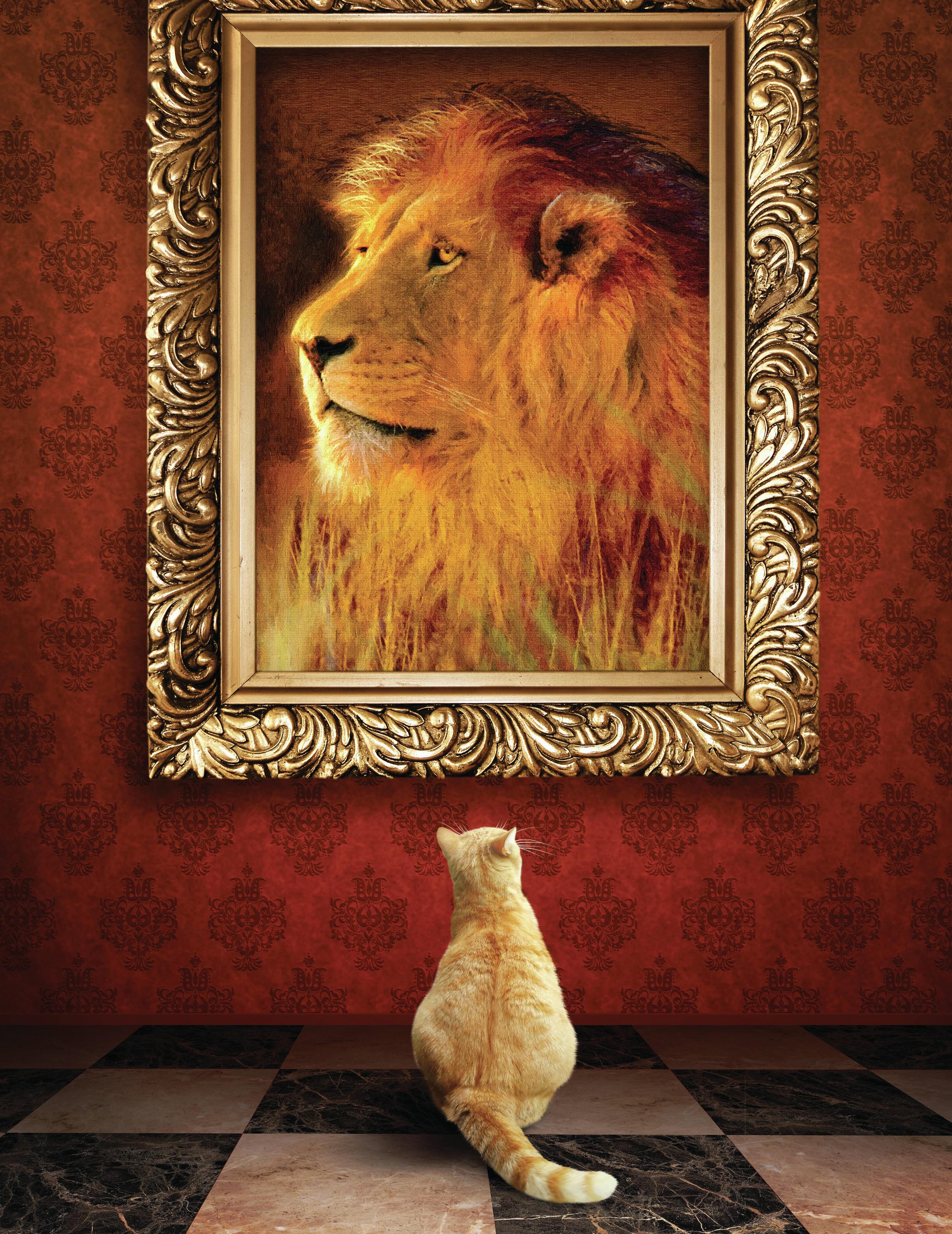

Mane event: Who wins in the battle of magnums Vs miniatures?

When it comes to the bottle size of sparkling wines, there is a case to be made that bigger is better, but also that great things come in small packages, as Giles Fallowfield discovers.

