Chain reaction: what’s driving the NFT drinks market

The fledgling NFT sector has been making huge headlines recently, and now drinks brands are looking for a piece of the action. Lucy Shaw investigates how the alcohol sector is dipping its toe in the world of crypto.

HAVING SEEMINGLY sprung from nowhere, NFTs took the world by storm last year. At the start of 2021, non-fungible tokens were the preserve of crypto geeks. By the end of the year, they had grown into a US$40 billon market, according to crypto analytics group Chainalysis, making them nearly as valuable as the global art market, which was estimated by Art Basel to be worth US$50bn last year. A clunky and unappealing term, ‘non-fungible tokens’ are unique units of data linked to virtual or physical assets, which are stored on a blockchain – a decentralised digital ledger. NFTs can be sold and traded, and come with certificates of ownership and authenticity, which give them their value. The first NFT was created in 2014 by digital artist Kevin McCoy and sold for just US$4. Fast forward to 2021, and on 11 March digital artist Beeple made history when an NFT collage of his sold at Christie’s for US$69.3m, placing him among the world’s top three most valuable living artists and drawing global attention to the NFT phenomenon.

Having seen how NFTs have blazed a trail in its art department, Christie’s wine section is keeping a close eye on the fast-evolving arena, as department head Noah May, explains: “Christie’s has been at the forefront of digital innovation over the last 12 months as one of the global auction leaders in the field of NFTs, having sold over US$150 million in 2021. We look forward to exploring a number of exciting opportunities in this sector and seeing how this innovative area of the market influences our business in the future.”

STRONG DEMAND

Jamie Ritchie, worldwide head of Sotheby’s Wine, believes young Asian consumers are likely to power the NFT drinks market. “We have very strong demand from Asian buyers for all wines and spirits offered in any of our locations. In 2021 they represented 57% of our sales by value – and this is before adding any NFT component, so we expect that demand to continue. Our sales have been trending younger, with one third of bidders being under 40 last year, and we can assume that the younger generation will take an increasingly important share of the NFT wine and spirits market,” he says.

While not exactly known for its swift adoption of cutting-edge tech, the wine trade’s ears pricked up when news of the Christie’s NFT sale hit the headlines, and a number of respected estates entered the NFT arena last year with their own digital offerings. While blockchain technology has been used for more than a decade to assure the provenance and authenticity of individual bottles, the creation and trading of wine NFTs is a far more recent trend.

