Idealwine: En primeur remains a ‘long haul’ investment opportunity

A year after the mixed reaction to the 2022 vintage, Bordeaux’s newest vintage is becoming available. iDealwine takes a look at the landscape of the 2023 en primeur and argues that where Bordeaux truly shines is in its capacity as long-term investment.

Early reviews indicate that the vintage will be quite impressive, featuring generous volumes and elegant, well balanced wines. Additionally, there are rumours that this year ’s prices will be more restrained than the year prior, creating the perfect conditions for enthusiasts to find great value at an attractive price.

To begin, what is en primeur? Many wine enthusiasts are familiar with the term, but not the detail. In the context of wine sales, en primeur refers to the opportunity to purchase a bottle before it has been publicly released. The modern system was introduced in the 1970s, gaining significant popularity in 1982, when Baron Philippe de Rothschild organised a well documented tasting of his wines while they were still maturing in barrel.

Today, these exchanges take place through La Place de Bordeaux – a complex, three-tiered trading system between châteaux (producers), courtiers (brokers) and négociants (effectively, wholesalers). Most of the en primeur wines put up for sale this spring will be unavailable for at least two more years as they continue to age. Purchasing wine in advance of its official release, through a pre-sale programme like en primeur, typically leads to advantageous pricing.

The beginning of last year ’s campaign, which centred on the 2022 vintage, was marked by relatively steep prices (~20.8% higher than the year prior, according to Liv-ex). This was the result of a small, high-quality harvest, which led to impressive wines almost everywhere in the region, directly contrasting with 2021, when the quality varied greatly from château to château.

While the opening prices of 2022 struggled to gain traction with some enthusiasts, the laws of supply and demand eventually intervened. Further into the campaign, prices cooled off and customers arrived in droves, as excitement for this high-quality vintage eventually emerged, generating an impressive amount of value.

Now, producers find themselves in the midst of a very interesting new vintage in 2023, with positive early reports of quality and quantity. However, like 2021, quality is a little more dependent on the château. For this reason, the question of opening day prices seems to be top-of-mind for everyone involved.

According to a survey of 50 leading wine companies by Wine Lister, prices are expected to fall by an average of 30%, and the campaign is expected to begin earlier than usual and happen very quickly, generating much excitement for this more condensed edition. The campaign is also expected to feature plenty of positive surprises, as producers such as Châteaux Canon and Pavie reportedly have the potential for 100-point scores.

If recent auction results are any guide to this year ’s campaign, there is much to be excited about. In 2023 iDealwine auctions, Bordeaux remained the most popular region of origin, with nearly 80,000 bottles sold (a 10.4% increase over 2022).

Although average prices came down by about 7%, this decrease was far less dramatic than in other French regions such as Burgundy (-35%) and Champagne (-20%). The price stability of Bordeaux has been a trademark for the region, which seems to avoid over speculation.

This is perhaps one reason for the enduring popularity of the top châteaux, which claimed six of the top 15 spots in iDealwine’s 2023 ranking of best-selling producers. The names in this list include some big success stories when it comes to en primeur sales. For example, Petrus (third in the ranking), has realised an average increase of 82% over the en primeur release price for vintages between 2017-21. Over this same period, Château Lafite Rothschild (eighth place in iDealwine’s ranking) witnessed an average increase of 22.9%.

However, while some properties can realise large gains in a very short period of time, where the region truly shines is in its capacity as long-term investment. For example, of the top 20 highest-priced Bordeaux bottles in 2023 iDealwine auctions (when scaled to 750ml), a staggering 15 came from vintages before 2000. Even the more recent vintages prove that waiting a few extra years can really pay off. For example, a 2015 Château Margaux sold for €1,438 in February, which is over 250% higher than its en primeur release price of €540.

