This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Should sake be as popular as beer and wine?

As global exports of Japanese rice wine grow both in value and volume, initiatives in the UK and the US are boosting sake’s profile among consumers looking to learn more about the category.

Japanese sake exports reached a record high of 47.5 billion Japanese yen (US$334m) in 2022, an 18% increase from 2021, and a 452% jump from 2013, according to the Japan Sake and Shochu Makers Association. China is by far the Japanese rice wine’s biggest export market, responsible for 14.2bn yen in export value last year.

The US follows close behind, with an export value of 10.9bn yen in 2022, followed by Hong Kong, Korea, Singapore, and Taiwan.

These two markets have long remained responsible for significant exports of sake, but other markets are now waking up to the potential of the Japanese liquor, spurred on by successful marketing campaigns by sake breweries to make rice wine a global drink.

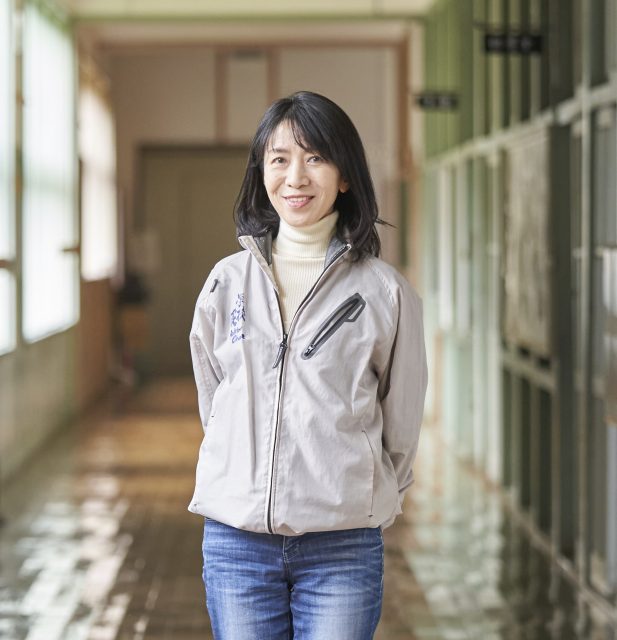

Rumiko Obata is the fifth-generation manager of Obata Brewery on Japan’s Sado Island, founded in 1892 by her great-great grandfather, Yososaku Obata. Obata has always had her sights set on the wider world. “I was born at the sake brewery, which is on a remote island. When I was a child I was always dreaming outside of the island,” she told the drinks business Asia.

After finishing university, Obata worked in the film industry; her passion for movies originating from that same desire to look outside of her small, secluded island – movies are “a two-hour trip to another world”, she said.

On her return to the brewery, alongside husband, Takeshi Hirashima, Obata was the first of her family to start exporting, starting with the US in 2003.

Since then, its reach has expanded into other markets, including Singapore, Malaysia, the UK, France, and Russia. Local tastes dictate which forms of sake are sold in each market. “It’s different for each country,” Obata explained.

Cloudy sake, or Nigori, with its texture and high flavour intensity, is popular in the US, as is sparkling sake.

Rice wine is also finding its feet in the UK market. Export sales by value were up by 37% year-on-year in 2022, and 22% in volume.

Erika Haigh, a sake educator and international kikisake-shi sommelier from Japan, moved to the UK in 2018, and launched Moto, the country’s first independent Japanese sake bar, shop and eatery in 2019.

Haigh is on a “crusade” to get British bars and restaurants, and their consumers, to think of sake like they do beer or wine. “My job at the moment does involve some convincing, simply because it is a beverage category that is different, and so people think it has to be treated differently,” Haigh told db Asia. “My whole thing is: don’t overthink it. It’s brewed like a beer, enjoyed like a wine, it’s a fermented beverage that’s not too high in alcohol, and it goes so well with food, given its umami components.”

Sake can be paired with any type of cuisine, she argued, from Indian to Italian, French, or British.

On 1 December, Haigh partnered with London’s Counter 71 on a 15-course British menu paired with five sakes from Obata Brewery. “Ultimately, amazing sake should be enjoyed in different countries with what is amazing from there. I love Counter 71 and that it’s a celebration of food here in the UK, and I really wanted to pair it with sake to drive that point home,” she said.

Haigh launched a second business, Kamosu, in March 2023, working as an independent sake merchant to supply expressions never before seen in the UK to London bars and restaurants. “People who come to a sake bar perhaps already know something about sake,” she said. “I wanted to start talking to people who would never have a sip of sake unless someone entices them to do so.”

Sake sales are booming outside of Japan, and with them the level of education is growing.

“Now is the time when people are ready for such conversations. a few years ago when I opened Moto, people were not truly ready for that. I could try to do things within the confines of my own bar, but it was still a little bit early to try to convince other people to change their beverage portfolios.”

Back to school

Obata has seen the international interest grow firsthand, and not just from a drinking perspective. She and Hirashima launched a sake-brewing school in 2015. To date, they have accepted more than 120 people from 14 countries into its Gakko-gura, or ‘school brewery’, built in an old school building that was abandoned in 2010 because of Sado’s ageing population.

Haigh, who attended the sake-brewing experience at Obata Brewery last summer, explained: “That’s something that sake breweries usually do not allow outsiders to do, because there’s a lot of experience you need to be an actual asset to the sake-brewing experience. In this capacity, Obata is the only brewery of the 1,200 sake breweries in Japan where you can have this experience.”

US sake exports were up by 3% in volume and 14% in value year on year in 2022 as popularity grows there too. New York City sake brewery Brooklyn Kura has launched a Sake Studies Centre ahead of a partnership with Japan’s Hakkaisan Brewery Co, based in the central Japanese city of Minamiuonuma, Niigata Prefecture, in a bid to “make sake a global beverage”.

The centre pegs itself as the first of its kind in the US, offering introductory classes or the opportunity to become certified as a sake server. The new 20,000-square-foot space, announced in November, is more than double the Brooklyn brewery’s previous capacity, offering different in-person and virtual programmes.

The brewery originally opened in Brooklyn in 2018. According to The Japan Times, Brian Polen, president of Brooklyn Kura, said: “our partnership with Hakkaisan led to the joint goal of making sake a global beverage”, highlighting the growth of sake consumption and knowledge among global consumers.

Related news

Bourgogne wine see global growth despite difficult market conditions