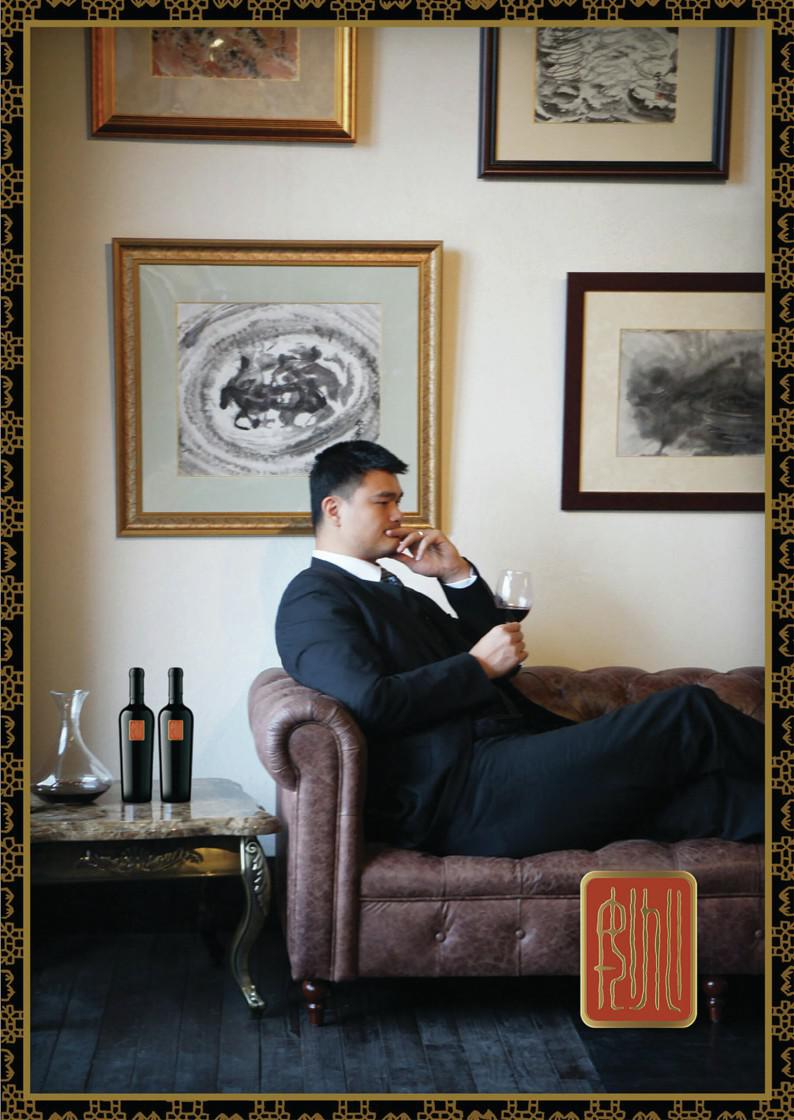

Keen to reach a younger, tech-driven audience, producers are turning to NFTs as a savvy marketing tool and a way to engage with new consumers. In April 2021, Yao Family Wines – the Napa Valley winery owned by former NBA star Yao Ming – auctioned a bottle of the 2016 vintage of its top drop, The Chop Cabernet Sauvignon, alongside a limited edition NFT in a first of its kind sale.

“Blockchain is the biggest technology revolution since the Internet. NFTs are a glimpse into the future of blockchain-powered assets and will become the standard for ownership, trading, provenance and trust,” Jonas Hudson, cofounder of NFT exchange GFT, which handled the creation and launch of the Yao Ming NFT, said when news of the release was announced. In December, fellow California heavyweight Mondavi joined the NFT game with its Robert Mondavi Winery x Bernardaud collection, formed of three wines bottled in 1,966 magnums designed by French porcelain house Bernardaud, sold with an accompanying generative artwork by Clay Heaton for US$3,500 each. Mondavi’s owner, Constellation Brands, sought the advice of wine-tech entrepreneur Gary Vaynerchuk – creator of what is set to become the world’s first NFT-backed restaurant, Flyfish Club, in Manhattan – before embarking on the project. “This is at the forefront of how we think luxury wine is going to be distributed in the future, especially to fine wine collectors,” said Robert Hanson, president of wine and spirits at Constellation, on announcing the launch.

“The industry has relied on a lot of historical practices that need to be challenged and transformed in order to make the wine category more relevant for future consumers.”

An early adopter, in July 2021 Saint-Émilion estate Angélus released an NFT artwork featuring a 3D animation of the château’s signature bell in collaboration with fine wine investment firm Cult Wines to mark the launch of its 2020 vintage. Selling for US$110,000 on OpenSea, the lot included a barrel of Angélus 2020 and dinner at the estate hosted by CEO, Stéphanie de Boüard-Rivoal. “Offering our wines via an NFT is an opportunity for us to be connected with the new players of the market and explore new habits of consumption,” de Boüard-Rivoal told the drinks business.

“In the near future, it might become a very normal and perfectly integrated way to offer wine if the currency becomes stable and secure.” Taking wine NFT and art collaborations a step further, in January this year, Margaux third growth Château Cantenac Brown commissioned New York-based artist David Popa to create a sculpture from soil sourced within the estate. Due to be built this spring on the Cantenac plateau in front of the property, the ephemeral artwork, entitled The Power of the Earth, will disintegrate when it rains, but its creation will be preserved as a drone video and auctioned as an NFT.

One of the more surprising NFT success stories is Toronto-based firm BitWine, which sells NFTs of virtual pixel art wine bottles at eye-wateringly high prices. In its first week the company raked in over US$50,000 in sales of digital bottles. Also in on the NFT act is young entrepreneur Flavien Darius Pommier, who hit the headlines in May 2021 when he started flogging digital bottles of wine from his family estate – Château Darius in Saint-Émilion – at over £300 each. His main motivation is to introduce wine to a new audience and make the intimidating industry more accessible.

With each NFT purchase buyers get two physical bottles, an original artwork, and the chance to store their wine at the château. “NFTs have no limits. Having seen the way they changed the art world, I realised they could do the same for the wine industry. I started selling them during the pandemic to solve the logistical problem of having to ship wine around the world when everything was shut down. I offered 100 NFTs of six vintages and they all sold out,” says Pommier. “I’m now planning on releasing a drop of between 500 to 1,000 NFTs of each new vintage around en primeur time in April.” His NFTs have been snapped up everywhere from Taiwan to Costa Rica. Pommier admits that the current NFT craze is similar to the dotcom bubble of the late nineties, and that there will inevitably be some casualties, but he believes the concept is here to stay. “The NFTs focused on authenticating wines could really change the industry. They’re another sales channel, but they won’t replace the existing ones. I really think they’re the future of the industry – using NFTs can help us to democratise wine,” he says.