Partner Content

ICONIC CHÂTEAUX

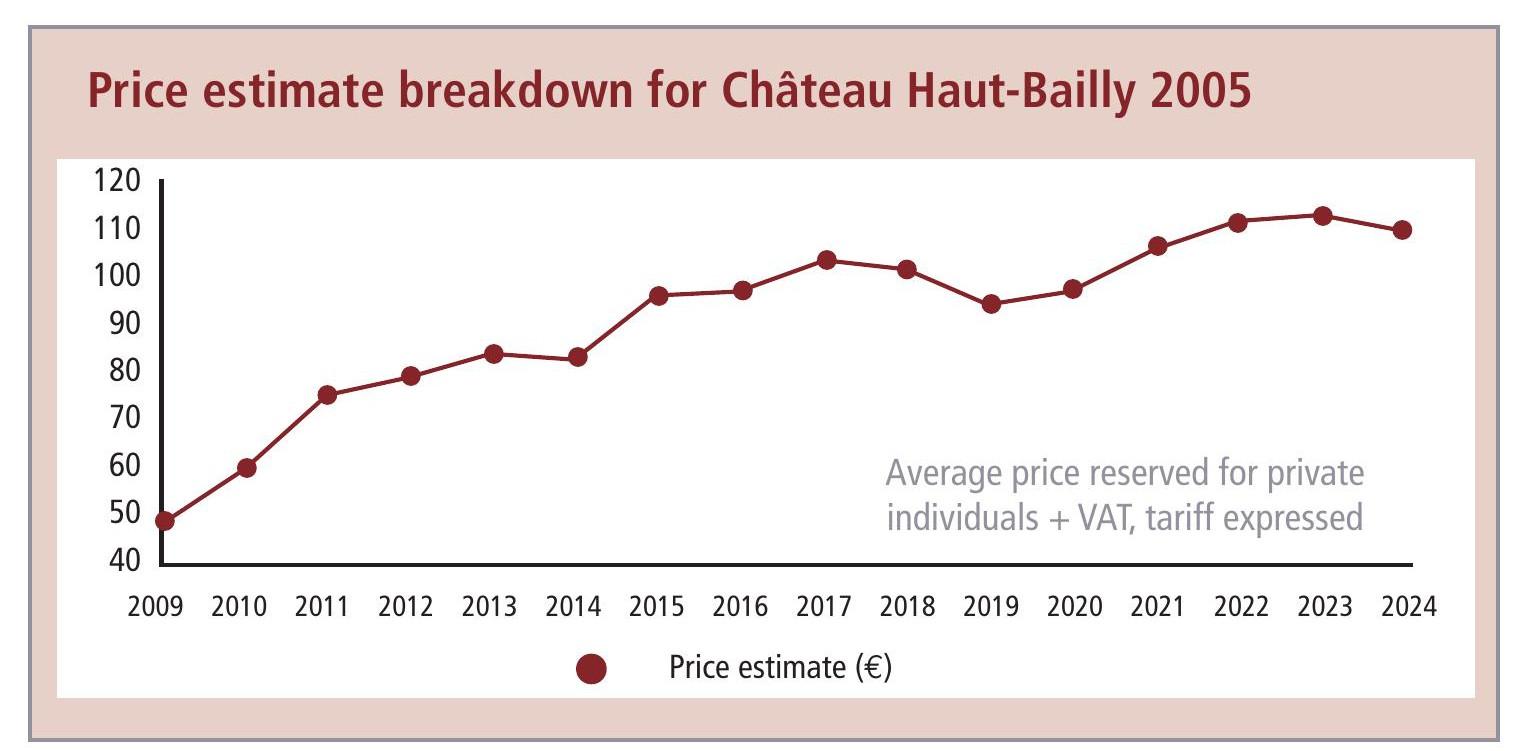

While long-time Bordeaux enthusiasts can perhaps be convinced of en primeur ’s value based on the performance of iconic châteaux, what about the sceptics, and those searching for more of a rising star or comeback story? These wine enthusiasts need only look to producers such as Haut-Bailly (28th place in 2023 Bordeaux rankings by auction value on iDealwine), with a 2005 vintage that has seen its price increase in 11 of the past 15 years. The vintage now trades consistently above €110 against an en primeur release price of only €62.

The key takeaway, once again, is consistency. Unlike speculative wines, which may observe a single, sharp increase or volatile peaks and troughs, this wine has slowly gained ground year after year, leading to a price graph that almost resembles a straight line (heading upwards, of course). This is the secret sauce in Bordeaux, where we often find long-term value rather than quick riches (or losses).

To conclude, the reason why Bordeaux tends to be such a safe bet in the long run is because its value is not based on speculation, but reality. Great Bordeaux wines are produced by consummate professionals who often have decades of experience of working alongside the world’s best winemakers. There is a reason why many of the greatest producers in the “New World”, such as Penfolds Grange winemaker Max Schubert, have travelled to Bordeaux to study its methodology.

About iDealwine.com

• Founded in 2000, iDealwine is France’s top wine auctioneer and leading online wine auction house worldwide.

• Fine Spirits Auction (FSA) is iDealwine’s dedicated spirits platform, launched in partnership with La Maison du Whisky, a French specialist in high-end spirits since 1956. Seven auctions of the finest whisky, rum, Cognac and more take place annually.

• Based in Paris, and with offices in Bordeaux and Hong Kong, iDealwine sources rare bottles from European cellars, private collections and direct from producers before meticulously authenticating and shipping to enthusiasts, collectors and trade customers worldwide.

• iDealwine provides wine and spirits market data and analysis, with over 60,000 price estimates, based on more than 3m auction prices.

• If you are keen to sell your wines or spirits, then check out iDealwine’s current auctions, sales and price estimates at www.idealwine.com or at FineSpirits.Auction

Bordeaux winemakers have an intricate understanding of what makes a wine ageworthy, having honed their expertise in this characteristic for a very long time – a sure bet, if ever there was one.

For those interested in sourcing 2023 Bordeaux wines at the best price they will ever be, make sure to head over to primeurs.idealwine.com.

Related news

Strong peak trading to boost Naked Wines' year profitability