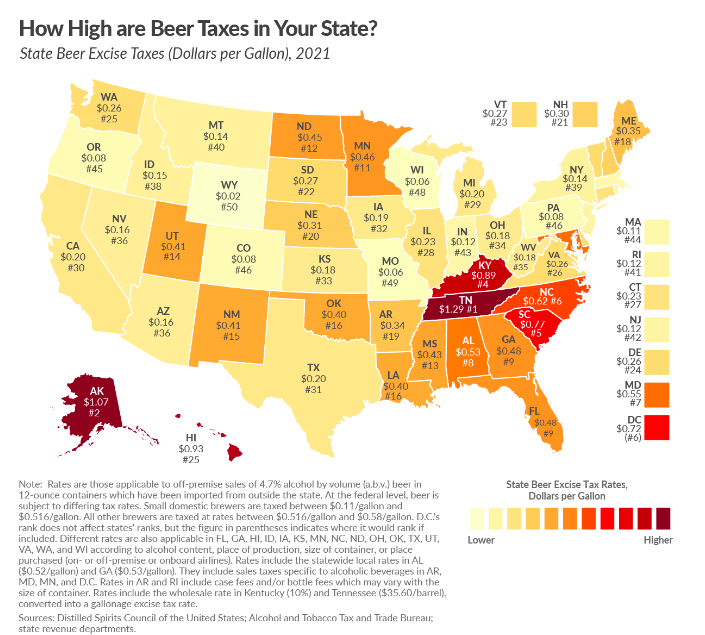

This map shows how much every state taxes beer

With the summer in full swing, England winning at the Euros and lockdowns lifting, there has arguably rarely been more incentive to grab a cold beer. But have you ever considered how much each state taxes your brew?

New research from The Tax Foundation has revealed exactly how much each US state taxes its beer.

It’s something you probably haven’t spent all that much time considering as you crack open a cold one and enjoy the game, but the state in which you live may well have a real-life impact on how much you’re paying for your beer.

The Tax Foundation has released a map showing exactly how much each state collects in taxes per gallon.

Partner Content

Way out in front is Tennessee, where the excise tax rate is as high as $1.29 per gallon. Meanwhile, Wyoming is right at the other end of the scale, collecting just $0.02 per gallon. Missouri and Wisconsin are the joint-lowest with an excise tax rate of $0.06 per gallon, while Alaska clocks in second highest with $1.07 per gallon.

Find out exactly how much your state taxes beer by viewing the map below:

Are you surprised by any of the tax rates listed on the map? Let us know in the comments, and meanwhile you can check out our article revealing how much every US state taxes wine.

H/T: The Tax Foundation