The consumption of sparkling wine has been outperforming that of still wine for a while now, and is predicted to continue to do so. But since the spring of 2020, when the Covid-19 pandemic hit, factors outside sparkling wine producers’ control have made trading conditions very difficult.

As you might expect from a market in turmoil over the past three years, consumer-purchasing habits have undergone changes. Since Covid-19 made its appearance, after the apparent initial brake on buying, we saw a massive swing to home consumption, with widespread on-premise shutdown, travel dwindling to a trickle, and all events cancelled.

This seems to have triggered a mini boom in half-bottle consumption of Champagne, which was probably at odds with the longer-term decline of this format. Since the turn of the Millennium there has been a steady growth of magnum and larger sizes still.

So what is happening now? Are there any recognisable trends towards smaller sparkling bottle sizes, or are consumers seeking out larger formats?

For Champagne, while sales of magnums and jeroboams have both nearly doubled in number between 2000 and 2022, each accounts for pretty much the same percentage share of a larger market for the format sizes, which is 2.05% and 0.14% respectively.

In terms of quality, it is widely accepted that for bottle-fermented sparkling wines, the magnum offers something extra. The larger volume of wine with the same level of oxygen ingress at the bottle neck as the smaller 75cl format helps to preserve freshness, slow down ageing, and give a certain x-factor to the wine.

By that logic, you might expect that for tank-fermented Prosecco, which many see as the main driving force behind sparkling wine’s recent boom, there would be little demand for magnums.

Isabelle Gruard, group marketing director at the Crealis group, the key player for providing foils, capsules and wire cages for sparkling wine closures through Sparflex, Enoplastic and PE.DI, says that in the Prosecco market the 75cl bottle accounts for the lion’s share around (81%) of sales.

The format size that is growing, says Gruard, is the 20cl single serve, which, based on this miniature bottle’s 50% share of the closures market, accounts for 11% of total Prosecco sales. The DOC figures also show evidence of this rise of the miniature, with the 20cl volume moving from 76.8m bottles in 2021 to 87.3m in 2022, the equivalent of 174,643 hectolitres, which is considerably more than Prosecco magnums’ total volume of 48,892hl in 2022.

Flavio Geretto, commercial director at Villa Sandi in Treviso, confirms that for its brands, “there is increasing interest in both large and smaller-than-75cl formats. “We have seen a lot of interest from the on-trade, with some special deals for the La Gioiosa brand only for big formats. As for small bottles, the trend is coming back with the increase of travel retail.”

The 2022 sales data of the DOCG Conegliano Valdobbiadene Prosecco Superiore (CVPS) shows an increase in exports, up from 41% to 42.6%, but overall volume very slightly down on 2021, at 103.5m bottles.

Over the past decade, Diego Tomasi, director of the CVPS Consortium, says that the share of formats outside the mainstream 75cl bottle size have remained at around the 6%-7% level. The majority of this is accounted for by the smaller format bottles, around 80%, and these are mainly sold by airlines during flights, while the larger formats are favoured for celebrations, he says.

For the bottle-fermented Italian sparklers of Franciacorta and Trentodoc, the drinks business spoke to the two largest producers in each DOCG, Ca’Del Bosco and Ferrari respectively.

In London recently to launch his latest 2018 vintage offerings, Ca’ Del Bosco’s president, Maurizio Zanella, said that 11% of the brand’s business is in half bottles, while magnums account for a slightly larger slice of the pie, at 12%.

Alex Hunt at UK distributor Berkmann Wine Cellars confirms “very good half-bottle business”, partly due to Gucci having its own label for Ca’ Del Bosco half bottles of its non-vintage cuvée prestige, which the fashion giant serves in its shops.

However, Ca’ del Bosco’s wider potential for growth has been held back not by the current worldwide bottle shortage, nor by Covid-19, and certainly not by a lack of demand, but rather by a string of more difficult harvests since 2017, a year when 60% of its crop was lost to frost, says Zanella.

