The top 10 trends shaping Champagne in 2024

By Patrick SchmittFollowing Champagne’s post-boom correction in 2023, what does the new normal look like for the region? Patrick Schmitt MW picks out 10 key developments.

IT MAY be a fixed area devoted to essentially one style of wine, but Champagne is a highly dynamic region.

Indeed, one of the main reasons for Champagne’s sustained success is the fact that the appellation is always changing, both adapting to forces beyond its control, and innovating to keep its consumers enthused and its competitors at bay.

With this is mind, I’ve picked out what I believe are the top 10 developments taking place in Champagne, based on the trends of 2023 and the first half of this year. Some of these concern the market, others the product.

Overall, as I point out in my report on this year’s Champagne Masters, it is clear that the quality of Champagne being made today is better than it has ever been. The incomes earned by this bounded region have been put towards improving viticulture and winemaking, while climate change appears – in this century at least – to have been mostly kind to Champagne, which has benefitted from a string of fantastic vintages – even if last year’s bountiful harvest was, for the most part, best-suited for creating brut non-vintage – as well as for replenishing reserves – rather than top-end, single-harvest wines.

1: NORMALITY RESUMES

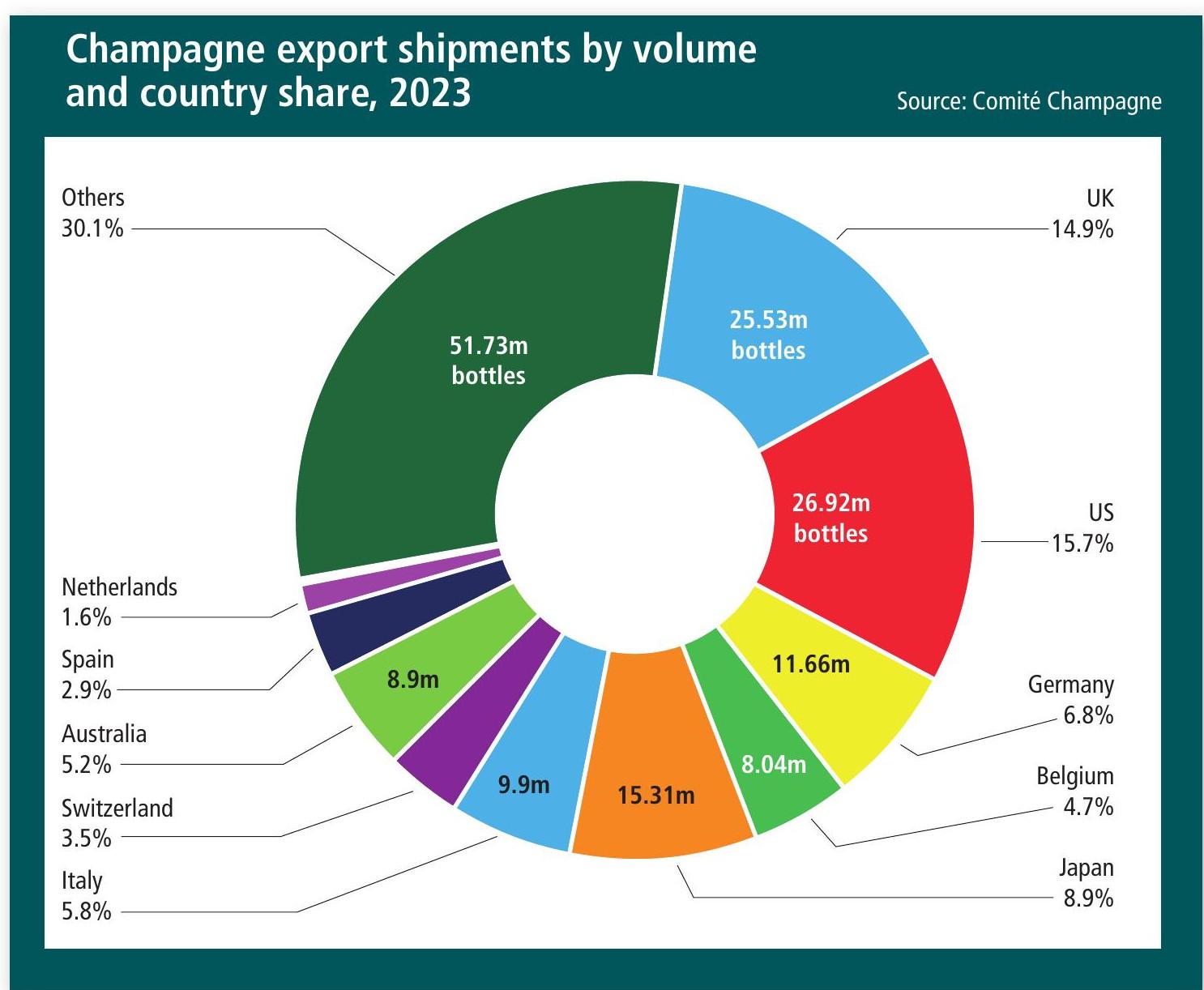

Now the shipment figures have been released for 2023, it’s clear that the post-pandemic party is over. Or rather, normality has returned to Champagne trading. As the numbers show, Champagne has retreated to its pre-pandemic size of around 300m bottles. Having suffered the declines of 2020, then enjoyed the bounceback in 2021, followed by the boom in 2022, which led to shortages among producers – and price increases for consumers – it’s now back to where it was in 2019 – volume-wise, that is.

Those times when Champagne was unable to supply global demand, and hence was ‘allocated’, also ushered in a brief era when price promotion on this sought-after product almost disappeared.

But, as a sign that the selling of Champagne is back to its past form, price-cutting has returned. As a result, major retailers in key markets such as the UK and France were offering attractive discounts on Champagne to their shoppers in the run-up to Easter – a way to boost income for supermarkets, but also to shift excess stock from the festive period.

Having said that, what is different is that the off-promotion prices for Champagne are much higher than they were pre-Covid. The price increases that were pushed through in 2023 and then again at the start of this year have not been reversed, even if the discounting is back.

