Heineken’s growth weaker than expected

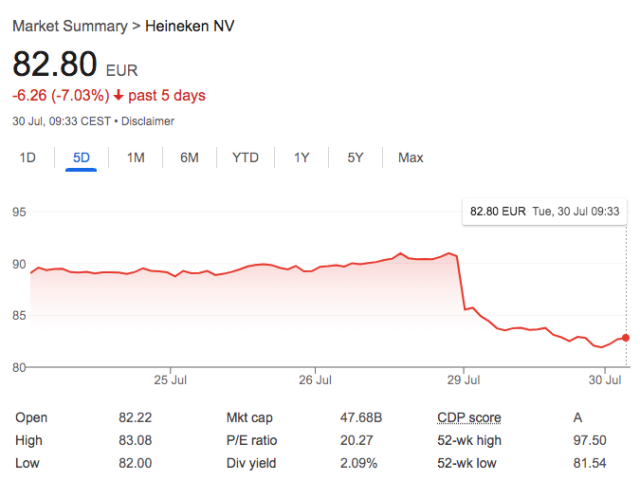

Dutch brewer Heineken has delivered lower operating profit and beer sales than widely expected in its half-year figures, resulting in a 10% drop in share price yesterday.

The company, which includes brands such as Birra Moretti, Amstel and Red Stripe, announced 2.1% in beer sales growth instead of the expected 3.4% and operating profit growth of 12.5%, which was below a forecast of 13.2%.

It reported a revenue of €17.823m for the first half of 2024, representing a 2.2% rise on the same time last year.

Figures were particularly wide of the mark in Europe, where 0.2% profit growth was delivered against an expectation of 15.1% with promotional spending cited.

China

In addition, Heineken revealed a non-cash impairment of €874m on its 40% stake in brewing company China Resources Beer, which was primarily due to the company’s decline in share price following concerns about consumer demand in China.

As a result, shares fell yesterday on the news, although they have recovered slightly this morning at the time of writing.

In terms of low- and no-alcohol, it reported that its Heineken 0.0 product had seen sales increase by 14%, including double digit growth in markets such as Brazil, Egypt, Vietnam and the UK.

Partner Content

Premium beer volume grew by 5% with the flagship brand up 9%.

Heineken revised its profit organic growth forecast for the full-year to a range of between 4% to 8%.

Solid

Dolf van den Brink, CEO and Chairman of the Executive Board, said that the company had delivered a “solid first half of the year” and the Americans region “stood out”.

He also highlighted €300 million of gross savings in the first half of the year, and that the brewer had a “clear line of sight” on cost saving initiatives which would result in around €500m for 2024, ahead of its medium-term commitment of €400 million per year.

Van den Brink added that cash would be reinvested into marketing and sales

He said: “Major ongoing saving initiatives resulted in a strong operating profit improvement, notably in Brazil and Mexico. APAC returned to growth, led by India and with the Vietnamese beer market stabilizing. We are actively navigating volatility in Africa.

“In Europe we gained market share in the majority of our markets and beer volume was slightly up compared to last year despite poor weather in June.”

“Our EverGreen strategy continues to shape our business. We are firmly on-track to deliver €0.5 billion gross savings for 2024, enabling us to invest in growing the category and in building strong brands.”

Related news

Northern Monk to raffle 15 litre Nebuchadnezzar of imperial stout