“Since then the problem has been dryness and hail, but not frost.” While 2018 was the most recent ‘normal’ harvest, he estimates that between 2017 and 2022 the equivalent of two whole harvests were lost in terms of yields. And after an early bud break last month, at least 10 days ahead of the average, Zanella is worried about frost again over the coming weeks.

HUGE GROWTH

Ferrari may well be the one sparkling brand to kick against the smaller-format trend, with communication director Camilla Lunelli saying: “Half bottles are growing slower than magnum sales, which are up in excess of 30%. We have seen huge growth, more than doubling by volume in the jeroboam size, thanks to our partnership with Formula 1. We have moved from 5,000 jeroboams in 2019 to 13,000 in 2022. Out of these, 7,000 are for the F1 podium. The growth in 2022 compared with 2021 was 28% in jeroboams, 10% for magnums, and 7% in half bottles”.

Not every sparkling wine appellation is quite as good at producing up-to-date information about bottle sizes as the Champenois. If we look at the data from 2000 to 2022 from the Champagne Comité, which divides its analysis into 14 format sizes right up to melchisedech – which holds the equivalent of 40 bottles, or 30 litres – we can see some longer-term trends emerge. The 75cl bottle remains dominant, while sales have grown over that period by about 75m bottles. The standard bottle size has retained a total volume share never lower than 92.46% of shipments, nor ever quite reaching 95%.

Champagne sizes under 75cl are divided into ‘quart’, ‘demie’ and ‘medium’, the last being 50cl (half a litre), the volume of which is now so low it comes up as 0% in terms of volume share, although Pol Roger ’s UK managing director, James Simpson MW, is keen to revive what he calls “the pint”. He awaits some sign of government approval before making any firm decision on the format. The problem, Simpson thinks, is that after Brexit, “the government, despite lobbying from the UK sparkling wine industry, became confused as to whether a pint was a metric or imperial measure”.

EXPORT MARKETS

The quart category covers the two single serve sizes of 20cl and 18.7cl, while demie is the 37.5cl half bottle. The volume of halves produced for all export markets (so excluding French domestic sales) has fluctuated since the turn of the millennium from a low of around 6.1m, though it dropped further in 2020 to just 5.7m half bottles, to a 24-year high of 8.8m half bottles in 2021.

Partner Content

The last time the demie reached above 8m sales was in 2007 and 2008, with the previous highest figure of 8.56m reached in 2006. At that 2021 high point, half bottles accounted for 2.44% of the Champagne market by volume (not number of bottles).

Alexei Rosin, managing director of Moët Hennessy UK, says that in the company’s seven-strong brand range of Champagnes, “half bottles account for between 1.5% and 7% of 75cl sales, across all channels”.

Nielsen MAT says format sizes smaller than 75cl account for 3.5% of total Champagne sales by value and around 2.8% of volume.

And while Moët, Veuve Clicquot and Ruinart all have smaller formats – half bottles of white and rosé in each case – as part of their ranges, only Moët has the 20cl Moet Minis (Brut Impérial).

This format grew by 16% in 2022, faster than the total brand, “and we are seeing an increase in demand for this format”, says Rosin. “We are seeing a growth in small formats in some areas and a decline in others,” he continues. “While Moët Brut Impérial 20cl grew in 2022 by 13%, our 37.5cl declined by 12%, but I’m not certain this is representative of consumer demand.”

For half-bottle sales, “the off-trade dominates,”says Roisin. “Brut Impérial sells five times as many in the off-trade as the on-trade. Half bottles are present in hotels, restaurants, events, and bars, as they work well, operationally, for creating Champagne cocktails, a growing trend.”

In terms of magnum formats in Moët and Veuve Clicquot, says Rosin, “we see magnums making up around 2% to 3% of volumes. For Ruinart it’s about 5% while for Dom Pérignon and Armand de Brignac large formats make up to between 10% and 18% of volume.”