As a result, the days of cheap Champagne, such as bottles selling for sub-£15 in UK retailers, appear to be over. This means that, nowadays, Champagne could be considered inexpensive if it’s priced below £30.

This development also explains why shipments may be down to 2019 levels in volume terms but, being worth almost €6.2bn, remain close to their 2022 peak – which was €6.3bn.

As Champagne Lanson president François Van Aal said to db at the start of the year: “In terms of value, Champagne is really stable, which is due to price increases, as well as more value in the country mix and the market mix.”

2: A REPOSITIONING OCCURS

With Champagne becoming increasingly expensive – a function of rising grape prices, but also of higher interest rates, along with the increasing cost of dry goods, energy and labour – the entry point of the category is no longer cheap.

This shift has required a repositioning from the producers of Champagne’s most inexpensive expressions – who are having to divert pricier grapes to high-value cuvées while, in some cases, discontinuing their most affordable labels, even if they once sold in high volumes.

Such a development has been witnessed in Champagne’s domestic market in particular. For example, Christophe Juarez, who is CEO of Champagne Nicolas Feuillatte, told db that 2023 had seen the discontinuation of the brand’s base-level Brut Sélection and the launch of the more premium Grande Réserve, resulting in a 25% fall in sales volumes for what is France’s best-selling Champagne, with a 40% share of Champagne sales in the country’s retail sector.

“We decided to reboot our strategy in the off-trade and premiumise our offer, which meant a 15%-20% increase in our price position, as we moved from the bracket of less than €19 a bottle to €24,” said Juarez.

Similarly, Stanislas Thiénot, who is the managing director of Arvitis – which owns a number of marques, including Canard-Duchêne – told db that his group’s volumes had declined by “almost 20%” in 2023, following the decision to axe an entry-point label in the domestic retail sector.

“We made the decision to stop selling Champagne Marie Stuart in France, where it was only sold in supermarkets and retailed for around €17,” he said, telling db that this move involved losing almost 500,000 bottles in sales (while noting that the overall amount of Champagne sold in French supermarkets dropped from 35m bottles in 2022 to 27.4m bottles last year).

Explaining his decision regarding the domestic distribution of Marie Stuart, he said: “We prefer to keep our grape sourcing to supply a brand with more value,” before noting that the combination of the rising expense of grapes, interest rates, labour, energy and glass had pushed up the cost of Champagne production by 30%-35%.