Partner Content

Keen to capitalise on the growing global thirst for NFTs, last October cousins Sam and Dov Falic launched BlockBar – the world’s first direct-to-consumer, NFTbacked wine and spirits marketplace. The motivation behind the firm is to simplify the high-end wine and spirits-buying process, cut out the middle men and attract a new audience. “Utilising NFTs, we empower collectors to connect directly with luxury brands and solve the issues around storage and authenticity,” says Dov. The physical stock bought on BlockBar is stored in a facility in Singapore, while the NFTs are traded on the Ethereum blockchain. New drinks ‘drops’ are added to the platform every fortnight. The target market is a mixture of space-deprived collectors looking to diversify their portfolios, crypto skeptics seeking tangible assets and crypto experts looking for interesting ways to splash their cash. Australian estate Penfolds was the first winery to partner with BlockBar last November. The offering comprised a barrel of its small-production Magill Cellar 3 from the 2021 vintage, which was turned into 300 single-bottle NFTs that can be redeemed for the physical bottle when the wine is released in October 2023. The Falics want BlockBar to become the largest global marketplace for highend wine and spirits; a feat they believe they can achieve without cannibalising existing channels. “We want to expand the market and attract new people into this world of investing and collecting. We’re not fighting for a bigger piece of the pie, we’re fighting to expand the pie,” says Sam.

Another big player in blockchain-based wine trading is WiV Technology, founded in 2020 by Tommy Nordam Jensen, who counts Château Margaux 2017, Lafite 2017 and Cos d’Estournel 2017 among his top-selling NFTs. Like the Falics, Jensen is driven by a desire to simplify the winebuying process. “We’re building an ecosystem that will allow wine to become a much better financial asset than it has ever been in its history. Our aim is to make investing in wine more efficient, transparent, profitable and fun than ever before by utilising all that this buzzing industry has to offer,” he says. Matthew O’Connell, CEO of fine wine trading platform LiveTrade, believes that for blockchain-based wine trading to succeed, the technology needs to be universally embraced. “The application of blockchain technology to the fine wine space has interesting potential, especially in relation to provenance, although the requirement for a comprehensive solution on this front to be industry-wide is an impediment for implementation. The jury remains out on the broad relevance of NFTs as a means of selling wine if they don’t have the ongoing from-source provenance overlay,” he says.

While the growth of the wine NFT sector is being driven by crypto geeks, the Ethereum blockchain may evolve into an important sales channel for fine wine investors. Jensen of WiV Technology believes that over the next five years NFTs will become the global standard for trading and owning wine. “We’re in the first inning right now, but as technology grows in this space, the ability to track and authenticate wine will increase in transparency and ability, and wine as an investment asset will dramatically change,” he predicts.

Though NFTs may be difficult to fake, their future success will depend on the stance regulators take as the fledgling industry develops. At the moment there are few safeguards when it comes to digital wallets being stolen. The transaction costs of cashing in Bitcoin can fluctuate wildly too. And companies that fail to deliver on their promises of what NFTs can actually offer are myriad. Add to this, the environmental impact of the power needed to be generated to run the servers for transactions, and the whole picture around NFTs becomes increasingly cloudy. In the meantime, we can expect to see many more wine and spirits brands dipping their toes into the arena to see whether their digital offerings have legs.

While it may take time for traditionalists to embrace the idea of wine NFTs, their ability to capture the attention of an impressionable new audience of devotees should be celebrated.

