What does the bid to offer ratio tell us about the fine wine market?

By db staff writerMore than just blind numbers, the bid to offer ratios on Liv-ex can point to emerging trends and opportunities in key regions such as Bordeaux and Burgundy.

The bid to offer ratio numbers quoted on Liv-ex serve as a fair barometer of the fine wine market – and are a useful tool for those looking for insights and opportunities.

A ratio above 1 tends to point to higher demand: for example, back in 2021, the bid to offer ratio on the exchange exceeded 2:1. Right now, the picture is less rosy; the bid to offer ratio on the exchange is closer to 1:5, signalling more risk aversion and uncertainty.

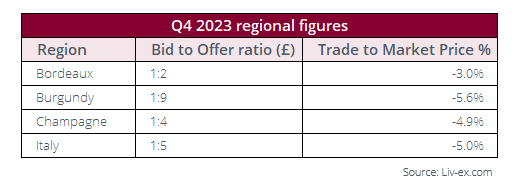

However, looking at different regions’ bid to offer ratios can shed light on potential opportunities.An interesting pattern emerges when comparing four of the most prominent regions on the exchange.

Burgundy has the lowest bid to offer ratio of these four regions, which reflects the relative illiquidity of the market and the increased risk this brings. This risk aversion rises at higher price points, as is illustrated by the fact that the bid to offer ratio worsens when you consider wines with a price of more than £15,000 a case.

This relation appears to translate into the gap between the trade price of wine and their Market Price. On average, Burgundy cases in Q4 2023 traded 5.6% below their Market Price; for cases with a Market Price over £5,000, the gap widened to 8.2% below market on average, and trades occurred on average 14.3% below market for cases with a Market Price over £10,000. Indeed, 28% of Burgundy cases traded 10-15% below their Market Price in Q4 2023.

It’s worth noting that, while the region is currently one of the biggest fallers, the Burgundy 150 is also the clear winner among the Liv-ex 1000 sub-indices in terms of its two-year performance, up by 6.2%. The index comes in third behind the Champagne 50 and the Italy 100 in terms of its five-year performance (+25.8%).

With the upcoming 2022 Burgundy releases and further (small) price increases, now could be the time to look at older vintages. At the other end of the spectrum, the region with the narrowest bid to offer ratio is Bordeaux, a result of its relative liquidity and buyers flocking to this ‘safe bet’ during the current downturn.

In Q4 2023, Bordeaux cases traded much closer to their Market Price than Burgundy, on average just 3% below. However, as in Burgundy, cases with a Market Price of over £5,000 traded 4.9% below Market Price on average, and 6.2% below for cases with a Market Price above £10,000.

Italy and Champagne both have wider bid to offer ratios than Bordeaux, but narrower than Burgundy. Their trade to Market Price percentages also followed the pattern described above, with Italy trades on average 5% below Market Prices, and Champagne 4.9% below, in Q4 2023.

The bid to offer ratio is a direct reflection of market conditions, and regional differences can point to opportunities. Currently, the regions with the lowest bid to offer ratios are also the ones where buyers are on average securing the largest discount on cases traded compared to their Market Prices.

fine wine monitor – in association with Liv-Ex

Liv-ex is the global marketplace for the wine trade. Along with a comprehensive database of real-time transaction prices, Livex offers the wine trade smarter ways to do business. It gives access to £81m-worth of wine and the ability to trade with 500 other wine businesses worldwide. It also organises payment and delivery through its storage, transportation and support services. Wine businesses can find out how to price, buy and sell wine smarter at: www.liv-ex.com

Related news

Majestic confirm Enotria & Coe acquisition