3: ARABIA PROVIDES HOPE

Rather than dwelling on areas of decline, the Champenois are always on the lookout for new sources of demand. Such a search seems to be taking them into new regions, as the established markets appear stable at best.

One area of the world showing promise for Champagne is the Arabian Peninsula, which may at first seem unlikely, considering the severe restrictions on the sale and consumption of alcohol, but changes are taking place.

Already, however, the United Arab Emirates (UAE) has softened its stance on alcohol, and Champagne seems to be benefitting. With almost 90% of the 11mstrong population being expatriates, there is a fairly sizeable Champagne market in the country, and the growth in fizz (and wine) sales is coming on the back of an enlarging economy, expanding foreign population and increasing numbers of tourists.

While Dubai is the biggest consumer, gaining access to the market for drinks producers can be challenging, due to the fact that only two companies are allowed to import and distribute alcohol in the city – Maritime and Mercantile International (MMI) and African & Eastern (A&E).

On the other hand, Abu Dhabi has a more open approach to trading alcohol, with as many as 10 distributors currently active in the market, with the possibility for more to be established.

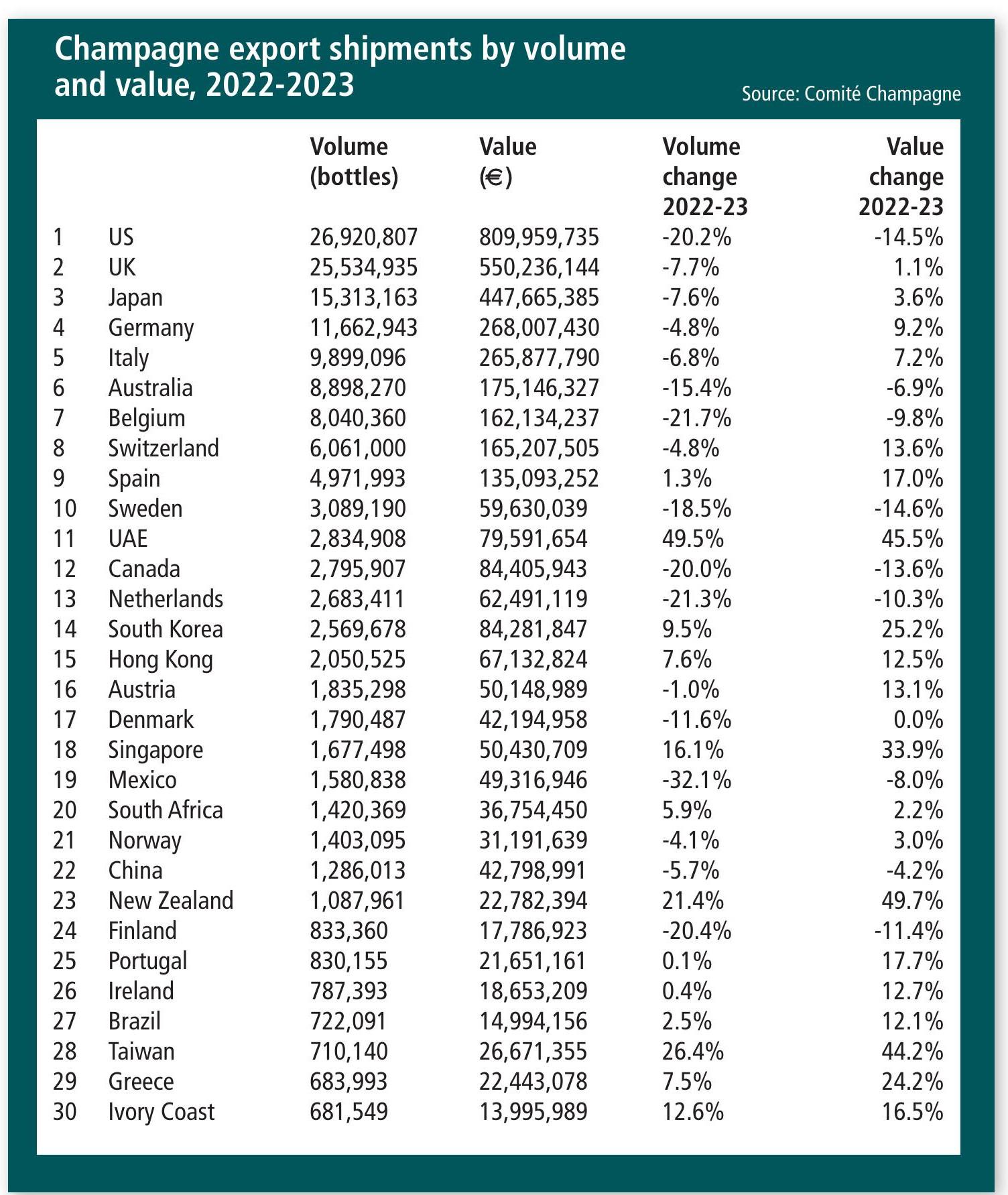

Challenges aside, the UAE is clearly already a growth market and becoming a significant source of Champagne sales, fast catching up with Sweden and, should the UAE overtake it, the Arabian country would move into the top 10 worldwide for volume sales of the fine French fizz. As you can see in the figures for the top 30 Champagne markets by shipment volumes for 2023, the UAE is approaching 2.9m bottles in scale.

However, with this volume being worth almost €80m in turnover, in value terms the nation is already in the top 10, with Sweden totalling just under €60m.

Driving such growth is not just a booming economy and a growing population, but also a recent relaxation in the rules for purchasing alcohol in Dubai – having decriminalised alcohol in 2020, it scrapped a tax of 30% on alcohol last year, as well as dropping the licence fee needed to buy alcohol in the commercial and tourism hub last January. As for other parts of the Arabian Peninsula, it is Saudi Arabia that has made the headlines this year as it looks to partially lift its total prohibition on alcohol – with preparations under way to open a liquor store in the capital Riyadh (although it is only for diplomats).

