California’s Duckhorn falls short of Q1 estimate

The Napa stalwart has missed its estimate for the first quarter of 2024, with revenue down 5.2% year-on-year.

The Duckhorn Portfolio failed to meet analysts’ expectations for both its Q1 revenue and full-year guidance, the Napa producer has announced.

Revenue declined 5.2% year-on-year to US$102.5 million, missing Wall Street’s estimates.

As a result, Duckhorn has lowered its First Quarter EBITDA to US$34.7 million, which represents a decrease of US$1 million, or 2.7%.

“We delivered a quarter at the high end of our expectations as we lapped an unseasonably strong first quarter in the prior year,” said Deirdre Mahlan, interim president, chief executive officer and chairperson.

“In addition, we generated 90 bps of adjusted EBITDA margin expansion on less discounting and a focus on cost management.”

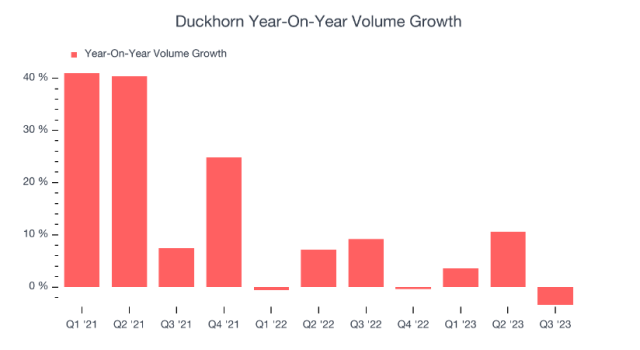

Sales volumes were down 3.4% year-on-year for the California wine group, marking a reversal from the 9.2% year-on-year increase it posted 12 months ago.

However, the decline may not be quite as telling as it appears.

Partner Content

According to analysts at StockStory, the company’s annualised revenue growth rate of 11.1% over the last three years has been “impressive for a consumer staples business”.

Wall Street also expects Duckhorn’s earnings to continue to grow over the next 12 months, with analysts projecting an average 23.2% year-on-year increase in EPS (earnings per share).

Add to this the significant investments made by The Duckhorn Portfolio this year, including acquiring Sonoma-Cutrer Vineyards from Brown-Forman in November for US$400 million, and the numbers could soon be on the rise again.

Speaking of the Sonoma-Cutrer acquisition, CEO Mahlan called Sonoma-Cutrer one of “the fastest-growing major brands in the luxury Chardonnay category.”

“We see opportunity to further accelerate that growth and enhance operating margins of the combined business,” said Mahlan.

“This transaction expands our presence and visibility, diversifies our portfolio of luxury American winery brands, and dramatically increases our position in the luxury Chardonnay category.”

The move may well swing the direction of the needle as 2024 gets underway, as no doubt will sales from the rumoured “Napa vintage of a lifetime”, with producers reporting outstanding quality for the 2023 vintage.

Duckhorn will also likely have more wine in barrel next year, with its vice president of winemaking revealing that high rainfall throughout the 2023 growing season had brought extra canopy growth in the vineyard, which has led to 5% to 15% higher yields for most of the producer’s varieties.

Related news

Castel Group leadership coup escalates

For the twelfth day of Christmas...

Zuccardi Valle de Uco: textured, unique and revolutionary wines