Italian red wines are trending in the US, Drizly says

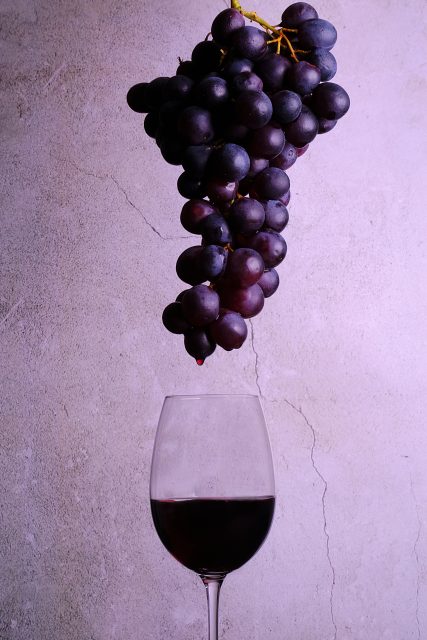

By Sydney EvansDemand for lesser-known grape varieties is growing among US consumers, online retailer Drizly has said, with Italian red wines showing particular promise.

Eager to explore, Gen X and millennial consumers are branching away from traditional (and often domestically grown) grape varieties like Cabernet Sauvignon and Pinot Noir.

Instead, a clear preference has emerged on online drinks platform Drizly, where the share of Italian wine has to 14% in 2023, up from 13% in 2022.

The share of long-term favourites like Nebbiolo, Montepulciano and Sangiovese has remained flat year-on-year.

Younger consumers are looking to Italian alternatives, with Sagrantino, Brunello and Corvina among the fastest growing varieties on the platform.

Having become almost extinct from the market in the 1960s, Sagrantino was reintroduced after campaigns from local winemakers saw it achieve the DOC status in 1977.

Indigenous to the Umbrian town of Montefalco, several Sagrantino wines from the region were awarded medals at this year’s Autumn Tasting.

Partner Content

Adam Rogers, research director for ISWR Drinks Market Analysis, said: “While the most engaged Gen X and millennial consumers make up just under 30% of total regular US wine drinkers, they account for nearly 60% of the total wine spend.”

The prediction follows earlier findings from consumer intelligence company NielsenIQ this year that saw consumer preference for Italian red wine up by 6% compared with 2022.

The year 2023 has been a challenging one for Italy’s winemakers. Extreme weather saw vineyards in Romagna hit with floods and grapes left sunburnt from soaring temperatures. Challenges brought on by climate change were also responsible for wine production seeing a 12% slump in the country, falling behind neighbouring France as harvests struggled against heavy rainfall.

But there remains a growing taste for the country’s red varieties in the US.

While traditional reds will not necessarily be replaced, an appetite for more novel varieties provides exciting potential for retailers wanting to tap into younger consumers.

Liz Paquette, head of consumer insights for Drizly, said: “adding more unique varieties and bottles in trending categories, like Italian red wines, offers opportunity for retailers to differentiate their inventories online.”

Related news

WWE legend goes viral after Napa wine tasting

Favourite kosher wine 'impossible to find' due to trade war

Piccolo power: why Henkell's small bottle has stood the test of time