However, it’s thought that the rules on alcohol will relax further in the near future, once Salman of Saudi Arabia, the world’s oldest living monarch at the age of 88, hands over the throne to his son, Mohammed bin Salman, who wants to boost tourism and reduce the country’s dependence on oil.

“Saudi Arabia is the market of tomorrow, but not this year or the next, but five years’ time… At the end of the day, it will be a strong market, it will be the new Dubai, and with even more money to invest,” predicted Alex Tarditi, Asia-Pacific and Middle East export manager at Vranken-Pommery Monopole, during a discussion on potential Champagne markets with db.

4: PINOT NOIR MOVES INTO THE SPOTLIGHT

While Chardonnay has been the fashionable grape of Champagne for much of this century – sold as blanc de blancs – today the spotlight is shifting towards Pinot Noir.

Not only does this mean there are more blancs de noirs coming on to the market, but also more village and single-vineyard expressions, bottled to express the particular characteristics of Pinot Noir from a specific site.

The trend is being dubbed “the Burgundinisation of Champagne”, according to Bollinger MD CharlesArmand de Belenet. Explaining the move, he said that, historically, Champagne had had more in common with Bordeaux, “with its big châteaux”, but it is “now nearer to Burgundy with its focus on terroir and villages”.

Such a development is qualitative too, with this year’s Champagne Masters showing a marked increase in the excellence of blanc de noirs – once a category featuring relatively disappointing wines, and encouraging the judges to conclude that Champagne needs Chardonnay. Not any more, it seems.

5: AGEING GETS EXPERIMENTAL

The Champenois are becoming more adventurous with how they ferment and age the base wines for making Champagne, as well as the finished Champagne itself.

Examples include pioneering approaches such as the use of gold-plated barrels by Champagne Leclerc Briant, or of egg-shaped oak containers by Champagne Drappier. Some Champagne houses – notably Drappier and Veuve Clicquot – are also ageing finished Champagne under the sea.

Partner Content

Meanwhile, producers seem to be playing with their stores of wine, with an increasing number blending their past vintages and keeping them as ‘réserves perpetuelles’. While these are mostly used to add depth, complexity and stylistic consistency to non-vintage cuvées at growers and maisons such as Pierre Péters, Philipponnat and Louis Roederer, others, for instance Henriot, make a Champagne solely from this solera-like, multi-vintage collection, which this producer calls Cuve 38.

