WSTA: inflation data offers ‘little to celebrate’

By James EvisonFollowing the news that food and drink inflation remains stubbornly high, the Wine and Spirit Trade Association (WSTA) has called on the government to take action on duty to relieve the pressure.

The news comes as alcohol and tobacco CPI inflation remains high at 12.2% in December 2023 for the 12 month rate and 2.2% at the monthly rate.

These rises are against big falls in other consumer goods, such as clothing and footwear, which has fallen by 3.1%, transport by nearly 3% and furniture by more than 3%.

Speaking about the high alcohol inflation, chief executive of the WSTA, Miles Beale, said it was “a relief” the headline rate of inflation was unchanged, but highlighted how food and drink inflation was “much higher” and was running at twice the headline rate and four times the government’s own target.

Little to celebrate

He said: “Overall, there is little to celebrate for our great British drinks industry. Last year’s record excise duty rises are by far the major factor driving alcohol inflation, forcing up prices for consumers, reducing demands and leaving SMEs struggling to stay afloat.

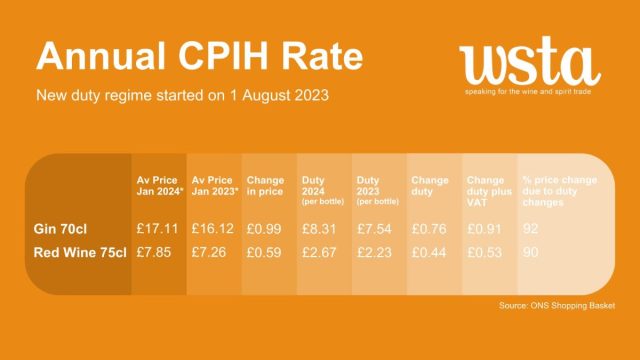

The Government’s own figures show that last year’s historic duty increases are fuelling inflation. Over 90% of the price increases consumers have been forced to suffer are down to duty increases introduced by Government (see table below).

If the Government is serious about taking measures to cut inflation and keep prices down, the simple answer is to cut alcohol excise duty at the next Budget and stop the duty system reforms where they are now.”

Partner Content

Focusing specifically on wine and fortified wine, Beale added that the detailed data from the Office for National Statistics “shows clearly the impact of last year’s record duty hikes”, referencing the big changes to the rates system that happened last summer.

He said: “Alcohol inflation is running at twice the overall rate, wine inflation continues to rise while fortified wine inflation is over 16%, completely undermining the Government’s own economic targets.

“Unlike fortified wine – which was hit with an immediate duty increase depending on strength in August – as a result of the temporary easement the full impact of the Government’s new duty system has yet to hit wine businesses. Unless the Government wants to see wine inflation rise further it must make permanent the easement mechanism at next month’s Budget and keep red tape to a minimum.”

Treasury “losing cash”

Beale’s comments also follow the negative impact on sales from alcohol duty hikes meaning the Treasury is losing out on tax revenue. Beale said last year that duty rises are “counterproductive”, as they reduce sales, and result in less revenue to the Treasury.

He added consumers were “still in the grip of a cost of living crisis”, and “cannot afford to keep stretching their budgets”.

Related news

'Like an April Fool’s joke': drinks trade slams EPR fees as ‘flawed’ scheme goes live

Drinks industry challenges ‘flawed’ waste packaging scheme

Extended producer responsibility: what it means for the alcohol industry