39% of wine drinkers ‘actively moderating their consumption’

Almost 40% of regular wine drinkers are actively moderating their consumption, particularly among younger age groups, according to the latest findings from Wine Intelligence.

In a briefing by Wine Intelligence CEO Lulie Halstead last month, when considering data commissioned by Vinexposium ahead of its Paris fair, it was revealed that the trend to reduce alcohol intake was strong among wine drinkers, and particularly those aged 18-34.

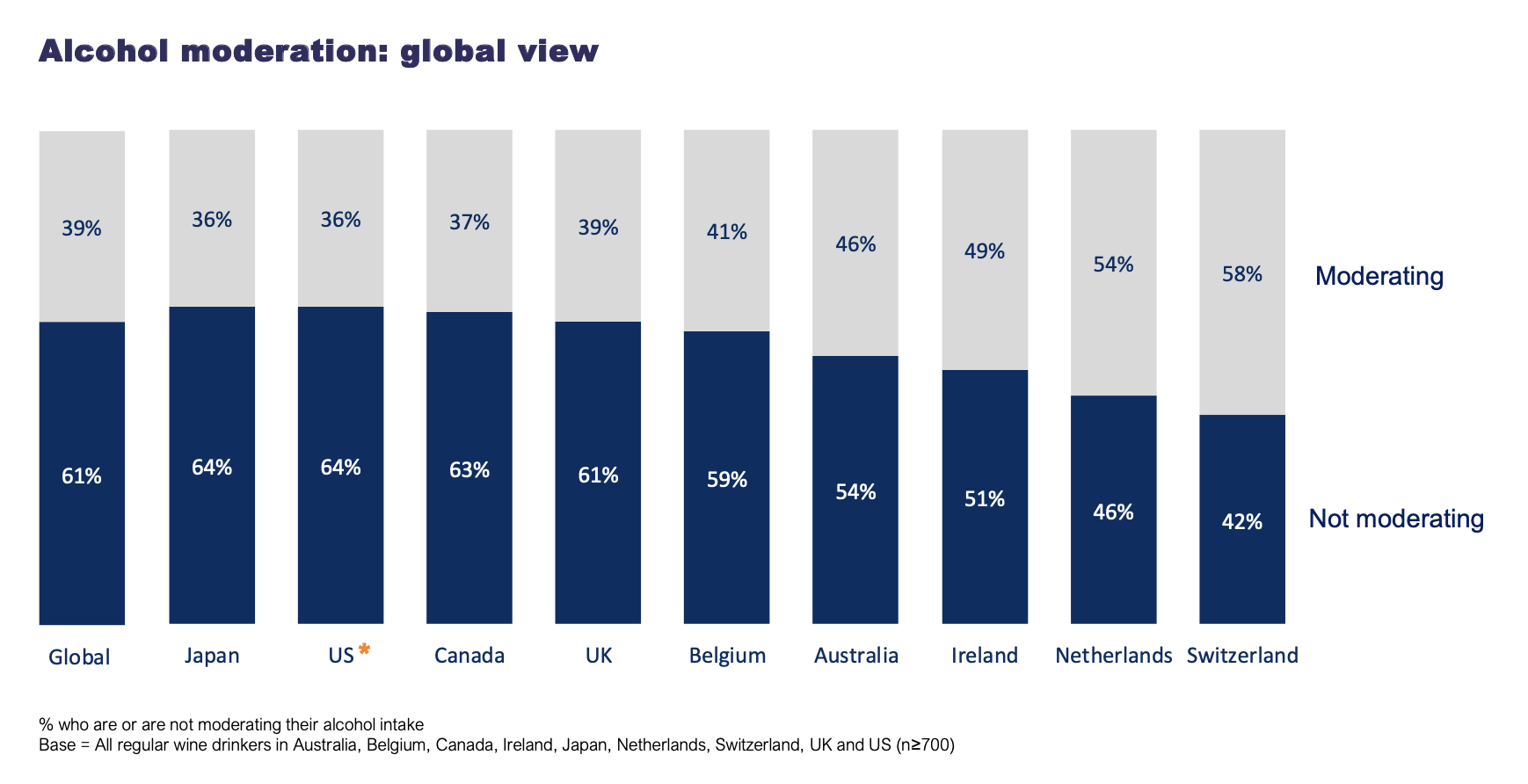

Using consumer research conducted during 2019 and 2020, Halstead began by recording that, “Globally, 39% of consumers are saying ‘I am moderating’”, having surveyed regular wine drinkers in Australia, Belgium, Canada, Ireland, Japan, Netherlands, Switzerland, UK and US – with ‘regular’ being those consumers who drink wine at least once per month (see bar chart, bottom).

She continued, “This might be drinking less alcohol at certain occasions, or reducing the strength, or choosing not to drink at all at some occasions.”

She also said that “new evidence collected during the past 1-2 months” showed that some consumers were “switching”, which meant alternating between alcohol and non-alcoholic drinks during an occasion, such as from a glass of wine to tonic water, and then back again, or choosing to create their own mixed drink to lower the alcohol content.

In the US specifically, she recorded that “30% of regular wine drinkers say they ‘would definitely prefer to buy a bottle of Champagne that has lower alcohol levels; lower than 10% ABV’ – so the idea there is for reduction, rather than abstinence.”

While she observed trends from the consumer research to show that some drinkers were giving up alcohol for certain periods, for example, taking part in a ‘dry’ month, she said that the trend now appears to be “moderating more smoothly across all life, rather than big ups and downs”.

As for the types of consumers most likely to be reducing their alcohol intake, Halstead said it was “the millennials, those up to around the age of 40, who are the strongest moderators”, adding that they are “typically doing ebb and flow, rather than stop-start moderation”.

Partner Content

Continuing, she said that “Generation Z, those from the legal drinking age up to 24, have been the age group where we’ve seen the most significant changes in alcohol consumption.”

She explained, “This age group typically consume alcohol when socialising, and because the socialising opportunity has dropped [due to the pandemic], they have not been so able to consume alcohol; their consumption patterns are much more spiky.”

Notably, looking over the longer term, she said that the “incidence rate of wine drinkers has dropped significantly in the past 10 years in key markets,” commenting that a decade ago, in the UK, the proportion of adults aged 18-34 who were regular wine drinkers was around 50%, but if you look at the figure for the same age group at the end of 2020, it is now 24%.”

While this decline is a concern, she then said that those in this age group who do drink wine regularly are “typically more premium spenders”, and “heavily engaged”, commenting, “that is the good news”, before noting that the wine market “has lost the marginals”.

Meanwhile, she said that “the Generation Xs, boomers and seniors are, fortunately for the industry, still enjoying wine, with a lot of the volume coming from the over 55s.”

Nevertheless, in conclusion, she observed that “Consumers are increasingly thinking about alcohol consumption – they are thinking about different ways of controlling or moderating what they drink.”

Related news

Castel Group leadership coup escalates

For the twelfth day of Christmas...

Zuccardi Valle de Uco: textured, unique and revolutionary wines