6: VITICULTURE IS GETTING CLEANER

More growers and négociants are moving towards sustainable viticulture. Such changes are good for the environment, but also yield better grapes, which are more disease-resistant due to thicker skins – allowing producers to harvest bunches later and produce riper, richer base wines. Although organic and biodynamic viticulture is only a small proportion of the vineyard area in Champagne, almost all the major houses are experimenting with the approach, with some trialling regenerative agriculture too. While Louis Roederer has for some time been strongly associated with biodynamics at scale in Champagne, as has Leclerc Briant, the producer making especially big moves, and noises, in organics at the moment is Telmont.

The producer, which is now majority-owned by Rémy Cointreau, stopped using herbicides in 2000 and started converting its vineyards to organic practices in 2017, with the aim to be 100% certified organic by 2025 across its own 24.5ha estate, and entirely organic by 2031, when all its suppliers – which represent almost 60ha of vineyards – will be certified too.

Meanwhile, Ruinart is trialling ‘vitiforestry’, having planted trees and hedgerows at its vineyards in Taissy to provide habitats for fauna such as ladybirds and bats that are useful in the management of pests.

Finally, taking a more hi-tech – as well as more sustainable – approach to the vineyard is Moët & Chandon, which has created a partnership with a company called Yanmar to advance robotic vineyard management in Champagne, particularly in ‘challenging’ sloping sites.

7: CHAMPAGNE’S VARIETAL OFFER EXPANDS

Producers are increasingly emphasising the role of Champagne’s lesser grapes – in other words, those other than Pinot Noir and Chardonnay. Not only are there more single-varietal Meunier Champagnes on the market, but more producers are trialling the appellation’s ‘ancestral’ grape varieties: Petit Meslier, Arbane, Pinot Blanc and Fromenteau (the local name for Pinot Gris).

Among those replanting Petit Meslier and Arbane – albeit on a small scale – is Champagne Bollinger, with the producer ’s viticultural team believing that such late-ripening varieties may be useful in the future, should the region continue to warm.

Meanwhile, Drappier has become the first producer in Champagne to grow all eight grapes authorised for use in the appellation, having just planted the region’s first hybrid variety: Voltis.

Voltis is a fungus-resistant grape, which is now allowed to be planted in Champagne on an experimental basis. Drappier was already making a blend with four white grapes of the region, called Quattuor, combining Arbane, Chardonnay, Petit Meslier and Pinot Blanc, while it launched a varietal Fromenteau in 2021, which is also organic and sugarless, and named Trop m’en faut! – a play on words for the local name for this grape variety.

8: PACKAGING IS GETTING GREENER

Although Champagne is famous for heavy bottles, transparent glass and ornate gift boxes, there is a move towards more environmentally-friendly packaging. For example, Telmont has ceased the use of gift boxes and now uses green bottles, which are made from 85% recycled glass. Drappier – which is a carbon-neutral producer – uses lighter, brown, 87% recycled glass bottles, and Ruinart has created a 99% paper, recyclable case, moulded to the shape of the bottle, which weighs 40g compared to 355g for the previous gift box.

Many other examples abound, but one aspect of Champagne packaging that won’t be changing any time soon is the use of foil covering on the tops of sparkling wines, known as the ‘coiffe’.

While the EU has made the application of this extra packaging optional, the Comité Champagne has decided to make la coiffe compulsory and include it in the appellation’s specifications, calling it “a historic attribute of Champagne” that “contributes to the prestige and value of the bottle”. The organisation also says that the foil covering “accounts for only 0.6% of the Champagne industry’s total greenhouse gas emissions”, adding that “it can be recycled”.

In other words, a producer like Telmont could ditch la coiffe, but it would no longer be allowed to label its products as ‘Champagne’.

9: CHAMPAGNE IS GETTING MORE COMPLEX AND DRIER

As outlined in the report on this year’s Champagne Masters, producers are making more complex cuvées, which are drier, with more brut nature expressions emerging. It’s a trend towards winemaking precision generally that, at its pinnacle, cellar master at Moët & Chandon Benoït Gouez has referred to as ‘Haute Oenologie’.

Gouez used the term when unveiling the first release from Moët’s new Collection Impériale, calling it “the ultimate of what we can craft with the knowledge we have today”.

It blends wine from seven vintages, employing all types of ageing, with wine matured in oak, in bottle on its lees, as well as in stainless steel. It is also Moët’s first zero-dosage Champagne.

