Why are US consumers loving Japanese whisky?

Japanese whisky’s share of overall whisky sales in the US remains small in comparison with Scotch and Bourbon, but its average unit price continues to climb on beverage delivery platform Drizly.

The category’s share of sales has hovered at around 4% over the last five years, according to Drizly.

However, the platform has reported that its average unit price has grown from US$78.77 in 2019 to US$87.65 in 2023, revealing a trend in US consumers premiumising when it comes to Japanese serves.

Liz Paquette, head of consumer insights at Drizly, said: “Despite premiumisation cooling across other categories, consumers are continuing to spend more per bottle in this category.”

Sales of Japanese whisky on the platform fluctuate seasonally, with gifting responsible for driving sales. Last December, the category’s share increased to 4.6% of the platform’s overall whisky category sales.

In the past 12 months, gift orders made up a 29% share of Japanese whisky sales on the platform, compared to a 16% share for the whisky category overall. In December, gift share of the Japanese whisky category spiked at 43% of sales.

Partner Content

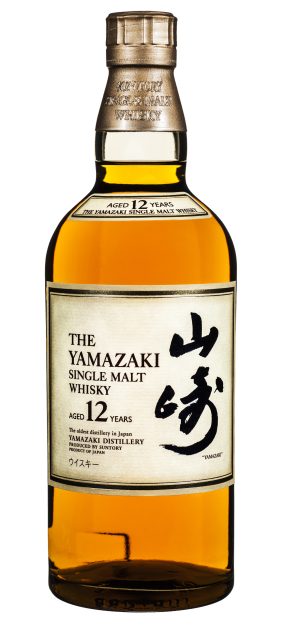

The five best-selling Japanese whisky brands on Drizly are Hibiki, The Yamazaki, Toki, Nikka and Hakushu. Among these brands, the average unit price varies significantly, from just US$38.88 for Toki to US$229.80 for The Yamazaki.

Hibiki has been a top Japanese whisky brand on Drizly for years, and the Hibiki Japanese Harmony is the category’s best-selling SKU.

Suntory is responsible for producing four of the category’s top five brands on Drizly. However, according to the platform, the fastest-growing whisky SKUs from Japan to date in 2023 include two non-Suntory brands: Kamiki Intense Wood Whisky and Bushido Rei Pure Malt.

“Toki surpassed Nikka [average unit price $88.68] to gain the number three position this year, so it appears there is growing popularity of more affordable options in this expensive category,” Paquette said.

“Japanese whisky is likely popular among different sets of consumers for different reasons, whether they are just being introduced to the category or purchasing a treat for a special occasion or gift.”

Related news

Treasury Wine Estates plans leaner future amid US and China slowdown

The db wine crime files 2025: part 2

Don't pour this Christmas drink down the sink, plumbers caution