Trophy wines within reach

By db staff writerFine wine prices are falling, bringing the price correction that enthusiasts have been waiting for – especially when it comes to the ‘Big Eight’ producers.

‘Falling prices’ – two words that don’t often come together in 2024, but a very welcome change for fine wine buyers. Rayas, Leroy, Auvenay, Rousseau, Roumier, Bizot, Arnoux-Lachaux and Grange des Pères make up the ‘Big Eight’, among the most sought-after estates on the secondary market, all marked by soaring prices in 2022 then significant price drops in the past year. Is it too soon to speak of a return to a wine lovers’ market? Has the bubble burst in Burgundy? Is a first growth Bordeaux comeback finally on the horizon?

‘Falling prices’ – two words that don’t often come together in 2024, but a very welcome change for fine wine buyers. Rayas, Leroy, Auvenay, Rousseau, Roumier, Bizot, Arnoux-Lachaux and Grange des Pères make up the ‘Big Eight’, among the most sought-after estates on the secondary market, all marked by soaring prices in 2022 then significant price drops in the past year. Is it too soon to speak of a return to a wine lovers’ market? Has the bubble burst in Burgundy? Is a first growth Bordeaux comeback finally on the horizon?

Questions abound when it comes to the future, but iDealwine’s data reveals lower prices do not reflect falling demand for blue-chip bottles. It’s more the result of a highly charged global geopolitical situation, rising interest rates and other unfavourable macroeconomic factors that left many would-be buyers highly price sensitive in the secondary market.

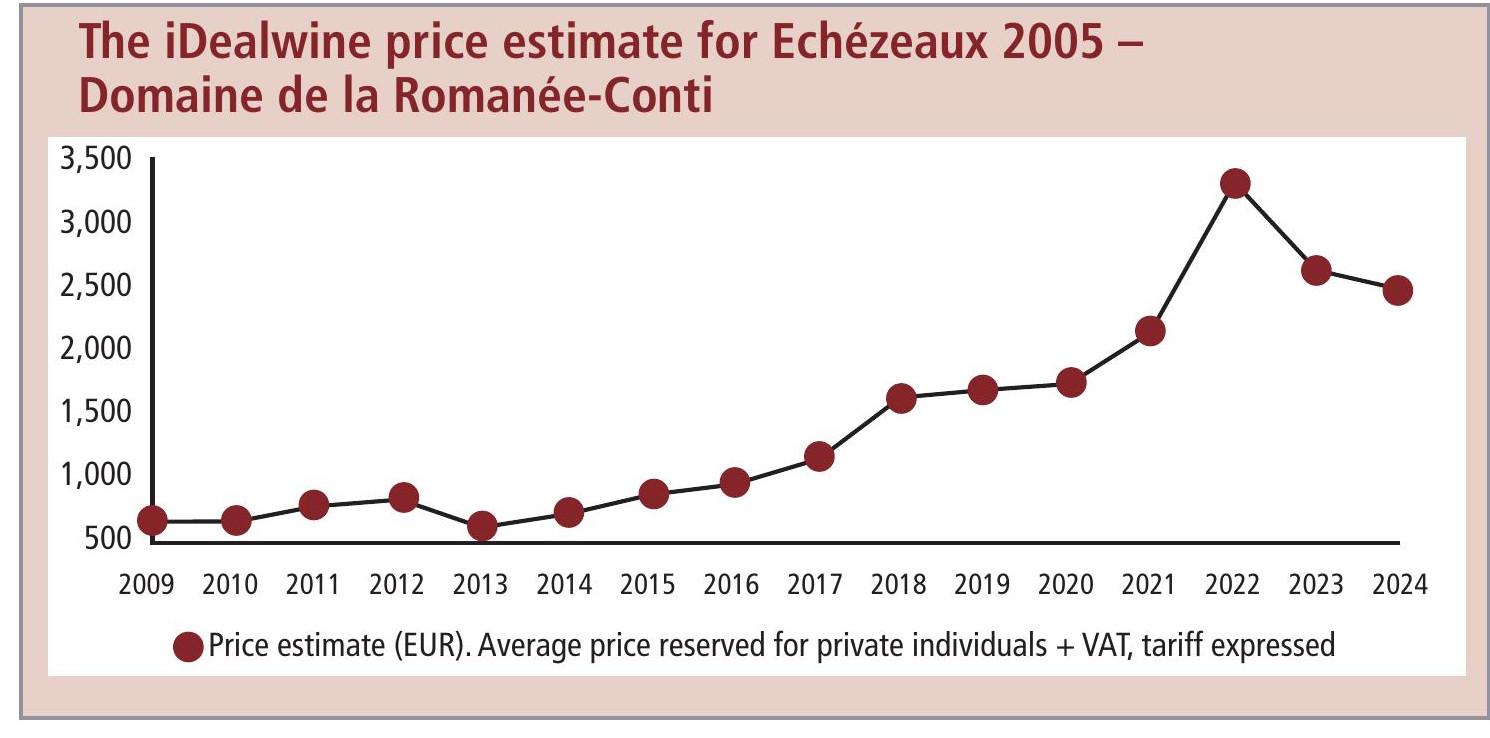

The price drop for the Big Eight is consistent with pre-pandemic prices, or at least those recorded in early 2021, which means we’re talking about a ‘price correction’ in Burgundy (as six of the eight estates are from this region), rather than a bubble bursting. And what of the titan DRC? Prices have fallen at auction by 15%, but Domaine de la Romanée Conti remains the most sought-after estate in fine wine, having reclaimed the title in 2024 from usurper Domaine d’Auvenay.