In high spirits

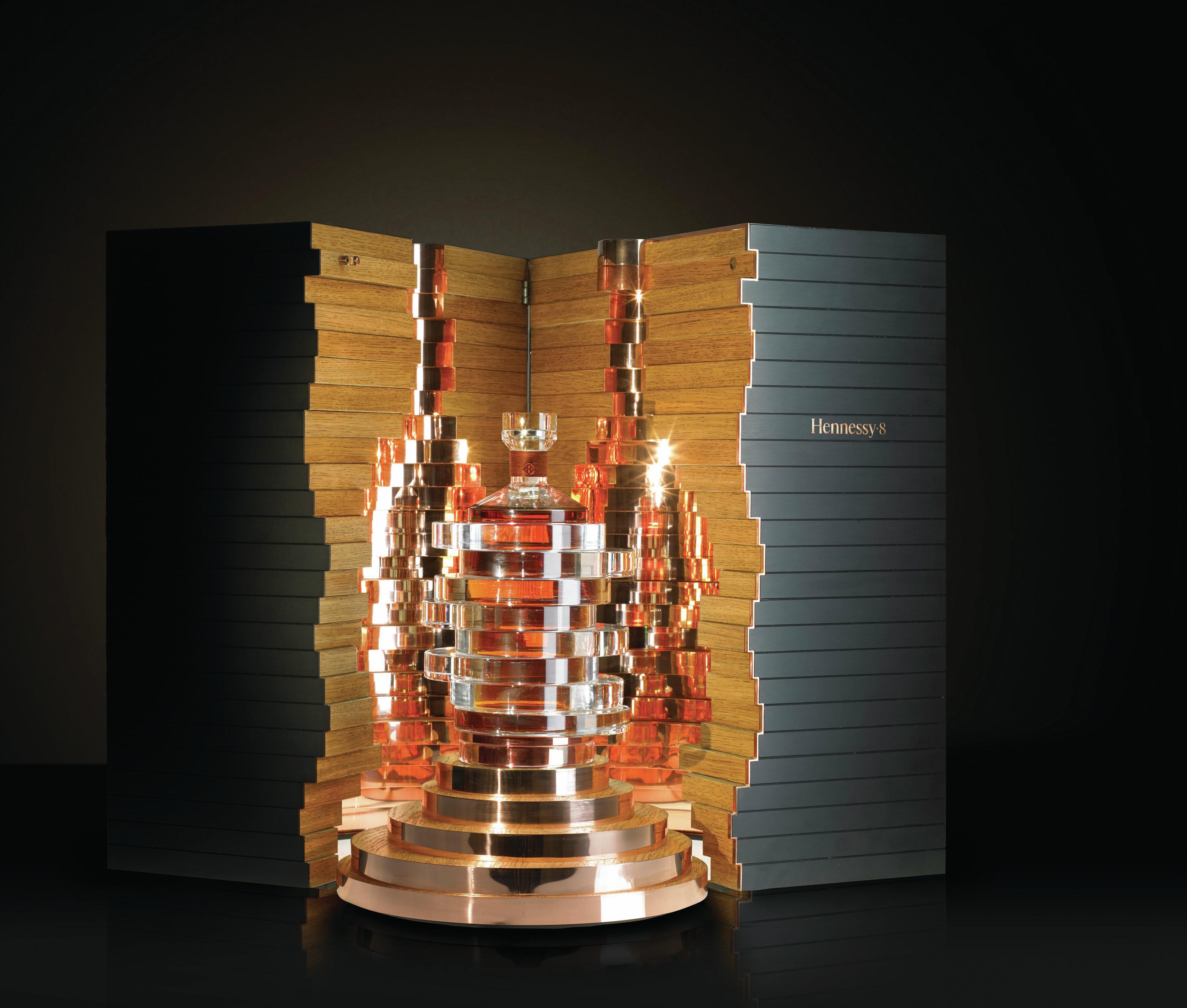

It’s not only wineries that are keen for a slice of NFT action – spirits brands have been entering the arena with gusto. The first NFTs to be offered on fledgling trading platform BlockBar when it launched last October were linked to 15 bottles of Glenfiddich 1973 Armagnac cask priced at US$18,000 a pop. Two months later The Dalmore got in on the act, selling a complete set of its Decades No.4 Collection on the platform. Luxury Cognac brand Hennessy joined the NFT party in January, offering up two bottles of Hennessy 8 Cognac on BlockBar priced at 70.47 Ether – around US$225,000. Never one to miss a white-hot trend, ultra-premium Tequila brand Patrón unveiled its first NFT on BlockBar in January –a bottle of Chairman’s Reserve – one of just 150 in existence. “We pride ourselves on being at the forefront of innovation and saw a distinct connection between the Tequila connoisseur and those operating in the NFT world. We hope we’re able to attract new audiences into the world of Patrón through our NFT release,” the brand’s president and global chief marketing officer, Kathy Parker, told db. “NFTs have created an opportunity to reinvent the retail experience and will be hugely important for luxury spirits brands as consumers continue to research and invest in the space,” she added.

Feature findings

• A ‘non-fungible token’(NFT) is a unit of data linked to virtual or physical assets, which is stored on a blockchain –a decentralised digital ledger. NFTs come with certificates of ownership and authenticity, which give them their value.

• By the end of 2021 NFTs had grown to become a US$40 billon market.

• A growing number of wineries have entered the NFT arena, from Yao Ming Winery and Mondavi in California to Angélus and Château Darius in Bordeaux.

• In October 2021, cousins Sam and Dov Falic launched BlockBar, the world’s first direct-to-consumer, NFT-backed wine and spirits marketplace.

• Tommy Nordam Jensen, founder of WiV Technology, predicts that over the next five years NFTs will become the global standard for trading and owning wine.

Related news

Strong peak trading to boost Naked Wines' year profitability