markets are wide open to the idea that Australian wine can command a premium, while others need a bit more convincing. As a result, wine producers are adjusting their export strategies to make sure their bottles reach those consumers who most appreciate their rare quality to price ratio.

“Australian wines represent fantastic value for money and over-deliver in terms of premium wines compared to other regions that are priced out, such as Napa Valley, Bordeaux, etc.” says Geber.

Asian promise

Almost all the producers contacted for this piece agreed that Asian markets hold the most promise for Australian fine wine, and in fact Asian markets made up 50% of the top 10 markets by value share for Australian wine, according to IWSR data.

Singapore, Malaysia, Taiwan, and Hong Kong all top the list of booming export markets, while the UK is also ripe for the taking, if producers can withstand the recent duty hikes. Rich Burch has some strong words to say about these changes.

“The UK is a market that needs to check itself,” he tells the drinks business. “The UK Government’s recent decision to impose a historic and transformational duty on wine suggests that it is out of touch with the industry and the current cost of living crisis that people are facing.”

With the wine world increasingly moving towards premiumisation, he adds, the decision to put a duty on ABV “is counterproductive and will continue to erode the value proposition and quality of those wines.”

Arguably, a premium wine can only be as premium as local market legislation allows it to be.

“Now we face the additional challenge of making premium wine with a lower alcohol content and navigating an overly regulated wine market,” says Burch. “This decision will make Australian wine more expensive and put inferior wines on the shelf which I’m not sure UK consumers will be happy about.”

This particular hurdle notwithstanding, more work is required in the European and North American markets “to enable consumers to trade up on their Australian wine with confidence,” says Langmeil’s James Lindner, who counts China as an extremely important market for his fine Barossa wines.

Immediately responsive

Following the lifting of punitive tariffs on Australian wine exports to China in March 2024, producers have re-committed with varying degrees of vigour to what was once their biggest market. For some, such as Château Tanunda, China has been “immediately responsive”, with orders coming through thick and fast.

Others, like fellow Barossa producer Langmeil, have taken a more cautionary tack “to ensure our re-entry into the market is consistent and sustainable,” explains Lindner. “We are still in the pipeline-filling stage; the real test will be the pull-through by Chinese consumers in a challenging economic environment and a smaller imported wine market.”

Few would argue against the fact that China has changed substantially since Australian wines were last consumed there in any meaningful quantity. The People’s Republic is not only facing rising interest rates and reduced wine consumption, but according to Burch many businesses involved in wine supply chains and distribution have also undergone some shape-shifting.

“For us, much of the past six months [since the tariffs were lifted] has been focused on understanding what these businesses look like now and their capacity to market and sell wine,” he says.

Geber believes these changes to the traditional supply model may provide windows for opportunity in the years to come. “New opportunities are on the horizon as the China market matures in retail and online channels, plus advances are made in direct delivery models,” she says with confidence.

Photo credit: Dragon Fine Art Photography

Rewriting the rules

Interestingly, the rules for ‘trading up’ are also being rewritten.

“The way we premiumise today is very different from how it was five or 10 years ago,” says Julian Dyer, Australian Vintage’s chief operating officer for UK, Europe and the Americas.

“It’s no longer about trading up from good to better wines but about introducing new styles and new concepts or formats. We are fortunate that globally the buying community is very receptive to innovation, as we all recognise that doing the same thing won’t grow sales.”

For Australia, part of this crucial innovation means diversifying from its flagship grape variety Shiraz to put its unique stamp on other international grapes. According to Tim Pelquest-Hunt, chief winemaker, Orlando, Pernod Ricard Winemakers, Australian Riesling is “a highly underrated gem, delivering exceptional purity and freshness at an attractive price point while evolving gracefully over time.”

Riesling also answers the increasingly loud consumer cry for white wines with bright acidity, and as Rich Burch puts it: “Consumers know what they are looking for… most of the time.”

Tempranillo, on the other hand, has the ability to thrive in Australia’s hot, dry climate, making it a resilient choice and is “gaining traction for its bold fruit flavours and impressive ageing potential,” Pelquest-Hunt continues. He believes that international grape varieties will play “an increasingly important role in Australia’s premium wine landscape” moving forward, but only if producers add “our own unique stylistic interpretations.”

Allocation reshuffle

Equally, the establishments in which top-end Australian wines are offered will become ever more important; with some producers looking at an allocation reshuffle between the on-trade and off-trade as part of their premiumisation strategy.

The on-trade is “extremely important for levelling up that perspective of premium Australian wines,” says Geber. “It’s a great way to build confidence in the brand, whether that be the brand of Australia, or our own. We’d love to see our wines on more wine lists across the globe.”

Likewise, Pernod Ricard places an emphasis on getting its wines into upmarket hospitality venues. “Particularly for premium and above, this approach allows for sampling by the glass, enhancing the tasting experience and consumer appreciation for quality wines,” says Pelquest-Hunt.

However, in the off-trade, he adds “a targeted channel strategy ensures that our prestige wines reach the right consumers by leveraging product packaging and instore visibility effectively.”

Fine Australian wines are going to become more visible over the next 12 months, and those in-the-know will be keeping an eagle eye on the most attractive prices. In light of what is happening at the other end of the country’s wine spectrum, singing one’s premium attributes from the rooftops will be paramount for the next chapter of the nation’s story.

“Further consolidation and scale [at the lower end of the market] will drive Australian wine volume in the ultra-competitive commercial space, where global consumption continues to be challenging,” says Langmeil’s Lindner. “Small and focused continues to suit our family’s goals.”

And with international corporations circling to acquire Australian brands, “small and focused” suddenly becomes a more precious currency than ever.

Related news

South Australia wine exports to China reach post-tariff high

Everything you wanted to know about the Australian beer industry