Rare whisky declines and fine wine value stalls, report claims

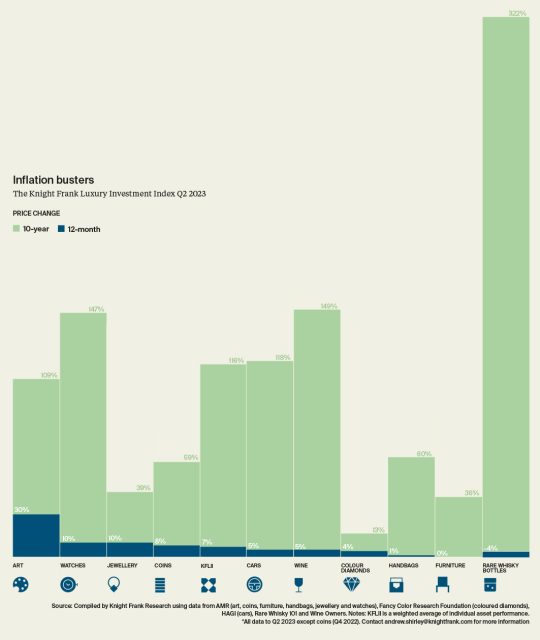

By James EvisonThe value of rare whisky bottles has declined in the past 12 months, and fine wine growth has stalled, according to the latest version of the Knight Frank Luxury Investment Index.

According to the report, whisky has dropped 4% in the previous 12 months, although its ten-year average is still the highest growth of all luxury assets at 322%.

Fine wine has continued to grow at 5% in the past year, but against a decade-long increase of 149%. The slowdown in the wine market comes off the back of previous double-digit rises.

Speaking about the news, compiler of the Index, Nick Martin, said: “Burgundy has been the big success story of the past decade, with prices having escalated 367% by the early autumn of 2022. However, the top of the Burgundy market peaked around that time and has since fallen by at least 9%. Published prices tend to lag realised sales, indicating that there is further to fall.

“Whereas Burgundy is scarcity led, Champagne is a high-volume market, with certain prestige brands’ production running into the several million of bottles per vintage release. Prices of some of those prestige cuvées have been testing price elasticity of demand and seen sales stagnate as a result.”

Martin also predicted that “the heightened cost of capital may well act as drag on blue chip fine wine markets for the rest of 2023.”

Partner Content

He continued: “When interest rates have risen sharply to around 6%, new releases in particular, according to market economics, should be offered at a bigger discount to future value in order to convince consumers to spend on wine instead of holding cash. If wine markets are looking toppy with limited obvious upside for new releases, there’ll continue to be downward pressure exerted on secondary market prices more widely.”

But he also said some markets, such as South Africa, had grown by 11%, and Australia had also seen strong growth of 8%.

However, rare bottles of whisky, which traditionally had been the Index’s strongest 10-year performer by far, were the only asset to actually see a negative annual performance – dropping by 4%.

Industry consultant Andy Simpson said: “Bottles of rare whisky have had a far more sedate time from a performance perspective over the past three years. Higher value (over £5,000) bottles have re-traced recently due to a myriad of geo-political, social and economic reasons.

“Certain brands have still performed well, while the market leader (from a sheer volume of market perspective), Macallan, has seen particularly punishing losses with its index re-tracing almost 12% over the past twelve months,” he concluded.

Related news

Master Winemaker 100: Jesús Mendoza

Coterie-backed wine tech company raises nearly £1.1 million in crowdfunding