Tough market conditions put Australian wine exports in decline

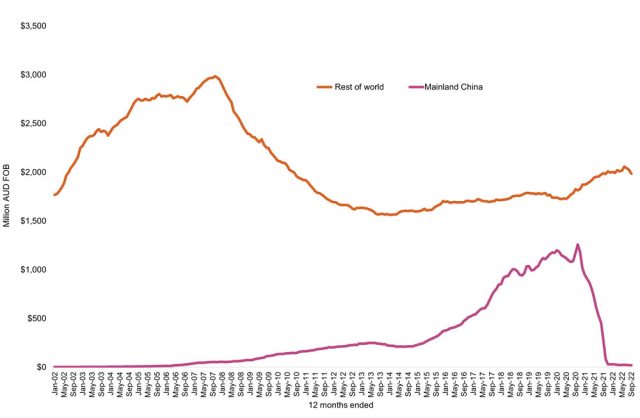

Australian wine exports declined by 11% in value to $2.01 billion and 1% in volume to 627 million litres in the year ended 30 September 2022, according to Wine Australia’s latest Export Report, but figures reflect that value is starting to stabilise.

high deposit tariffs on bottled Australian wine imported to mainland China, the impact of the global freight challenges, and the aftermath of changing consumer habits during the COVID-19 pandemic have all had an adverse effect on Australian wine exports.

There was a decline in exports to the UK, Hong Kong and Singapore, which is a result of “the return to anticipated shipment levels”, according to Peter Bailey, market insights manager for Wine Australia. This decline to the UK has been delayed compared to other markets with similar COVID-19 consumption patterns, such as the US and Canada, figures show.

Bailey is hopeful that the negative effect of Chinese tariffs is diminishing.

“We’re seeing the tail end of the decline in exports to mainland China having an impact on the total export figures; this is expected to wash out of the figures by the end of 2022,” he said.

When mainland China is excluded from the data, wine exports to the rest of the world held steady in value, declining by 0.2% to $1.99 billion and increasing by 1% in volume to 622 million litres.

Strong growth was recorded in exports to the US, Canada, Malaysia and Thailand.

Partner Content

Bailey said: “Pleasingly, the growth trend in the US and Canada was driven by both ends of the price spectrum; premium wine exports continued to grow and unpackaged commercial exports increased, as shipments of the record 2021 vintage accelerated following a slower than usual start due to global shipping pressures.

“Furthermore, the number of exporters to the US is at the highest level since 2008 and of the exporters to the US that ship wine at a value of $10 or more per litre free on board (FOB), 75% experienced growth demonstrating that green shoots continue in the market for premium Australian wine.

Total exports look to be stabilising, but the wine sector should continue to expect some “market fluctuations”, Bailey added, as rising inflation and interest rates put pressure on margins and reduce consumer spending in key markets.

Australian wine exporters shipped to 118 destinations during the period, up from 111 the previous year.

The strongest growth came from North America, up 6% to $604 million, and Southeast Asia (up 15% to $291 million).

The large decline was to Northeast Asia (down 46% to $321 million, driven by mainland China) and to Europe (down 12% to $621 million, driven by the UK’s return to more normal shipping levels) outweighed the growth to other regions.

Related news

Strong peak trading to boost Naked Wines' year profitability