Who are the ‘sleeping giants’ of the drinks industry?

A new online alcohol study highlights a number of ‘sleeping giants’ that are currently underperforming but could take 2024 by storm if they wake up…

The annual Online Alcohol Report (Salience Index 2023) analyses the online traffic and authority of drinks websites throughout the year.

Its findings are based on performance indicators including year-on-year visibility, search volume trends, brand awareness, and the number of monthly online searches for each brand, as well as consumer engagement rate on social media platforms.

“The report serves to remove the blinkers on who you see as your competition,” says Brett Janes, managing director for UK marketing firm Salience.

He explains that the study “looks at all serious players” in the space to give “an unbiased view on organic, social and brand performance within the sector.”

According to Janes, one way to identify the ‘sleeping giants’ in the drinks industry is by weighing up how visible a website is (based on its organic traffic score) against the level of authority (respect, trustworthiness and reputation) that same website has.

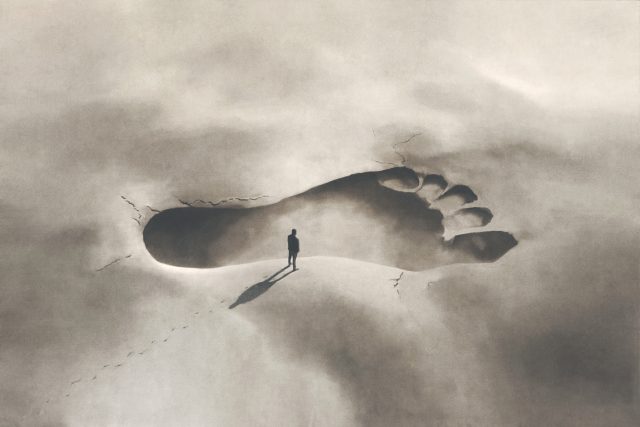

Sleeping giants

Sleeping giants are those brands which have “high authority and low traffic volume”. In other words, people like and trust them, but they’re lagging behind in terms of search traffic.

Ultimately, these ‘sleeping giants’ are not yet capitalising on the sizeable amount of consumer goodwill there is towards them.

The report highlights The Bar, Tanners Wine Merchants, Beers of Europe, Arran Single Malt and Bargain Booze as sleeping giants to watch out for.

Partner Content

English wine producer Nyetimber also has high authority but a low traffic score, and could be considered a potential sleeping giant, as do websites clos19.com and beermerchants.com.

“Analysing visibility versus authority is a great way to find sleeping giants in the industry,” the report explains.

“Authority is all about the stature and reputation of your website. Search engines like high authority sites as they’re loaded with trustworthy signals and likely to provide useful services and content…

“The higher your authority is, the more chance you have to rank for competitive keywords and boost your visibility.”

Over-achievers

On the flip side, low authority brands who rank high in volume terms are also considered in the report as the ones to watch.

“Those with high visibility but low authority may not have the brand reach compared to rivals, but they over-perform in search engines thanks to technical SEO, content and site experience,” the report explains.

“These websites have strong traffic scores in spite of a lack of trusted links and press coverage.”

It highlights VIP Bottles, The Champagne Company, The Secret Bottle Shop, 365Drinks.co.uk, and The Sunday Times Wine Club as examples of ‘over-achievers’.

Also batting high in traffic terms but could do with improving their authority rating are urbandrinks.co.uk, and to a lesser extent champagnedirect.co.uk.

Related news

R&R Teamwork announces leadership change

Carlsberg pumps millions into Poretti

Why first-party data is a winning formula for alcohol brands