Softening prices in the fine wine market have gone beyond Burgundy. In the secondary market, prices have never been this volatile for iconic wines such as Château Rayas’ Châteauneuf-du-Pape, where price fluctuations have varied wildly. The average price of a bottle of Château Rayas, which soared to a record €1,502 in 2022, has fallen by 40% in 2023 (to €904), a hammer price comparable to those fetched in 2021.

Softening prices in the fine wine market have gone beyond Burgundy. In the secondary market, prices have never been this volatile for iconic wines such as Château Rayas’ Châteauneuf-du-Pape, where price fluctuations have varied wildly. The average price of a bottle of Château Rayas, which soared to a record €1,502 in 2022, has fallen by 40% in 2023 (to €904), a hammer price comparable to those fetched in 2021.

To say that prices are down everywhere would be misleading, however, as the data reveals (for the finest wines) that, the older the vintage, the less susceptible that it may be to price sensitivity. Vega Sicilia is a great example of this. Despite a slight decrease in the number of bottles sold at auction in 2023, the Ribera del Duero star saw its average price rise by 20% to €304.

Among the bottles of l’Unico that went under the hammer, a 1968 sold for €1,252, a 1962 went for €1,064 and a 1959 was auctioned for €901.

Bordeaux has also been buoyed by the success of mature vintages, with threequarters of top bottles sold at auction last year being pre-2010 . One of the older examples was a bottle of Château Latour 1906 which went under the hammer for €2,790. In fact, the value of Bordeaux sales increased by 2%, which might not seem like much, but it is significant in a softening market and widespread industry ‘Bordeaux bashing’.

Although the average bottle price dropped by 7%, this decrease was far less dramatic than in other French regions such as Burgundy (down 35%) and Champagne (down 20%). With this year’s en primeur campaign well under way, it’s worth keeping in mind that, for wine enthusiasts, Bordeaux remains a solid long-term investment, eschewing passing trends that may encourage speculation in other regions, with the data confirming it to be close to a safe bet at auction.

We hear you ask: how representative are these prices of the wine industry in general? The wine auction market differs in many ways from buying wine at retail, starting with the average price of the bottles sold. On iDealwine, bottles go under the hammer from €5 all the way to €22,912, with the average price settling at €152, a much higher price than the average £6 spend on a bottle of wine in the UK.

However, the auction price represents a drop of 22% when compared to last year.

So, even though fine wine prices slumped in general, and even though less famous wine regions (outside Burgundy, Bordeaux, Rhône and Champagne) accounted for only 13% of hammer prices, it is under-appreciated, under-the-radar regions where demand is growing most: prices rose in Alsace, Savoie and Corsica.

As is generally the case at auction, rarity is the common denominator here, with appreciating value most widespread in wines produced by recently deceased cult winemakers; but it is also evident in micro-production estates (and micronégociants), very old vintages (the oldest was 1841, a Napoléon Cognac) and shuttered estates no longer in production.

The latest consensus is that fine Bordeaux is the new destination for excellent value for money, specifically in vintages about to enter their drinking window.

Auction update – in association with iDealwine

About iDealwine.com

• Founded in 2000, iDealwine is France’s top wine auctioneer and leading online wine auction house worldwide.

• Based in Paris, and with offices in Bordeaux and Hong Kong, iDealwine sources rare bottles from European cellars, private collections and direct from producers before meticulously authenticating and shipping to enthusiasts, collectors and trade customers worldwide.

• If you are keen to sell your wines or spirits, check out idealwine.com.

About the Barometer

In 180 pages, iDealwine’s annual auction Barometer analyses the fine wine auction market and delves into the latest trends in fine wine. With an in-depth look at 15 French wine regions, fine wines of the world and a list of rising star producers in each one, the Barometer is an invaluable resource for serious wine enthusiasts. The Barometer is available for purchase on iDealwine.com, with a complimentary copy provided for clients.

In iDealwine’s annual analysis of the fine wine market and, more precisely, the wine auction world, it is clear that the fine wine cards have been reshuffled. Initial auction results in 2024 hint at a secondary market ready to heat up again (already there is a 13.5% increase in auctioned value and a flurry of bidding for top lots). Today’s calmer prices present new opportunities for wine lovers and renewed enthusiasm for wine from regions that have tended to be overlooked – for now.

Related news

Scaling up organics: the realities behind going big without chemicals

Libiamo! Christie's curates wine auction for Royal Opera House