But such precision winemaking is not the sole preserve of Moët. Haute Oenologie is part of a wider movement in Champagne towards more complex blends involving a greater span of reserve wines and the use of different ageing vessels.

Meanwhile, lower dosages – or zero sugar additions – are also being favoured to allow for maximum transparency of these complex Champagnes.

10: AND FINALLY… CHAMPAGNE IS PRODUCING MORE STILL WINES

In keeping with the sharper focus on Pinot Noir and specific vineyard locations, Champagne is increasing its emphasis and production of still red wines: Coteaux Champenois.

While Champagne has been making more still red wine for blending with white to make rosé – pink Champagne has been a growth market – today it is making fine and increasingly full-bodied Pinot Noirs for selling as Coteaux Champenois. The reason for this development stems from advances in viticulture and winemaking for still wine production, helped by knowledge sharing with Burgundy, as well as a string of warmer vintages.

Such has been this change that Bollinger MD de Belenet thinks that Champagne may soon rival the reds of the Côte d’Or in terms of quality. “I believe we will be able to produce outstanding still wines in the coming years, ones that are very similar to the great wines of Burgundy,” he predicts.

Champagne won’t lose its sparkle, but the advent of more still red wines helps to highlight the diverse terroir of the region, its advances in viticulture, potential for ripeness, as well as the quality of its wines based on Pinot Noir.

What’s the view from the biggest player in Champagne?

Alexei Rosin, managing director, Moët Hennessy UK & Ireland

“Overall, 2023 was a positive year for our Champagne brands. Greater availability at the end of the year meant fuller shelves and therefore we were better able to fulfil demand. Despite two years of notable shortages and high inflation, where prices have increased and promotions declined, the desirability of our brands remains very strong – the Christmas performance for both Moët & Chandon and Veuve Clicquot was strong given this context.

“Brand image for consumers remains strong, fuelled by increased investment in marketing, which has helped these brands remain at the top of consumers’ choice, especially at Christmas where their share is higher than the MAT. Investment in media campaigns and landmark events, engaging with hundreds of thousands of consumers such as the Solaire Culture Exhibition for Veuve Clicquot and Royal Ascot for Moët & Chandon, have proven successful in driving brand desirability and purchase. Our brands continue to innovate, for example with the launch of Moët & Chandon Collection Impériale in 2023 – and our Moët & Chandon Bar in Harrods posted strong sales at Christmas.

“Having said that, it is clear that the cost of living crisis and high inflation have impacted the Champagne category. The frequency of consumption, notably in comparison with 2022, was an exceptional year in terms of ‘indulgent’ spending. We expect to see more stability for the category moving forwards.”

The performance of Champagnes in 2023 in the UK:

In the off-trade, Moët Hennessy UK saw movement in line with national averages for the core lines. Champagne volumes were down 14%, with value down 9%, and prices overall increasing by 6%, with grandes marques as a subset of that declining 10.7% in value terms (source: Nielsen).

Against that background, Moët & Chandon Brut Impérial decreased by just 4% by value and gained value share by 0.6% of total Champagne. It remains the number one brand by volume and value in the UK.

Meanwhile, Veuve Clicquot Yellow Label declined in value by double digits, but lost just 0.7% value share of total Champagne.

Key points according to the Comité Champagne:

• Total Champagne shipments in 2023 were 299m bottles, down 8.2% on 2022.

• After three extraordinary years, Champagne is back to pre-Covid shipment levels.

• With 297.3m bottles shipped in 2019, sales fell in 2020 by 18% during the pandemic, and then bounced back by 33% in the following two years to reach over 325m bottles by the end of 2022.

• In 2023, France is down by 8.2% with 127m bottles. The domestic market has suffered more from inflation compared to export markets, which has weighed on household budgets throughout the year.

• Exports are down 8.2% from 2022, with 172m bottles shipped, but are well above their 2019 level (156m bottles), and now account for more than 57% of total sales, compared to 45% 10 years ago.

Read more

The big interview: Moët’s UK MD Alexei Rosin

Related news

Veuve Clicquot bets on Pinot Noir for La Grande Dame 2018

How to make top blanc de blancs in 'the kingdom of Pinot Noir'

How the wine industry is addressing labour standards in vineyards