INCREASED SHARE

Roisin says that some of this increased share is “due to highly educated Champagne drinkers understanding the superior quality delivered by a magnum versus a bottle, and some is driven by the trend for large formats in high-energy occasions, such as in clubs and ‘vibe dining’. Armand de Brignac does have a focus on large formats in these key occasions.”

He continues: “Krug has stopped producing half bottles as it no longer sees them as a strategic size for a prestige cuvée and while originally designed to support by-the-glass sales, now we think that these are better supported from 75cl for quality reasons.”

Pol Roger only offers its Brut Réserve Champagne in halves: “We used to do vintage in halves about 20 years ago,” says Simpson, who put NV halves back on its UK list around five years ago for “hotel customers, the odd Champagne specialist, and The Wine Society, which is probably our largest customer for halves, much of Wine Society’s allocation being used for its Christmas mixed half-bottle case. Our allocation remains small, about 400 cases of 12 bottles, but there’s a fairly significant premium over bottles, in the region of 15%. I’m sure that, during lockdown, we could have sold more but the stock, simply, did not exist.”

Sarah Knowles, The Wine Society’s Champagne buyer confirms the popularity of halves with its members

“We often list Pol, Bollinger, Boizel, and the society’s own Champagnes (Alfred Gratien) in halves most of the time, and frequently sell out as our demand outstrips allocations. That said, magnums and larger-format bottles have been in growth too over the past two years, and we are having to carefully forecast these sizes now.”

As for magnums at Pol Roger, Simpson says: “On NV we are in the region of 5%, somewhat more on vintage and Churchill”, plus small volumes of jeroboams, which he sees as being “qualitatively the best”. Anything larger is decanted, by Pol, from bottle or magnum into large format. This is “pretty much done to order, with the glass cost representing a significant percentage of the price the larger the format is”.

In Champagne, two of the large bottle specialists are Palmer and Drappier. Palmer makes its Champagnes, “without transferring into large bottle sizes, right up to the monumental 15-litre nebuchadnezzar,” says François Demouy, Palmer ’s communications and marketing manager.

“This process requires us to keep these treasures in our cellars for a very ong time. Demand is high and we manage these large formats under allocation. For a few harvests now, we have increased the production of large formats when nature allowed it.”

Drappier ’s commercial director, Charline Drappier, says that in 2020, “we witnessed an unusual rise in demand for half-bottles, due to the pandemic, and a boom for magnums in 2021, which reached a plateau in 2022. We are currently facing a shortage of magnums of Carte d’Or and Brut Nature, because four years ago, when we did the tirage, no-one could have predicted this spurt in demand.

“As for the larger formats, we’ve always made more of them than other producers, because it’s one of our specialties, and we have acquired a unique knowhow over the years. Jeroboams and sizes above are mostly exported. In the US, the demand for big formats seems to be higher than in other countries, but we have also sold quite a lot of them in Italy, Switzerland, and Germany.”

Mini Boom

Showing that bigger is not necessarily better, just like Prosecco producers some Champagne producers are making miniature bottles a key part of their business strategy. Lanson, for example, benefits from summer outdoor events such as the UK’s Chesterton’s Polo in the Park and Wimbledon fortnight, which are fast approaching. At the former, rosé magnums account for around a third of what Lanson sells over three days, says UK managing director Robert Rand, while at Wimbledon around a quarter of the Champagne sold is in miniature 20cl and 37.5cl bottles.

Similarly, for Champagne Pommery, with its separate Pommery POP franchise, the smaller-format market is extremely important. “We have both the 20cl and 18.75cl formats in the range,” says Julien Lonneux, international director, Vranken-Pommery Monopole.

“The 18.75cl format closed with a screwcap is kept for sectors where that is required for safely measure, like the airlines and the London Eye. The 20cl bottles that have a natural cork closure are premium priced but with the relatively high cost of dry goods compared with the 75cl bottle, margins are tight. North America, both the US and Canada, is a big market for 20cl Pommery POP.”

Variety, as the saying goes, is the spice of life. And it would seem that among the world’s sparkling wine makers, there is ample cause to continue offering both big and small formats.

Related news

The Castel Group rocked by Succession-style family rift