Booming Champagne could reach pre-Covid levels by year-end

Such has been the recovery in Champagne demand during the past two months, it’s thought that the region may reach its pre-Covid size by the end of this year.

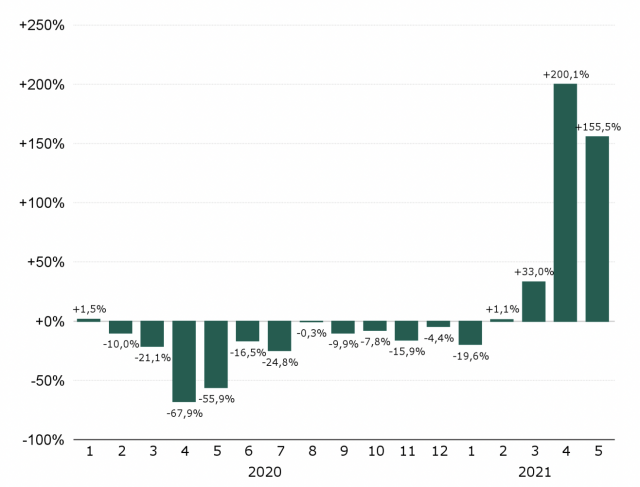

According to the latest figures from the Comité Champagne, total shipments, which include supplies to the domestic French market, are increasing at a rate of 150% in May compared to the same month last year, and they were up as much as 200% in April this year (see bar graph below).

It may not surprise you to hear that growth rates are marked relative to springtime in 2020, when the Covid crisis in Europe and the US was at its most concerning early stages, but even when current shipment figures are compared to pre-Covid Champagne performance, there is growth: May this year is up almost 13% compared to May 2019 (see figures, bottom).

Commenting on the bounce back in Champagne shipments during a discussion with the drinks business last week, Lanson chairman François Van Aal said it was a clear sign that the “market is re-opening again”.

Describing the situation as a “strong resurrection” he said it was “very encouraging and positive”, stressing that the latest increases were not only up on last year, but surpassing pre-Covid Champagne performance in April-May time.

He also told db that he believed that the current level of growth should mean that Champagne will return to its pre-Covid global market size of almost 300 million bottles in annual shipments.

Champagne shipments for 2020 dropped by 18%, representing a decline of 52.5 million bottles on 2019, which took the region from a total of 297.5m bottles in 2019 to 245m for 2020.

Having noted the surge in demand for Champagne in recent months, Van Aal then considered the longer term, recording that the first five months of 2021 (January to May) were showing a 44% increase in total shipments compared to the same period in 2020, and, while that figure is -2.3% relative to 2019, he said, “But every month, it is catching up, and I’m sure that by the end of June, this -2.3% will come back into positive.”

Over a 12 month period (June 2020 to May 2021), Champagne is up 1% versus the same period one year ago, and compared to June 2018-May 2019 it is -10%.

“The figures are showing an unprecedented crisis, which is why we are still -10% versus the same 12 month period pre-Covid, but we will catch up, I am confident that the market will come back to around 300m [bottles in annual shipments],” he said, when talking about the figures for the end of this year.

Concluding, he said of the current situation for Champagne, “It is a 180 degree turn relative to what we had one year ago at the same time, when we were stuck and there were dark days ahead, but now the market is reopening and it might come back stronger and bigger.”

Partner Content

Meanwhile, Pol Roger president Laurent d’Harcourt told db that the demand for Champagne since the spring of this year was so huge, it was causing problems.

“It is totally crazy, with our importers around the world asking for more allocations, and placing orders for the end of the year now,” he said, noting that the call for shipments for future sales was due to a concern over delays to transporting the stock.

“We have the orders, but sometimes there are logistics problems, due to a lack of drivers or shipping containers,” he said, adding that this was a challenge for everyone in the region, but also for all goods worldwide.

“The economy is dynamic everywhere, and there is a lack of resources, and the Suez Canal [blockage] has been a little nightmare for shipping,” he said.

Like Lanson’s Van Aal, d’Harcourt expressed his optimism that Champagne was getting back to its pre-Covid performance.

“The markets are reopening, the restaurants are reopening, and people are starting to be able to do weddings, events and launches, and things are looking good for the summer break, and while some have been wondering if [the current surge in Champagne shipments] is just refilling the pipeline, I think it’s because the sales are good,” he said.

He also expressed his optimism for the region based on the fact that the strong performance of Champagne post-Covid is being seen for all players in the sector. “I’m optimistic because the recovery seems to be for everybody: the growers, the coops, and the maisons,” he said.

Looking over the longer term, he added, “Champagne was 25 million bottles after the war and grew to more than 300m bottles over 65 years, and while it went down last year, I think it will come back to normal levels.”

Total Champagne shipments (compared to Covid trading)

- May 2021: 22m bottles (+155.5%)

- Jan-May 2021: 88.2m bottles (+44.2%)

- Jun 2020-May 2021: 271.1m bottles (+1.1%)

Total Champagne shipments (compared to pre-Covid trading)

- May 2021: 22m bottles (+12.8% compared to May 2019)

- Jan-May 2021: 88.2m bottles (-2.3% compared to Jan-May 2019)

- Jun 2020-May 2021: 271.1m bottles (-10.1% compared to Jun 2018-May 2019)